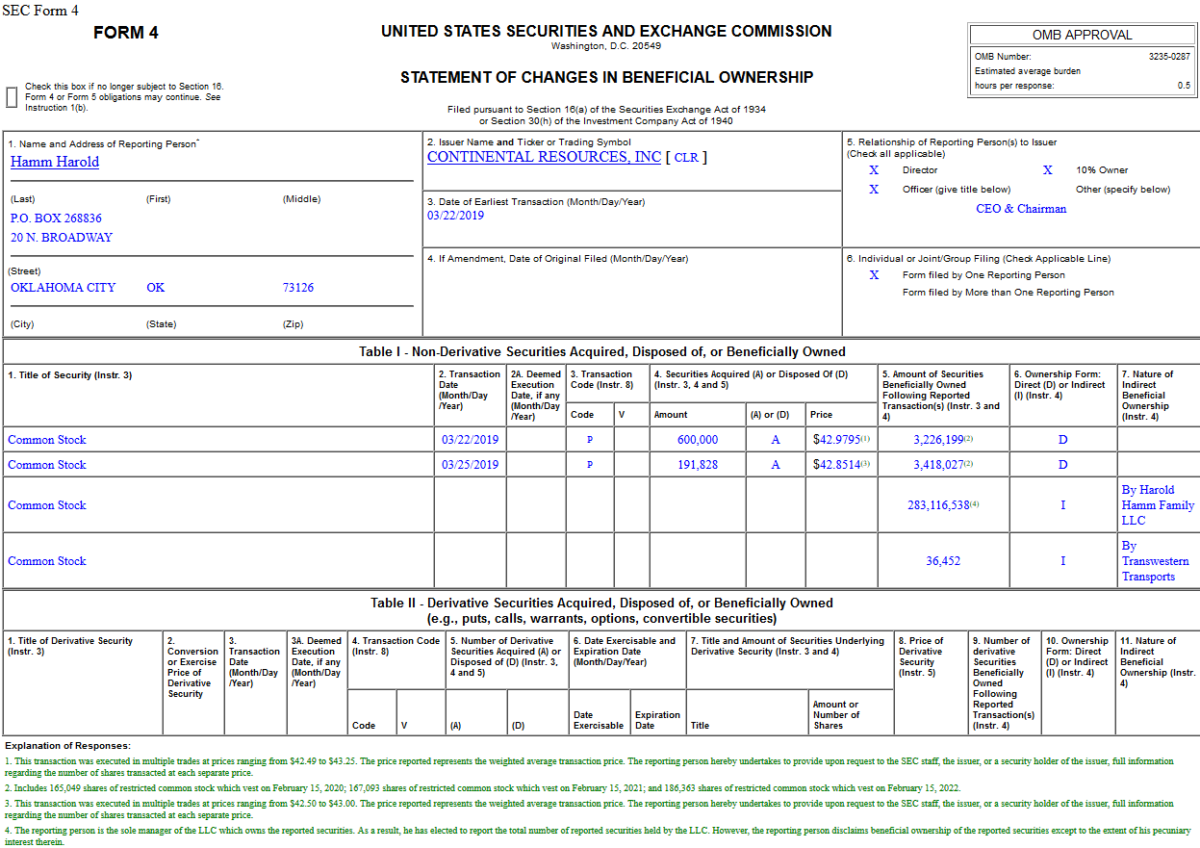

On March 22-25, 2019, Billionaire Harold Hamm – CEO & Chairman of Continental Resources, Inc. (CLR) – purchased 791,828 shares of CLR at ~$42.94. His cost was $34,007,798.

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.