- High Consumer Confidence Is A Notable Stock Market Warning (The Fat Pitch)

- US labor force hits new high amid rising trade tensions (New York Post)

- What Happens When Hedge Funds are Under the Gun (Institutional Investor)

- U.S. LNG exports to Europe increase amid declining demand and spot LNG prices in Asia (EIA)

- China Isn’t Afraid to Be the “Bad Guy” of CRISPR Research (Futurism)

- A Bargain-Priced CVS Tries to Heal Itself (Barron’s)

- Magician Performs A Ball Trick That Wows The Pants Off Penn And Teller (digg)

- Boeing Adds a Second Flight Control Computer on the 737 Max to Boost Reliability, Sources Say (Fortune)

- Meet The Pagani Huayra Roadster BC, A $3.5 Million Hypercar (Maxim)

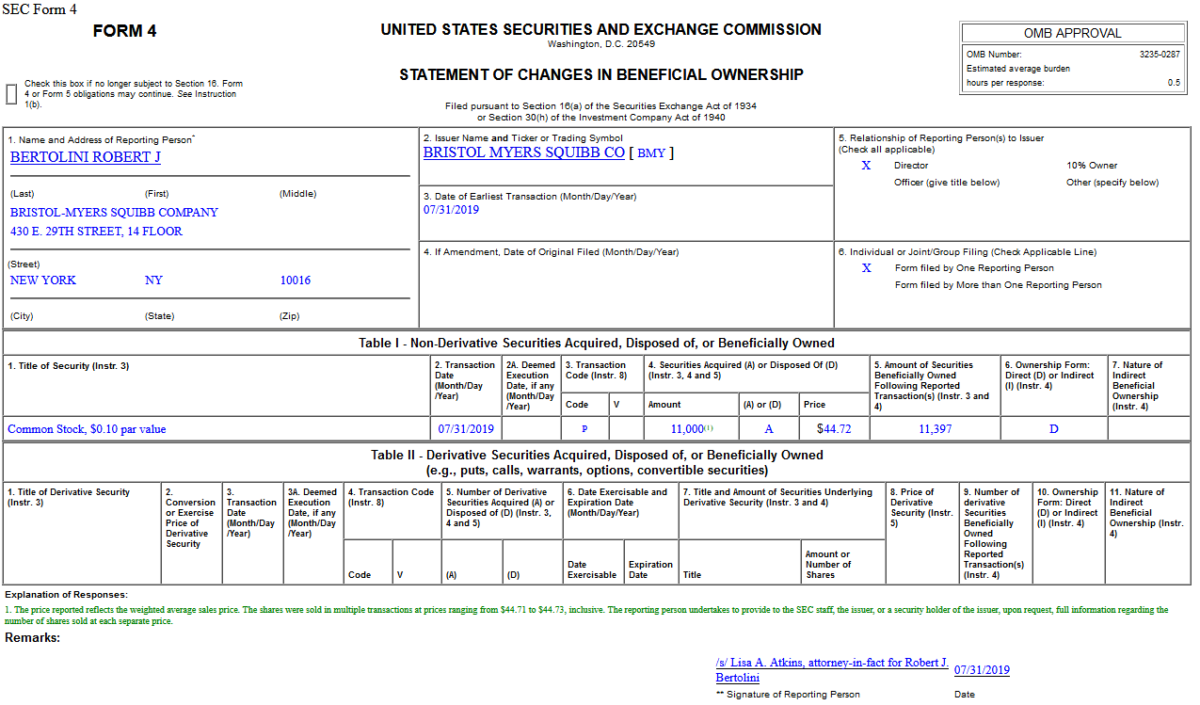

- Hedge Fund and Insider Trading News: David Einhorn, Michael Hintze, Neil Woodford, Och-Ziff Capital Management, Universal Forest Products, Inc. (UFPI), Bristol-Myers Squibb Co (BMY), and More (Insider Monkey)

Insider Buying in Bristol-Myers Squibb Company (BMY)

Where is money flowing today?

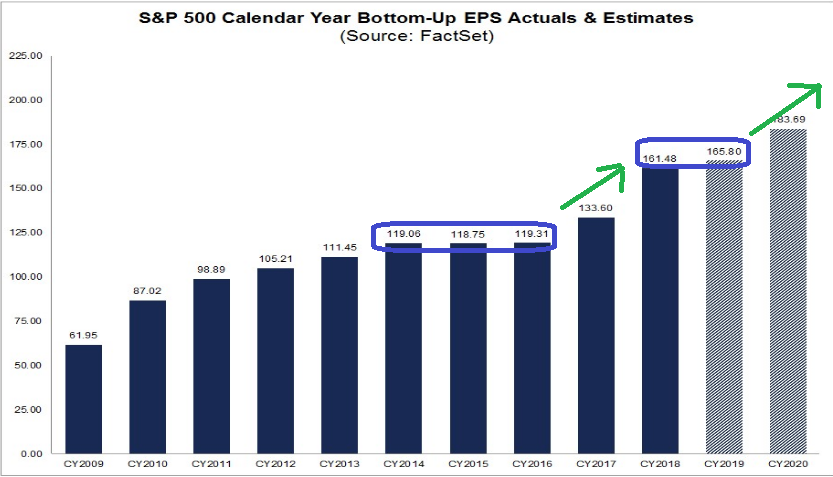

Q2 Earnings Better Than Expected

Source: FactSet

On June 30, the estimated earnings decline for Q2 2019 was -2.7%. As of today (with 77% of the companies in the S&P 500 reporting), the blended earnings decline has improved to -1%. Continue reading “Q2 Earnings Better Than Expected”

Indicator of the Day (video): $NAMO Nasdaq McCellan Oscillator

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 5 key reads for Friday…

- Trump’s new tariffs may set stage for more Fed rate cuts (Reuters)

- Exxon Mobil earnings beat, shares jump 2% (CNBC)

- Social Media Success Is Habit-Forming (Wall Street Journal)

- U.S., Japan Edge Closer to Limited Trade Pact (Wall Street Journal)

- South Korea Stocks Could Be Ready for a Rebound (Barron’s)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – Dell Technologies Inc. (DELL)

Today some institution/fund purchased 1,000 contracts of Jan 2020 $62.50 strike calls (or the right to buy 100,000 shares of Dell Technologies Inc. (DELL) at $62.50). The open interest was just 374 prior to this purchase. Continue reading “Unusual Options Activity – Dell Technologies Inc. (DELL)”