Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Tuesday…

- Hedge Fund and Insider Trading News: Ray Dalio, Warlander Asset Management, Copper Street Capital, Avangrid Inc (AGR), Knowles Corp (KN), and More (InsiderMonkey)

- Trump warns China not to wait for 2020 U.S. election to make trade deal (Reuters)

- Uber Lays Off 400 as Profitability Doubts Linger After I.P.O. (New York Times)

- Incyte Earnings Crush Views With 188% Gain (Investor’s Business Daily)

- Dell’s Crown Jewel, With Thomas Lott (Podcast) (Seeking Alpha)

- D.R. Horton profit beats as lower home prices boost demand (Reuters)

- Goldman Sachs says S&P 500 bull-run has legs but cuts earnings outlook (StreetInsider)

- Porsche’s Battery-Powered Taycan on Track to Overtake 911 (Bloomberg)

- Merck shares climb 3.7% after earnings blow past estimates (MarketWatch)

- Berkshire Hathaway’s Earnings Are Saturday. Watch the Stock Buyback Number. (Barron’s)

Unusual Options Activity – Range Resources Corporation (RRC)

Today some institution/fund purchased 3,635 contracts of Dec $5 strike calls (or the right to buy 363,500 shares of Range Resources Corporation (RRC) at $5). The open interest was just 185 prior to this purchase. Continue reading “Unusual Options Activity – Range Resources Corporation (RRC)”

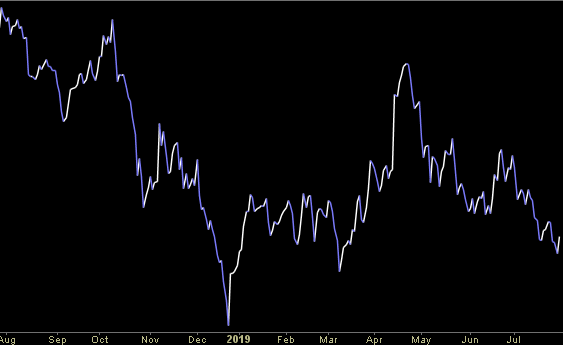

Where is money flowing today?

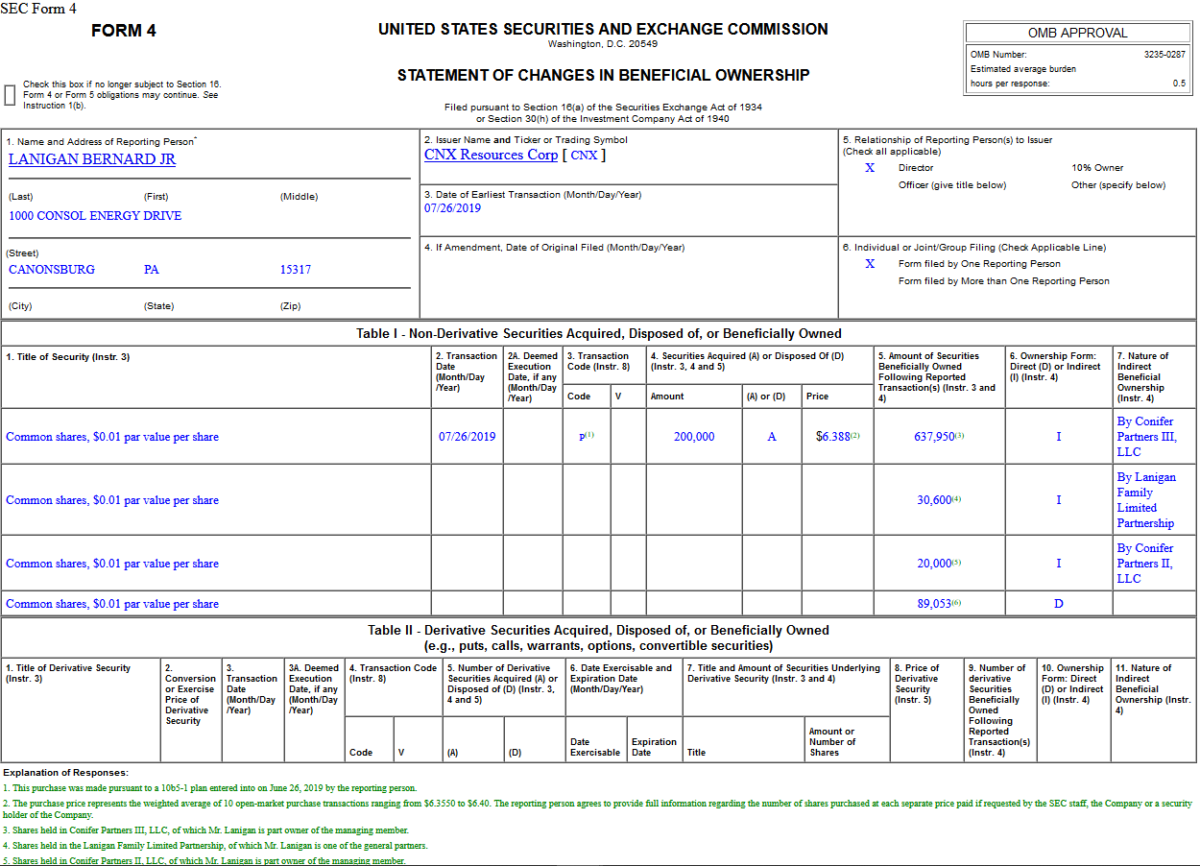

Insider Buying in CNX Resources Corporation (CNX)

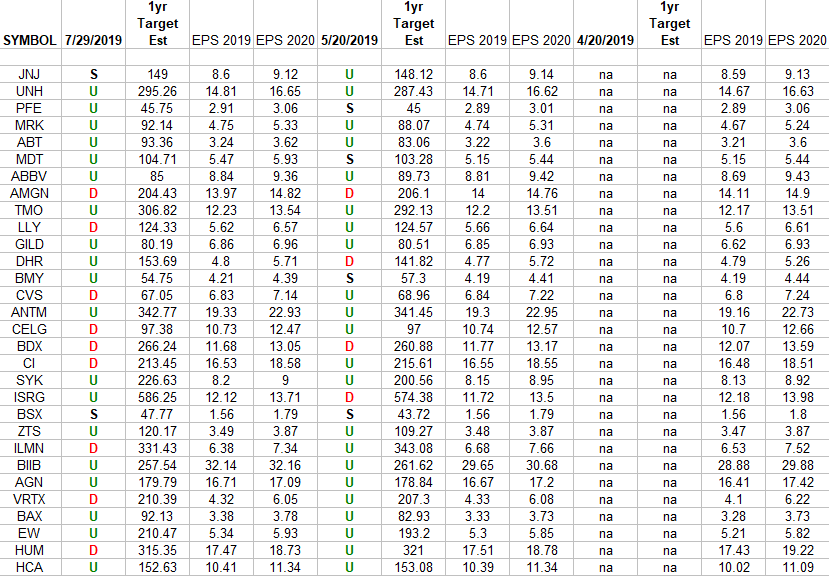

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Monday…

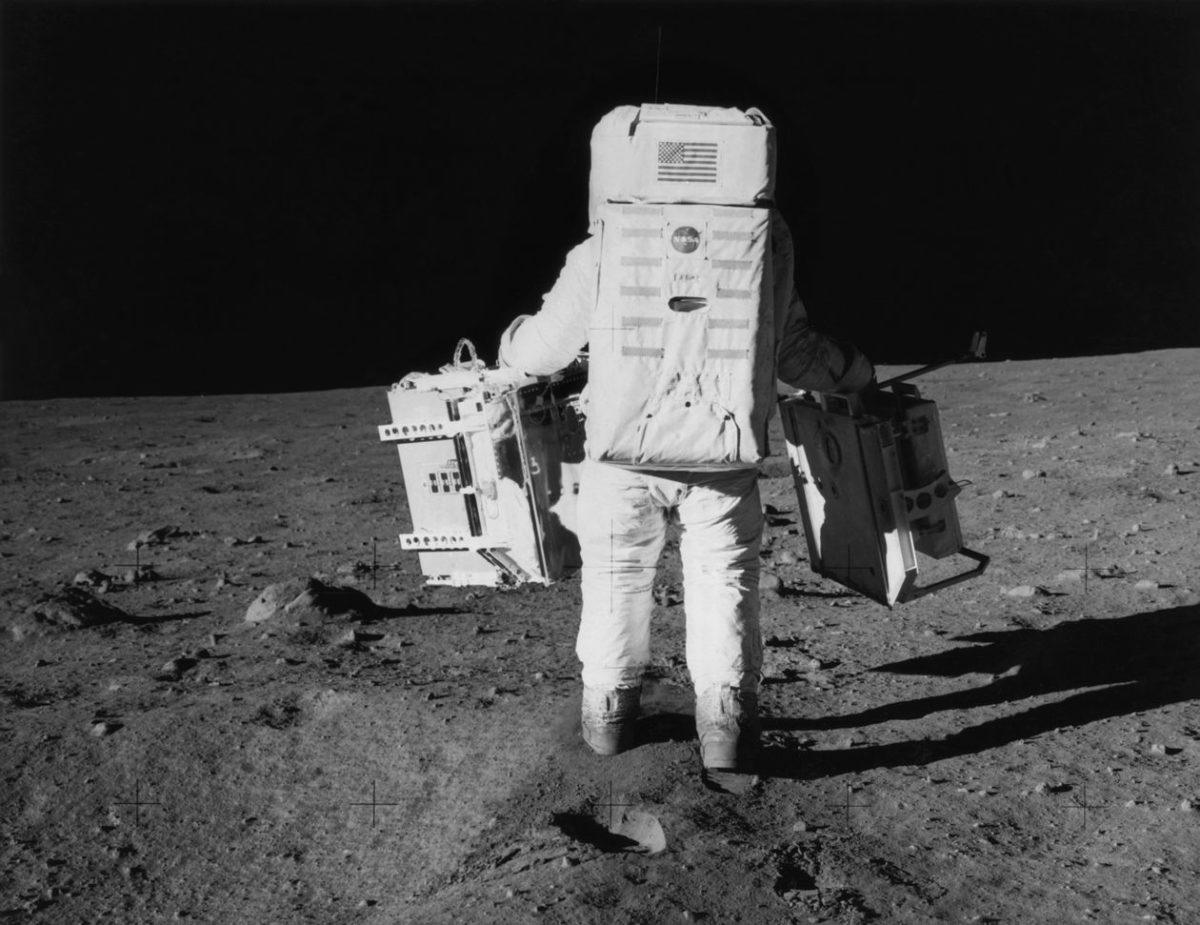

- What Are The World’s Next ‘Moonshots?’ (Barron’s)

- With Stocks at Fresh Highs, Investors’ Portfolios Look Alike (Wall Street Journal)

- 5G could change everything. Here’s what you need to know before you buy into the tech (USA Today)

- Hedge Funds Chasing 400% Return Show Risk in China’s Wild Market (Bloomberg)

- Quentin Tarantino nets his biggest opening weekend ever with $40.4 million take for ‘Once Upon a Time… in Hollywood’ (Business Insider)

- Former Fed Chair Janet Yellen says she’s in favor of an interest rate cut (CNBC)

- Bill Gates took solo ‘think weeks’ in a cabin in the woods—why it’s a great strategy (CNBC)

- 37-Year-Old Former School Teacher Is India’s Newest Billionaire (Bloomberg)

- Animal Spirits: Pfizer May Buy Low and Smart in Generics Gambit (Wall Street Journal)

- Financial Crisis Yields a Generation of Renters (Wall Street Journal)

Be in the know. 8 key reads for Sunday…

- Beijing says millions of tons of U.S. soy shipped to China in trade consensus (Reuters)

- Jack Ma’s $290 Billion Loan Machine Is Changing Chinese Banking (Bloomberg)

- How donuts fuelled the American Dream (Economist)

- How Two Stanford Dropouts Built a $2.6 Billion Company In Just Two Years (Entrepreneur)

- How Mary Ramos Brought 1969 to Life for Quentin Tarantino (GQ)

- Chinese LNG Imports See Strong Growth This Summer (OilPrice)

- Dyson: James Dyson How I Built This with Guy Raz (NPR)

- Land of the Giants: Why You’ll Never Quit Amazon Prime (PodCast) (Vox)