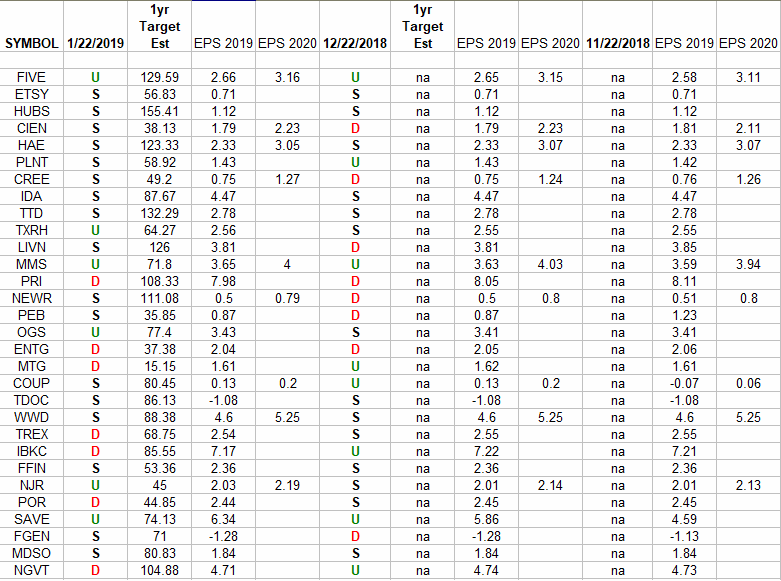

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted small cap stocks in the Russell 2000 index. I have columns for what the 2019 and 2020 estimates (if available) were: 11/22/18, 12/22/18, Continue reading “Russell 2000 (top 30 weights) Earnings Estimates/Revisions”

Unusual Options Activity

Today some institution/fund purchased 10,068 contracts of April $8 strike calls (or the right to purchase 1,006,800 shares of Encana ECA at $8). This is a larger sized bet for this stock and contract as the open interest was just Continue reading “Unusual Options Activity”

Be in the know. Top 7 reads for Tuesday…

- Chilling Davos: A Bleak Warning on Global Division and Debt (New York Times)

- Ray Dalio, founder of the world’s biggest hedge fund, sees a ‘significant risk’ of a possible US recession in 2020 (CNBC)

- Goldman upgrades Under Armour to Conviction Buy, sees 37% share upside (The Fly)

- Hedge Funds Hunt for Brexit Bargains (Bloomberg)

- A data point known as a canary in the coal mine for the global economy just fell off a cliff (Business Insider)

- Amazon will soon lose the biggest reason to pay for Prime (Business Insider)

- Elliott urges eBay to restructure business to double market value (Reuters)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

What the Commitment of Traders says about the US Dollar Futures

The Commitments of Traders is a weekly market report issued by the Commodity Futures Trading Commission (CFTC) enumerating the holdings of participants in various futures markets in the United States. It is collated Continue reading “What the Commitment of Traders says about the US Dollar Futures”

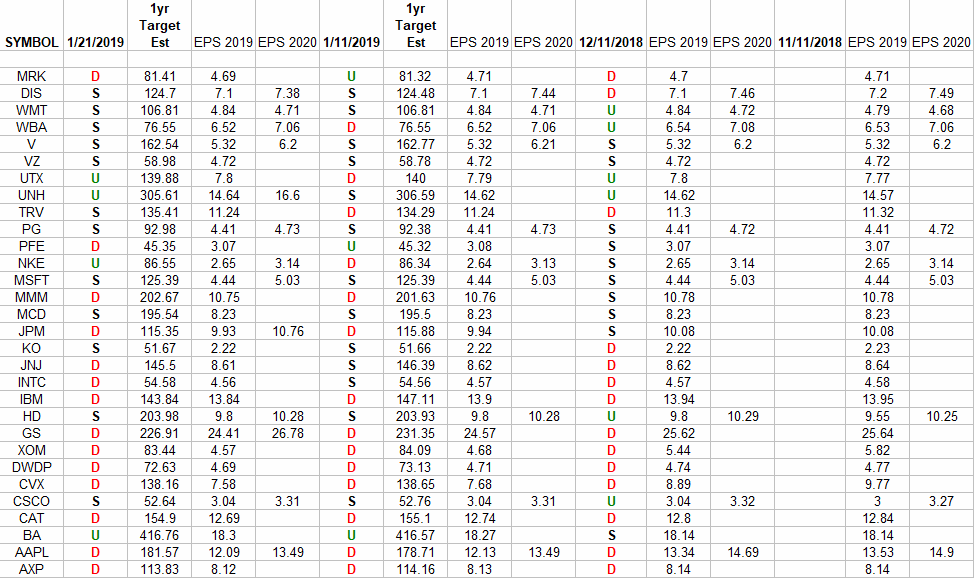

Dow 30 Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the DOW 30. I have columns for what the 2019 and 2020 estimates (if available) were: 11/11/18, 12/11/18, 1/11/19, and today 1/21/19. The column under the date Continue reading “Dow 30 Earnings Estimates”

Be in the know. 5 key reads for Monday…

- Abby Joseph Cohen Highlights Global Bargains (Barron’s)

- Why the stock market is headed for a swift recovery (USA Today)

- Amazon Knows What You Buy. And It’s Building a Big Ad Business From It (New York Times)

- Trump, Democrats Inch Closer Amid Personal Shutdown Sniping (Bloomberg)

- Trump and Kim to Hold Second Summit in February (Wall Street Journal)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 5 key reads for Saturday

- Skittish investors made it a painful year-end for hedge funds (New York Post)

- The Fed is Zeus and the algos are the underworld — Greek mythology is a lot like today’s wild markets, Macquarie says (Business Insider)

- Five Ways to Profit from the Boom in Life Science (Barron’s)

- What Keeps Economists Up At Night? And Other Stuff (NPR Planet Money)

- How to Do Great Things (Farnam Street)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

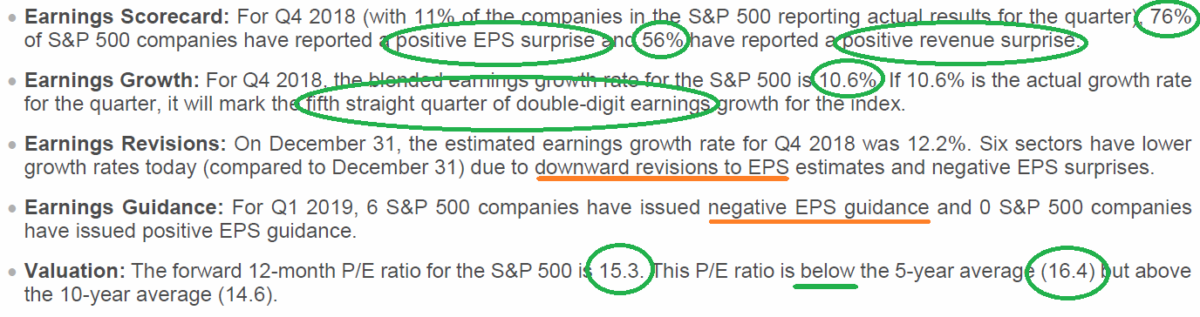

Earnings Update

Per FactSet, eps and revenues continue to beat by 76% and 56% respectively – after 11% of S&P 500 having reported Q4 earnings so far.

Guidance is a bit light but 2019 eps estimates remain ~$171.50 per share. If Continue reading “Earnings Update”

Unusual Options Activity

Today some institution/fund purchased 25,025 contracts of March $29 strike calls (or the right to purchase 2,502,500 shares of JD.com at $29). This is a big bet for this stock and contract as the open interest was just Continue reading “Unusual Options Activity”

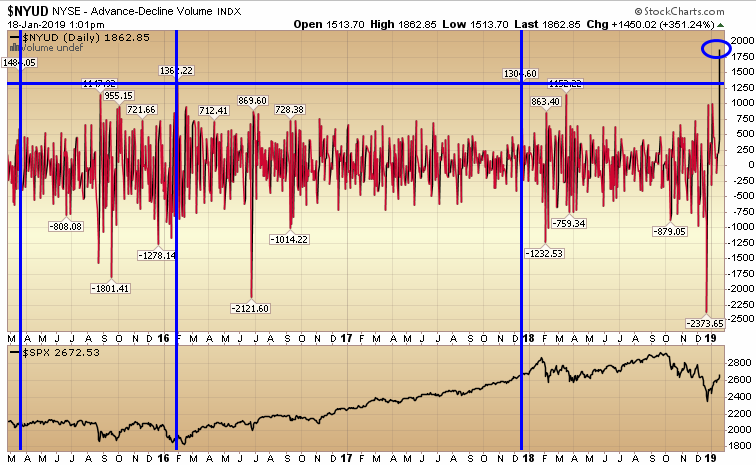

NYSE Advance Decline Volume

I have posted the $NYUD NYSE Advance Decline Volume indicator – which I have used as a barometer for many years. It’s currently at 1862 which is a very extreme reading and consistent with other periods of turnaround after Continue reading “NYSE Advance Decline Volume”