- Stocks will ‘rally into the end of the year’ after upside earnings surprise, says J.P. Morgan’s Matejka (MarketWatch)

- The explosion of ‘alternative’ data gives regular investors access to tools previously employed only by hedge funds (MarketWatch)

- China cuts banks’ reserve ratios, frees up $126 billion for loans as economy slows (Reuters)

- New Schlumberger CEO Outlines Strategic About-Face (24/7 Wall Street)

- Christine Lagarde and the Case for More QE (Bloomberg)

- Buy-the-Dip Bond Traders Are Scared of Momentum (Bloomberg)

- Trump Moves to Send Mortgage Giants Back to Private Sector (New York Times)

- Seth Klarman’s 3 Secrets to Value Investing (Yahoo! Finance)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PMN) – Position Management Notification

Unusual Options Activity – Schlumberger Limited (SLB)

Today some institution/fund purchased 4,002 contracts of Jan 2021 $42.5 strike calls (or the right to buy 400,200 shares of Schlumberger Limited (SLB) at $42.5). The open interest was just 1,458 prior to this purchase. Continue reading “Unusual Options Activity – Schlumberger Limited (SLB)”

Where is money flowing today?

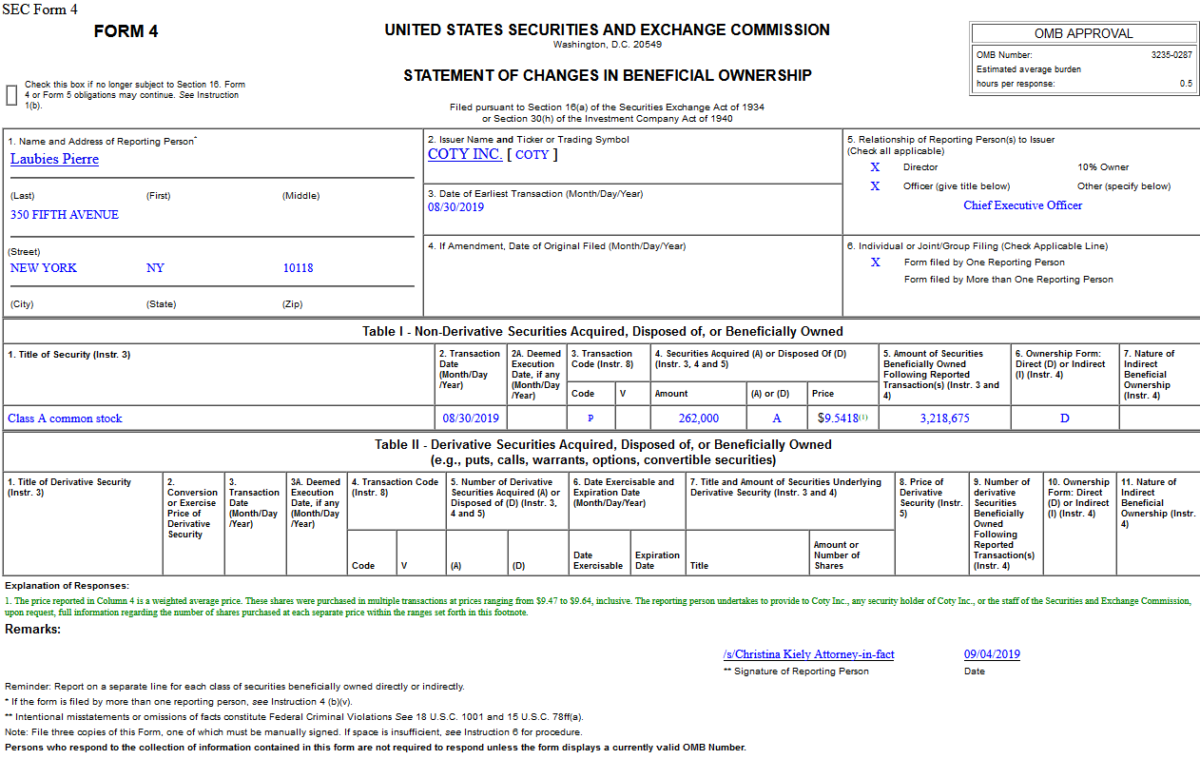

Insider Buying in Coty Inc. (COTY)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Thursday…

- Don’t Be Afraid of Stocks Now. Next Year Is Another Story. (Barron’s)

- Apple’s growing opportunity in India (Barron’s)

- The Fed will cut rates by a quarter point this month, not a half point, WSJ says (CNBC)

- China, U.S. to hold trade talks in October; Beijing says phone call went well (Reuters)

- U.S. Fed to further simplify ‘stress capital buffer’ plan: Quarles (Reuters)

- After 32 Rate Cuts in 2019, Traders Say Many More Are Coming (Bloomberg)

- Fed Beige Book Shows Wide Tariff Anxiety, Varied Impact So Far (Bloomberg)

- Nicklaus: `Tiger’s Going to Win a Lot More Tournaments’ (Bloomberg)

- A Recession Isn’t Inevitable: The Case for Economic Optimism (New York Times)

- Curb Your Enthusiasm: What AI Can’t Do (Forbes)

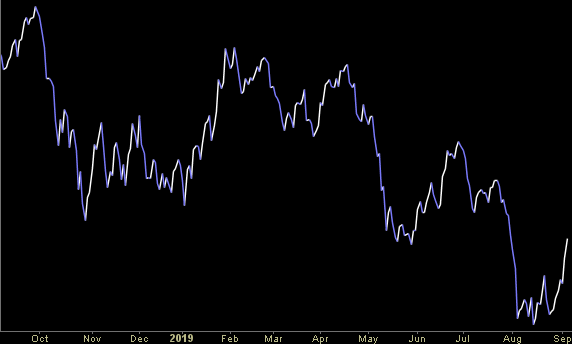

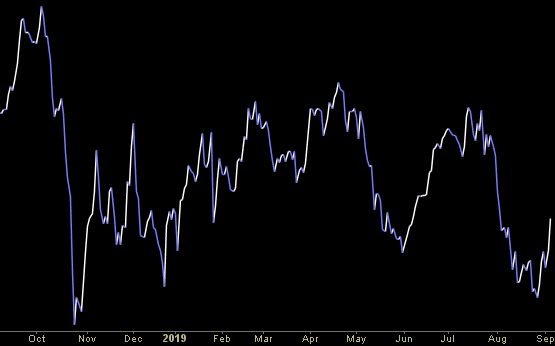

AAII Sentiment Survey Results: Pessimism Strong, Opportunity Stronger…

This week the AAII Sentiment Survey results came in slightly improved from last week. Bullish sentiment rose from 26.13% to 28.64% and Bearish Sentiment is beginning to thaw (dropping from 42.21% to 39.51%), but there is still a long runway of opportunity before euphoria starts to take hold – at which time we would become cautious. Continue reading “AAII Sentiment Survey Results: Pessimism Strong, Opportunity Stronger…”