Be in the know. 10 key reads for Wednesday…

- Oil prices rise after crude stockpile drop (Reuters)

- A Top Chinese Official Just Lowered the Temperature in the Trade War (Barron’s)

- Trump Picks Two Fed Nominees Likely to Support Easier Policy (Bloomberg)

- Tesla Stock Jumps On Record Second-Quarter Deliveries (Barron’s)

- Aaron Paul hints at ‘Breaking Bad’ movie (New York Post)

- Jobs Report Holds Make-or-Break Sway Over Fed Rate Strategy (Bloomberg)

- Christine Lagarde, managing director of the IMF, was just nominated for the top job at the European Central Bank (Business Insider)

- Formula E New York: Everything to Know, From the Cars to Nearby Bars (Bloomberg)

- Scientists Are Giving Dead Brains New Life. What Could Go Wrong? (New York Times)

- Hedge Fund and Insider Trading News: Daniel Och, Bill Ackman, Warlander Asset Management, FrontPoint Partners, Morphic Holding Inc (MORF), Acorn Energy Inc (ACFN), and More (Insider Monkey)

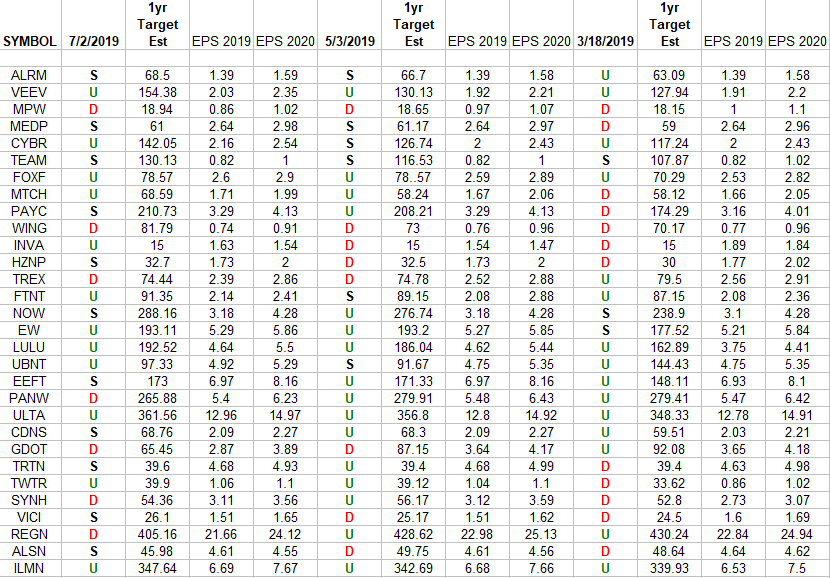

IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) [That are not included in our Dow+8, Nasdaq, and Russell spreadsheets in earlier posts]. Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions”

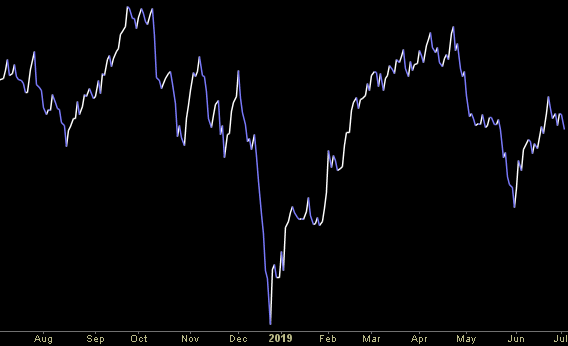

Where is money flowing today?

Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Today some institution/fund purchased 9,905 contracts of Jan $75 strike calls (or the right to buy 990,500 shares of JPMorgan Chase & Co. (JPM) at $75). The open interest was just 2,590 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”

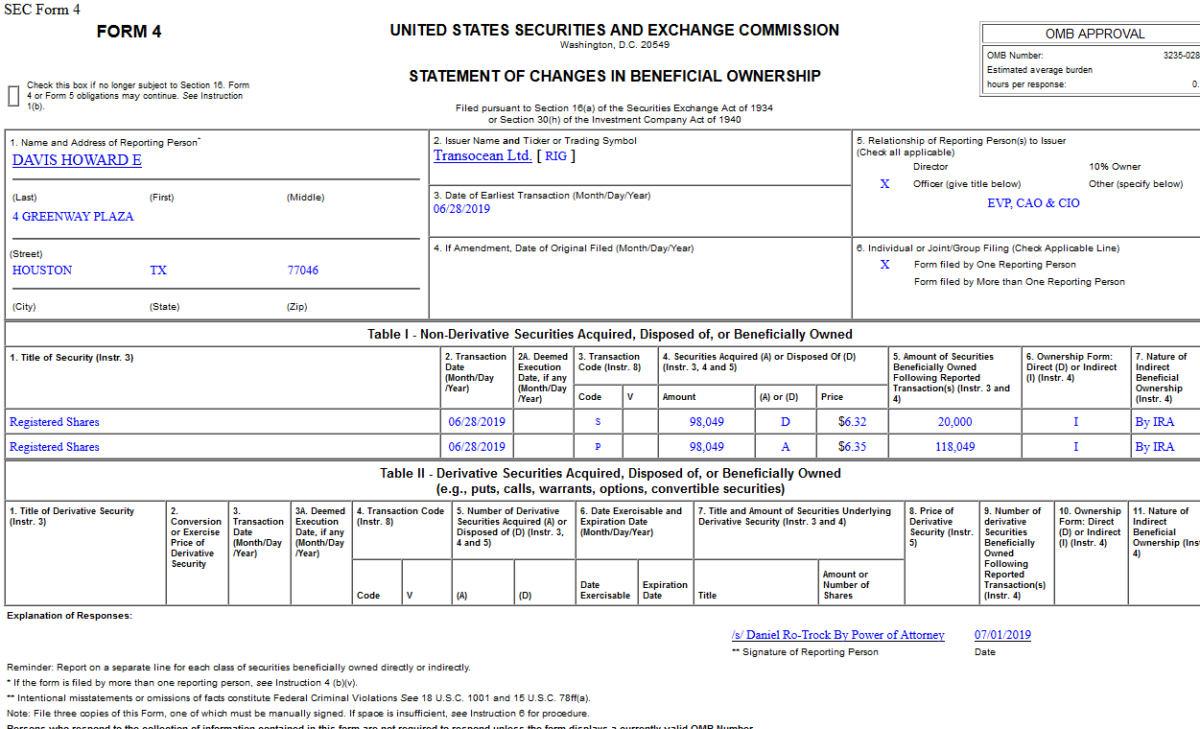

Insider Buying in Transocean Ltd. (RIG)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 7 key reads for Tuesday…

- Hey Dave, “Where’s the Beef?” (ZeroHedge)

- American Suburbs Swell Again as a New Generation Escapes the City (Wall Street Journal)

- OPEC and allies extend oil supply cut in bid to boost prices (Reuters)

- China’s Deleveraging Is Over (Wall Street Journal)

- Goldman Sachs Has 4 Top Pick Energy Stocks to Buy as OPEC Cuts Remain in Place (24/7 Wall Street)

- Hedge Funds Are Tracking Private Jets to Find the Next Megadeal (Bloomberg)

- Why Goldman Sachs Could Be a New Safety Stock (Wall Street Journal)

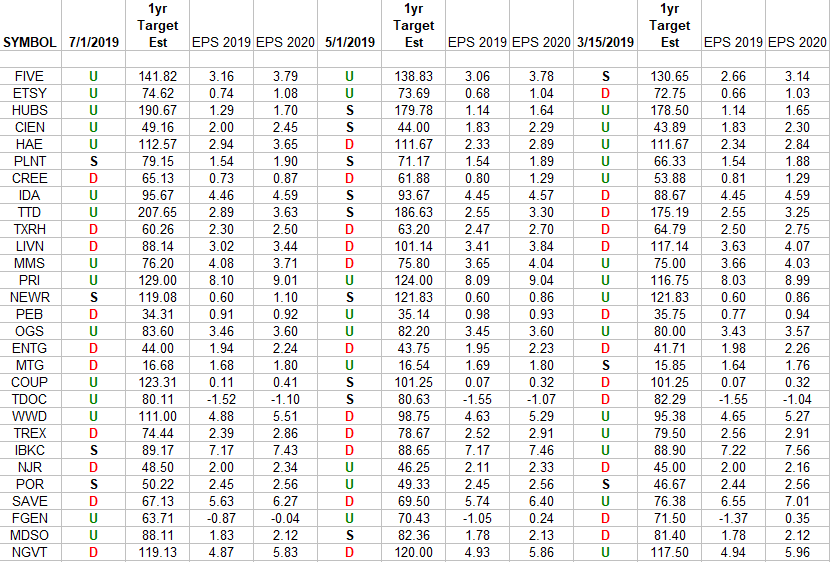

Russell 2000 (top weights) Earnings Estimates Climb Higher

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2019 and 2020 estimates (if available) were: 3/15/2019, 5/1/2019 and today. The Continue reading “Russell 2000 (top weights) Earnings Estimates Climb Higher”