1. Germany sells nearly $1 billion of 30-year negative yielding bonds (MarketWatch)

2. Opinion: The Fed needs to radically change policy and start printing money (MarketWatch)

3. Fed’s Kashkari says U.S. central bank should use forward guidance now: FT (Street Insider)

4. The US and Japan are holding trade talks, and a deal could settle shaky markets. (Business Insider)

5. Muni-Bond Buyers Are Desperate. Risky Borrowers Are Cashing In (Bloomberg)

6. Lamborghini debuts hyper-exclusive Aventador SVJ 63 Roadster, Huracán EVO GT Celebration (USA Today)

7. It’s Not a Bad Time for the Right Kind of Tax Cut (Barrons)

8. GE Power Is on a ‘Positive Trajectory’ (Barrons)

9. Milton Friedman on CEOs (Wall Street Journal)

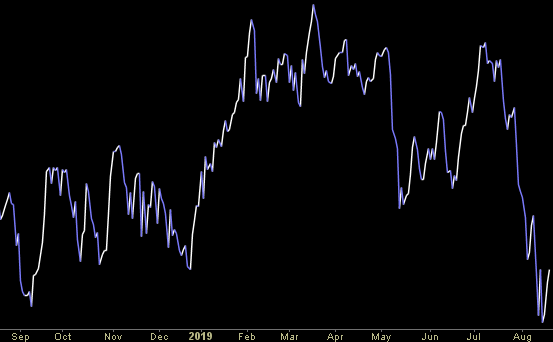

10. Traders Bet on Falling Volatility (Wall Street Journal)

Unusual Options Activity – General Electric Company (GE)

Today some institution/fund purchased 30,888 contracts of June 2020 $8 strike calls (or the right to buy 3,088,800 shares of General Electric Company (GE) at $8). The open interest was 19,435 prior to this purchase. Continue reading “Unusual Options Activity – General Electric Company (GE)”

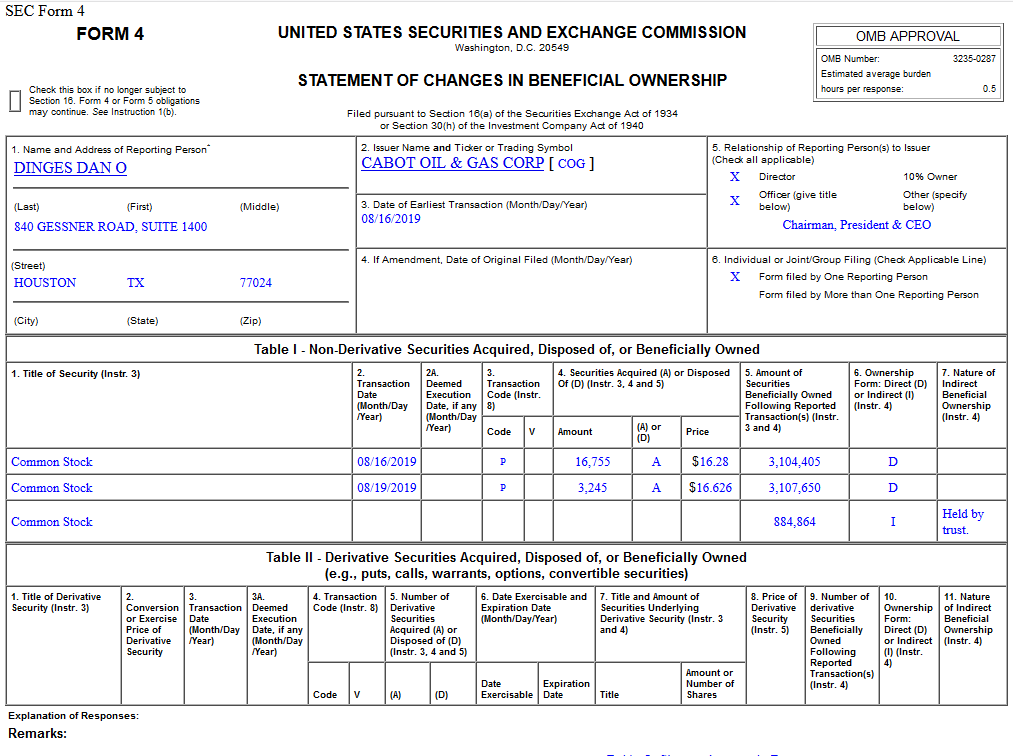

Insider Buying in Cabot Oil & Gas Corporation (COG)

Where is money flowing today?

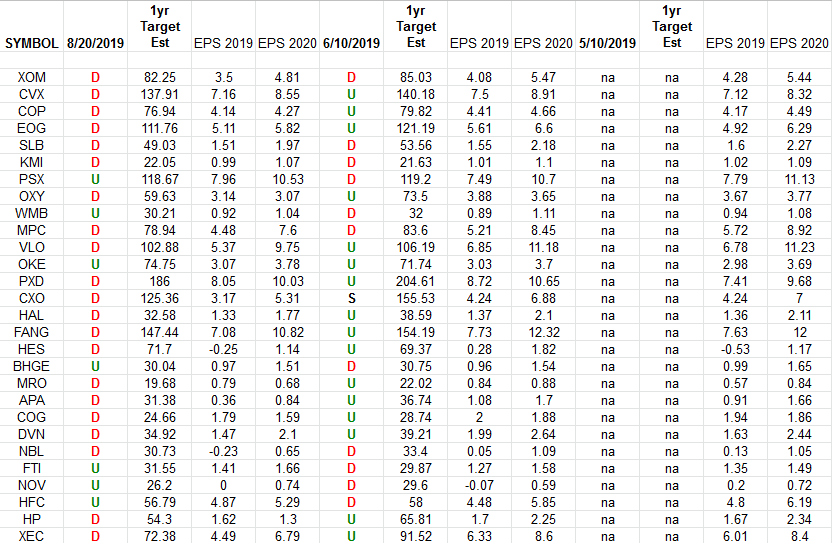

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

Be in the know. 10 key reads for Tuesday…

1. Wall Street Poised to Get Long-Sought Changes to Volcker Limits (Bloomberg)

2. ‘Tesla Killers’ Are Having A Really Hard Time Killing Tesla (Bloomberg)

3. Baidu.com (BIDU) Tops Q2 EPS by 60c (Street Insider)

4. Senior White House officials eye tax cut to avert slowdown: Washington Post (Street Insider)

5. These New Cars Have the Most Powerful Engines (24/7 Wall Street)

6. Baker Hughes Stock Slumped on GE Allegations, and Insiders Bought Up Shares (Barron’s)

7. Bank Regulator Pitches Low-Income Lending Rule Changes on U.S. Road Trip (Wall Street Journal)

8. Trump Administration Delays Ban on Huawei Working With U.S. Firms (Wall Street Journal)

9. The tide may be turning for the worst-performing S&P sector this year (CNBC)

10. Howard Marks: there’s sanity in stocks (MoneyWeek)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Unusual Options Activity – Ionis Pharmaceuticals, Inc. (IONS)

Today some institution/fund purchased 2,025 contracts of Jan 2021 $70 strike calls (or the right to buy 202,500 shares of Ionis Pharmaceuticals, Inc. (IONS) at $70).  The open interest was just 309 prior to this purchase. Continue reading “Unusual Options Activity – Ionis Pharmaceuticals, Inc. (IONS)”