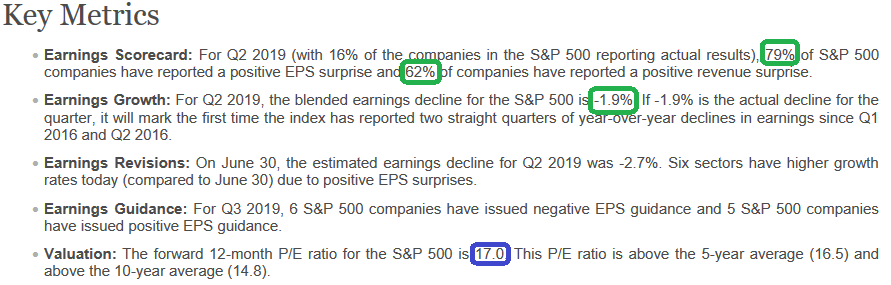

Data Source: FactSet

As of July 12, Q2 estimates had been taken down to -3.0% expectations year on year. With the banks having recorded earnings beats of 11-33% (year on year) this past week, things are looking up. In just one week these estimates have jumped to -1.9% with only 16% of the S&P 500 reporting so far. In other words, off to a strong start. Continue reading “Q2 Earnings looking UP…”