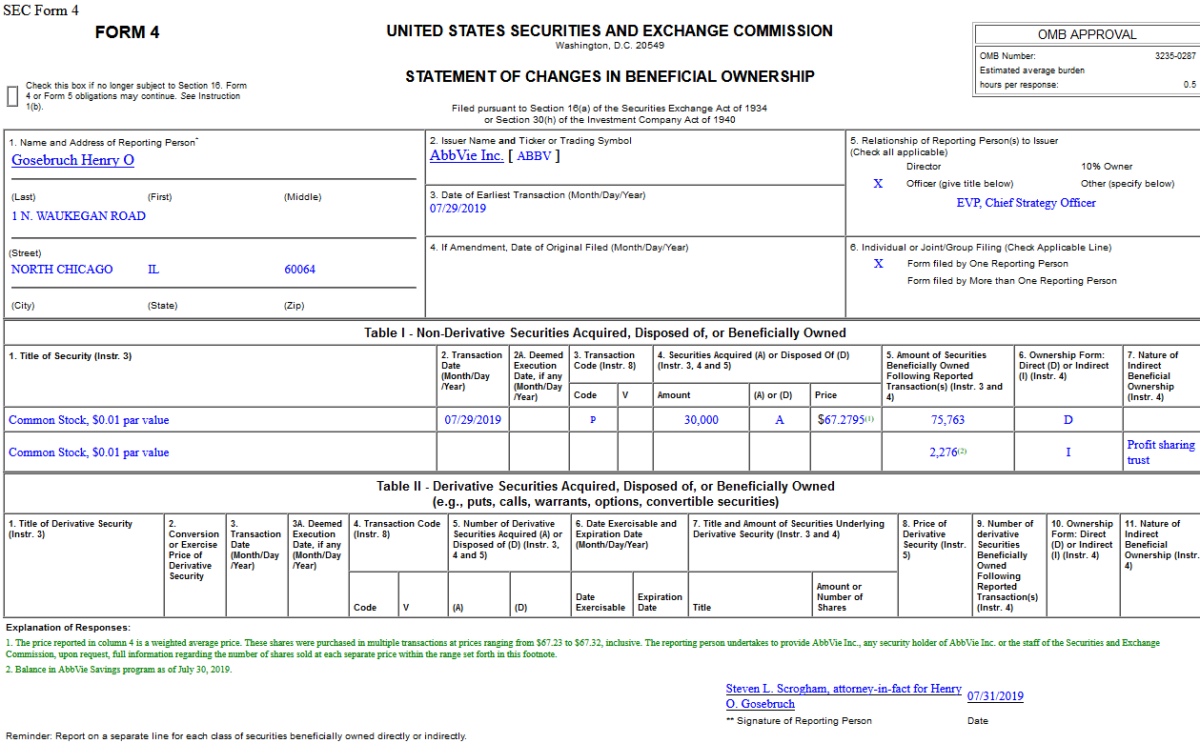

On July 29, 2019, Henry Grosebruch – EVP, Chief Strategy Officer of AbbVie Inc. (ABBV) – purchased 30,000 shares of ABBV at $67.28. His out of pocket cost was $2,018,385.

Hedge Fund Trade Tip (PMN) – Position Management Notification

Hedge Fund Trade Tip (PMN) – Position Management Notification

Be in the know. 7 key reads for Thursday…

- The S&P 500 Will Hit 3400 by 2020 Even If Earnings Are Lower, Goldman Sachs Says (Barron’s)

- Powell Suggests Fed Embarking on 1990s-Style Mini Easing Cycle (Bloomberg)

- China sees intensive contact with U.S. this month ahead of September trade talks (Reuters)

- Powell is ‘confusing’ the markets about Fed intentions, but a new cut is expected (CNBC)

- Merck Has a Good Problem and Plenty of Options (Wall Street Journal)

- Nordstrom Family Prepares New Proposal to Increase Stake in Retailer (Wall Street Journal)

- Dr. Michael Burry Of ‘Big Short’ Likes Asian Stocks (Forbes)

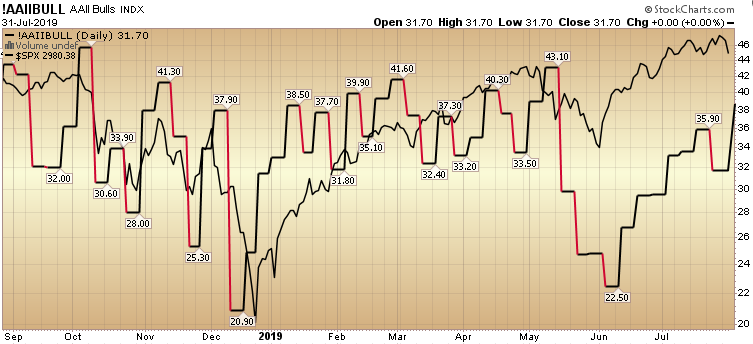

AAII Sentiment Survey Results: Getting up there…

While bullish sentiment jumped in the past week from 31.74% to 38.44%, we likely still have a little room to run. This is not the level that I would be aggressively adding risk (only selectively on laggard names that haven’t participated – if at all). In the lexicon of sell side analysts we are at a “hold.” Continue reading “AAII Sentiment Survey Results: Getting up there…”

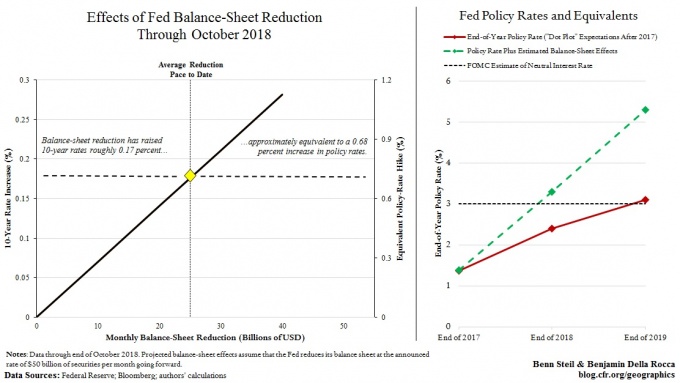

Relax, we got a ~40bps rate cut?

In November 2018, the Council on Foreign Relations did an article that attempted to quantify the impact of the Fed’s balance sheet runoff (Quantitative Tightening): https://www.cfr.org/blog/fed-tightening-more-it-realizes Continue reading “Relax, we got a ~40bps rate cut?”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – Pfizer Inc. (PFE)

Today some institution/fund purchased 1,000 contracts of Jan 2020 $20 strike calls (or the right to buy 100,000 shares of Pfizer Inc. (PFE) at $20). The open interest was just 325 prior to this purchase. Continue reading “Unusual Options Activity – Pfizer Inc. (PFE)”