Hedge Fund Trade Tip (PMN) – Position Management Notification

Be in the know. 5 key reads for Monday…

- The 10-year yield hasn’t done this in 20 years, and it could be a bullish sign (CNBC)

- Bullish for banks: Bank regulatory revisions pose dangers and could lead to financial crisis: say critics (New York Post)

- ‘Super Mario’ Draghi Set to Ride Again: Global Economy Week (Bloomberg)

- Pound Hits Highest Since July as Johnson Strikes Softer Tone (Bloomberg)

- From CLOs to ‘Ozark,’ Ex-Guggenheim President Builds an Empire (Bloomberg)

Be in the know. 10 key reads for Sunday…

- Big thanks to MarketWatch.com for picking up our article this week: Investor pessimism declines but remains elevated, AAII survey shows (MarketWatch)

- Hedge Fund and Insider Trading News: Bill Ackman, David Tepper, Ray Dalio, Organogenesis Holdings Inc (ORGO), Silicon Laboratories (SLAB), and More (Insider Monkey)

- Why Box is one of the most underappreciated companies (TechCrunch)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

- Huw van Steenis On What Central Banks Will Do Next (Podcast) (Bloomberg)

- Episode 371: Where Dollar Bills Come From (NPR Planet Money)

- Natural Gas Bulls End Week in Style as ‘Classic Short-Covering Rally’ Continues (Natural Gas Intelligence)

- What a Character: The Inimitable Career of Sacha Baron Cohen (The Ringer)

- Amgen’s Gene-Targeting Drug Shrank 54% of Lung Tumors in Study (Bloomberg)

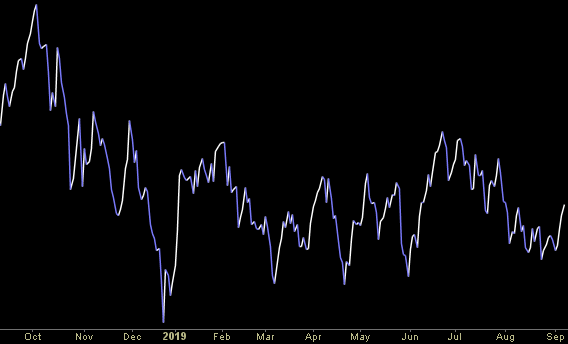

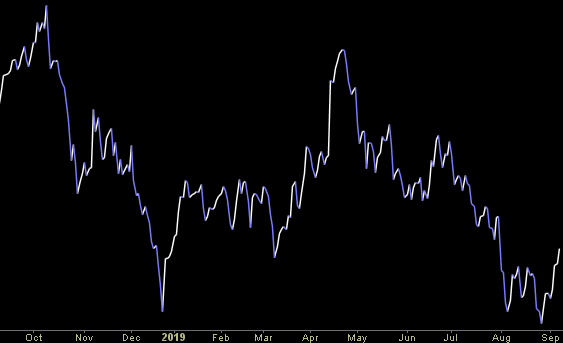

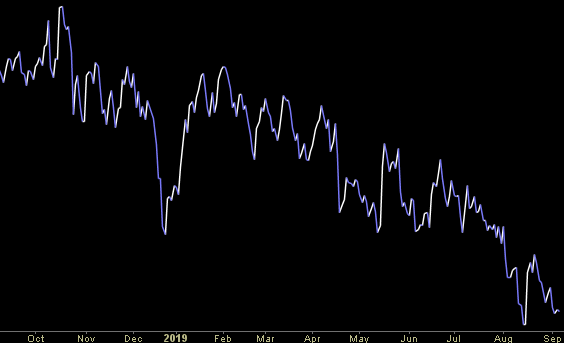

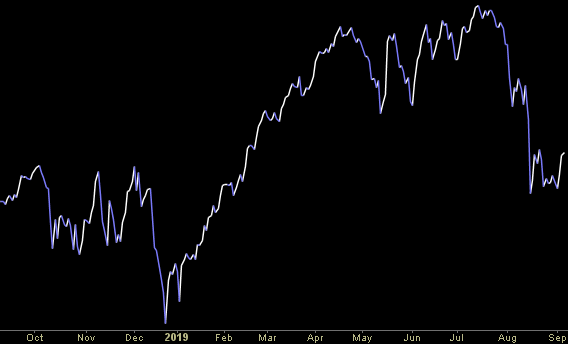

- Special chart suggests the market is starting a hot streak (CNBC)

Be in the know. 15 key reads for Saturday…

- The Big Picture: Calm Settles Over Stock Market, Buying Time For Bulls (Investor’s Business Daily)

- This Single Variable Explains What Drives Managed Futures Performance (Institutional Investor)

- September Macro Update: Rising Possibility of a Recession in 2020 (The Fat Pitch)

- Permian Basin natural gas prices up as a new pipeline nears completion (EIA)

- “Where Did I Find This Guy Jerome?” Trump Asks of Hand-Selected Fed Chief (Vanity Fair)

- The Eternal Pursuit of Unhappiness (Farnam Street)

- Powell Says Fed Will Sustain Expansion, Reinforcing Rate-Cut Bet (Bloomberg)

- The 2020 Evora GT Is the Best Lotus We’ve Seen in Decades (Bloomberg)

- Investors flocked to bonds and away from stocks in August at the fastest pace on record, says TrimTabs (MarketWatch)

- Opinion: Gold’s big drop is just the beginning of a longer slide (MarketWatch)

- U.S.-China trade conflict could take years to resolve: Kudlow (Reuters)

- Small-cap stocks could jump if a trade deal is signed (Barron’s)

- Stock dividends are Japan’s latest export (Barron’s)

- Mallinckrodt Bankruptcy Fear May Be Premature (Barron’s)

- Eddie Murphy Says He’s Doing A Stand-Up Comedy Tour in 2020 (Maxim)

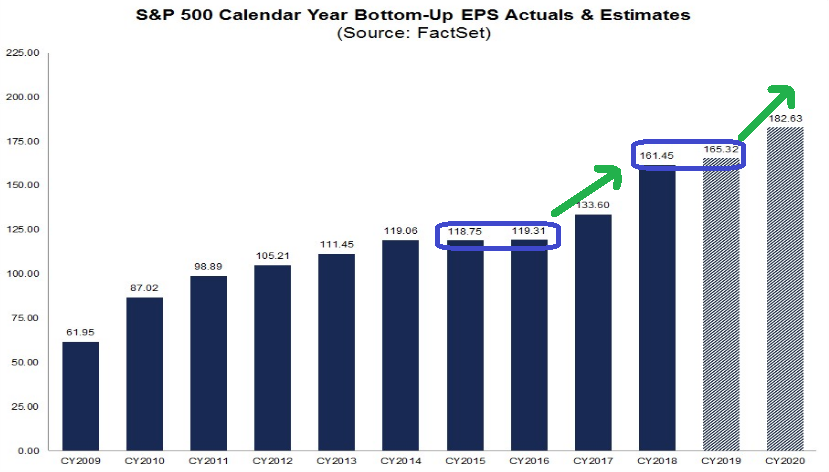

2020 Earnings Estimates – “Strong Like Bull”

Unusual Options Activity – Dow Inc. (DOW)

Today some institution/fund purchased 1,279 contracts of Jan 2021 $42.50 strike calls (or the right to buy 127,900 shares of Dow Inc. (DOW) at $42.50). The open interest was just 114 prior to this purchase. Continue reading “Unusual Options Activity – Dow Inc. (DOW)”