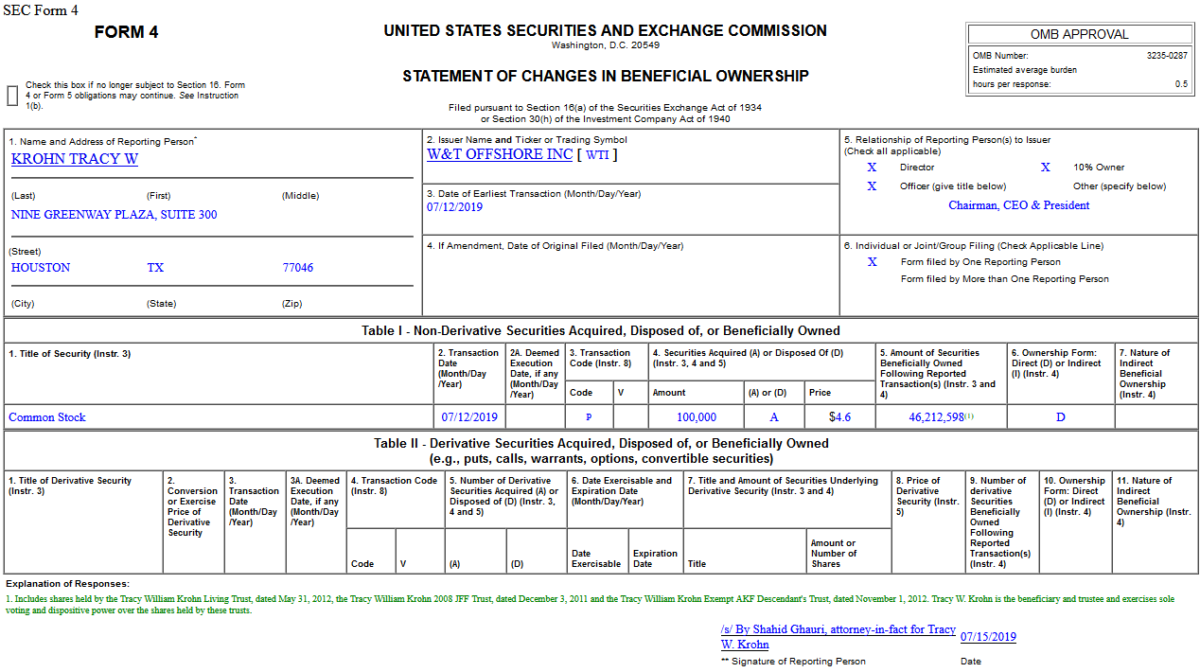

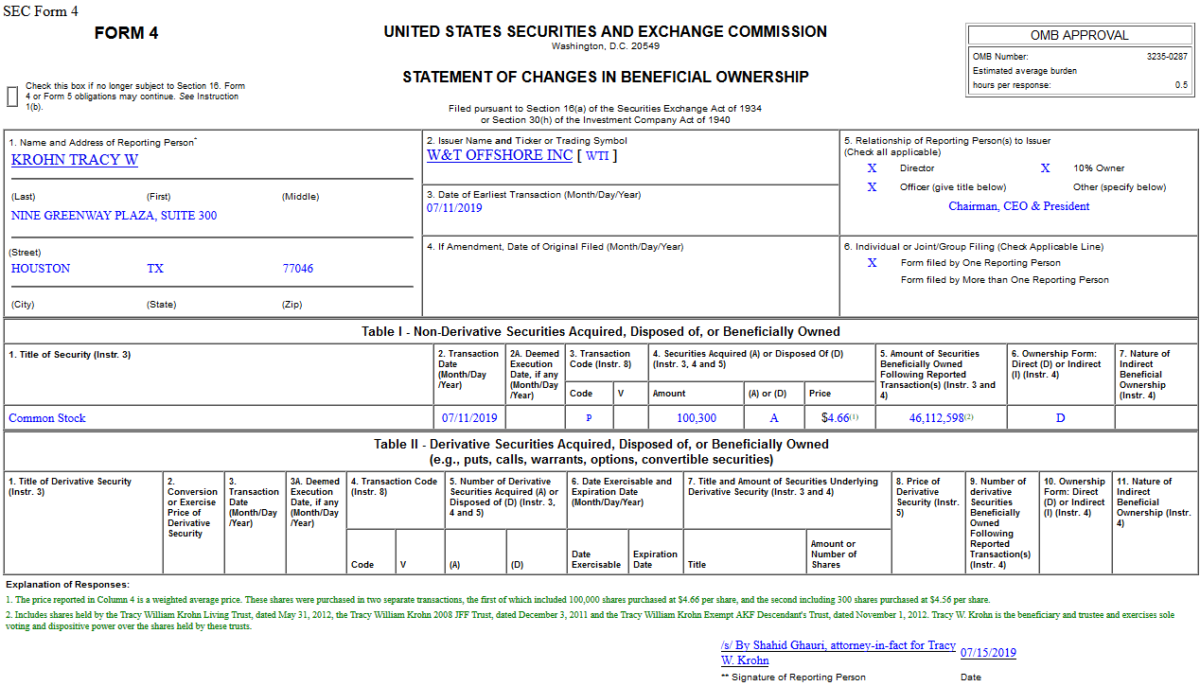

In addition to the $467,398 purchase we featured yesterday (below), on July 12, 2019, Tracy Krohn – Chairman and CEO of W&T Offshore, Inc. (WTI) – purchased another 100,00 shares of WTI at $4.66. His out of pocket cost was $460,000.

Continue reading “More Insider Buying in W&T Offshore, Inc. (WTI)”