Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 15 key reads for Thursday…

- The Fed will be growing its balance sheet again, but don’t call it ‘QE4’ (CNBC)

- James Bullard says the Fed still has a ‘little more to go’ with rate cuts (CNBC)

- Hedge Fund and Insider Trading News: Tiger Global Management, Elliott Management, Aldeyra Therapeutics Inc (ALDX), Restoration Hardware Holdings, Inc (RH), and More (Insider Monkey)

- Drug-Price Legislation Unlikely Before Election, Analyst Says (Barron’s)

- China says in close communication with U.S. over October trade talks (Reuters)

- Netflix Stock Has Taken a Beating. Here’s How to Play a Bounceback. (Barron’s)

- Trump Announces a Trade Pact With Japan (New York Times)

- Latinos may be the key to future US economic growth, study argues (CNBC)

- AbbVie Is Up After Another Analyst Reconsidered Its Allergan Acquisition and Upgraded the Stock (Barron’s)

- Wells Fargo acting chief Parker likely to get job by default (Yahoo! Finance)

- Despite Setbacks, Biogen is a Buy for Value Investors (Yahoo! Finance)

- 4 Blue-Chip Large-Cap Stocks That All Yield a Massive 7% or More (24/7 Wall Street)

- Millennials Continue to Leave Big Cities (Wall Street Journal)

- Trump Says Impeachment Could Derail U.S.-Mexico-Canada Trade Deal (Wall Street Journal)

- An Unimpeachable Reason to Buy Stocks (Wall Street Journal)

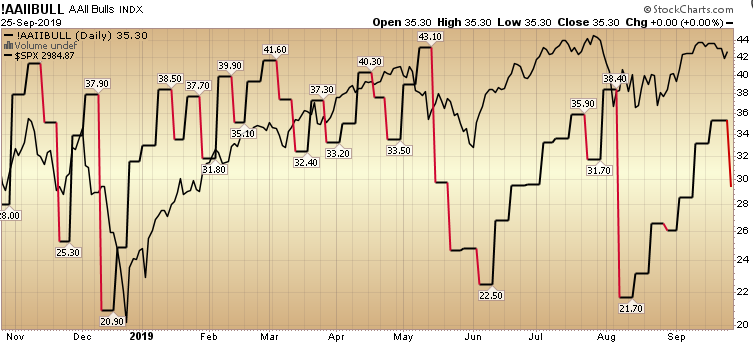

Know When To Hold ‘Em: AAII Sentiment Survey Results

As a long time Country fan, the song that came to mind when writing this piece today was Kenny Rogers’ “The Gambler.” Continue reading “Know When To Hold ‘Em: AAII Sentiment Survey Results”

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Today some institution/fund purchased 26,380 contracts of Jan $60 strike calls (or the right to buy 2,638,000 shares of Las Vegas Sands Corp. (LVS) at $60). The open interest was 26,380 prior to this purchase. Continue reading “Unusual Options Activity – Las Vegas Sands Corp. (LVS)”

Where is money flowing today?

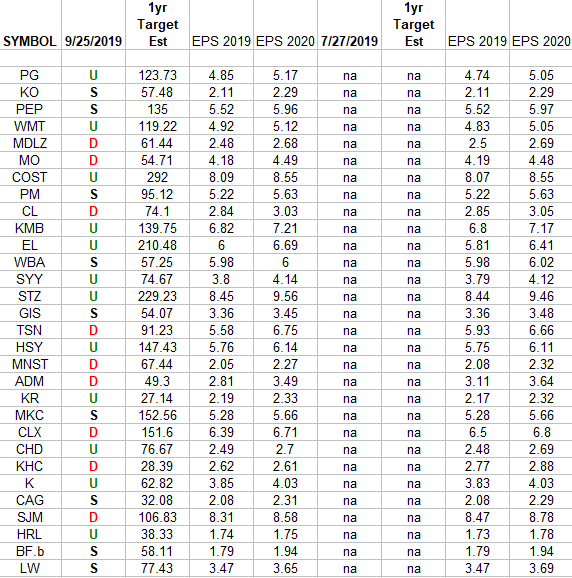

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. The column under the date 9/25/2019 has a letter that represents the movement in 2019 Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Wednesday…

- How Pelosi’s impeachment inquiry into Trump could be a plus for one stock sector (MarketWatch)

- Metals billionaire Andrew Forrest is making a $300 million bet on the next big commodity — plastic (MarketWatch)

- What Trump’s Impeachment Inquiry Means for the Stock Market (Barron’s)

- McDonald’s CEO Wants Big Macs to Keep Up With Big Tech (Bloomberg)

- Trump’s Fed tweets pull interest-rate expectations lower, new study finds (Business Insider)

- Explainer: Trade deal in focus as Trump, Japan’s Abe head for summit (Reuters)

- 7 Value Stocks With Double-Digit Revenue Growth (Yahoo! Finance)