- Netflix (NFLX) is Raising U.S. Prices by 13% to 18% (Street Insider)

- JPMorgan (JPM) Misses Q4 EPS by 23c (Street Insider)

- Wells Fargo (WFC) Tops Q4 EPS by 2c (Street Insider)

- Raymond James Says Top MLPs May Be Poised for a Monster Year (24/7 Wall Street)

- Warning to Investors: Powell Is No Greenspan (Wall Street Journal)

- China to Ramp Up Efforts to Support Economy in 2019 (Barron’s)

- All Eyes on Corporate Guidance (Wall Street Journal)

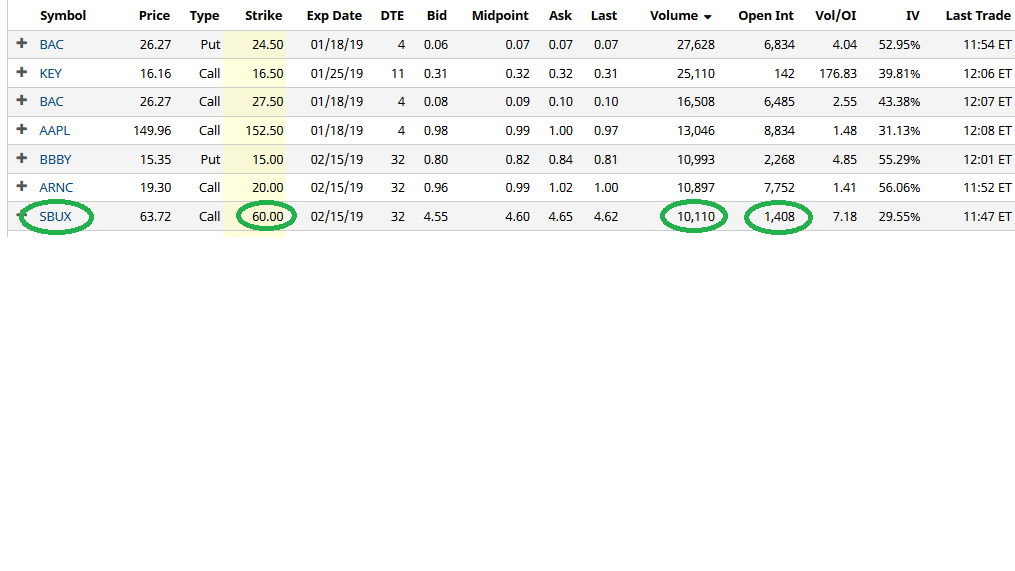

Unusual Options Activity

Today some institution/fund purchased 10,100 contracts of February $60 strike calls (or the right to purchase 1,010,000 shares of Starbucks at $60). This is a large sized bet for this stock and contract as the open interest was just 1,408 prior to this purchase. Starbucks $SBUX reports on 1/24/19.

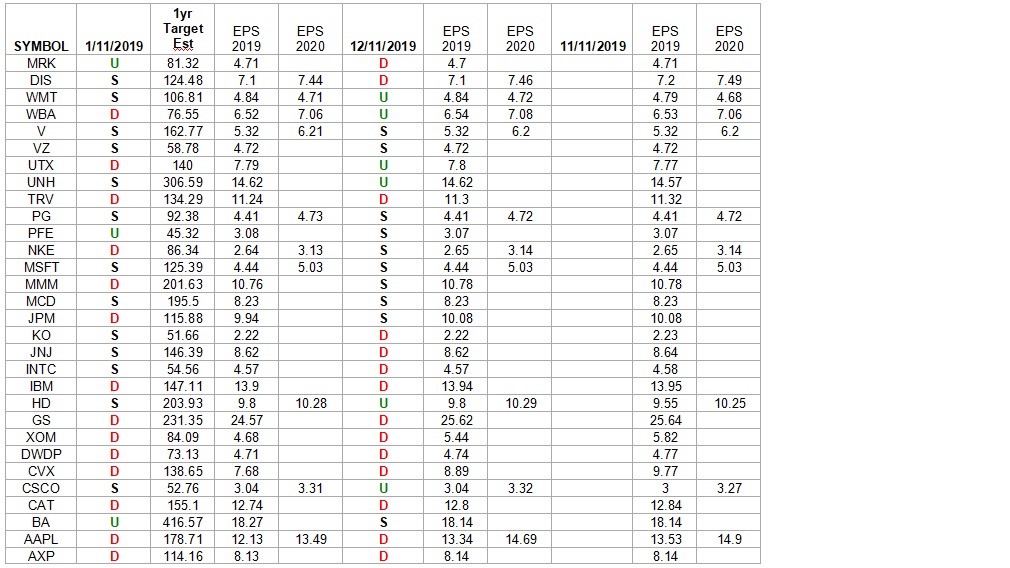

Dow 30 Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the DOW 30. I have columns for what the 2019 and 2020 estimates (if available) were: 60 days ago, 30 days ago, and this weekend (1/11/19). The column Continue reading “Dow 30 Earnings Estimates”

Be in the know. 5 key reads for Monday…

- The Worst Might Be Over for FedEx Stock (Barron’s)

- Snap shares rise after Citi upgrades stock, citing better ad revenues (CNBC)

- Train Your Brain Like a Memory Champion (New York Times)

- Jessica Alba Shares the Routine That Helps Her Run the Multimillion-Dollar Honest Company (Entrepreneur)

- Former White House communications chief Anthony Scaramucci to appear in Celebrity Big Brother. (The Sun)

What the Commitment of Traders says about Orange Juice Futures

The Commitments of Traders is a weekly market report issued by the Commodity Futures Trading Commission (CFTC) enumerating the holdings of participants in various futures markets in the United States. It is collated Continue reading “What the Commitment of Traders says about Orange Juice Futures”

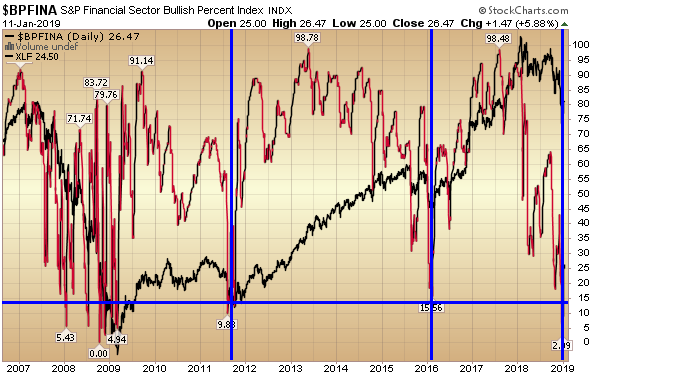

Bullish Percent – What it says about Financials ahead of Earnings

With bank earnings on deck, it’s a good time to take stock of the health of the Financial sector to anticipate possible moves in the sector in coming months. Continue reading “Bullish Percent – What it says about Financials ahead of Earnings”

Be in the know. 5 key reads for Sunday:

- Would Big Pharma Pay for the Wall? ()

- Saudis Say OPEC+ Oil Cuts on ‘Right Track’ to Balance the Market (Bloomberg)

- Cannabis company stock soars after Thiel-backed fund says it won’t sell shares (New York Post)

- How Companies Like Apple Sprinkle Secrets in Earnings Reports (New York Times)

- Carl Icahn Reportedly Building Stake in Caesars ()

What I’m reading today…

- Why the Fed Backed Off on Interest Rates (Barron’s)

- Airline Stocks Are Pricing In a Downturn. We Disagree (Barron’s)

- General Motors predicts stronger 2019 Earnings (NY Post)

- In the Riskiest Corners of the Stock Market, Exuberance Is Back (Bloomberg)

- January Option Expiration Week Trends Weak (Quantifiable Edges)

- Coming to America 2 Is Happening (Vanity Fair)

- Millennials Are About to Get Locked Out of the Real Estate Market—Again (Fortune)

- Robb Report Car of the Year 2018 (Robb Report)

- The Secret to Getting the Freshest Krispy Kreme Doughnuts (Reader’s Digest)

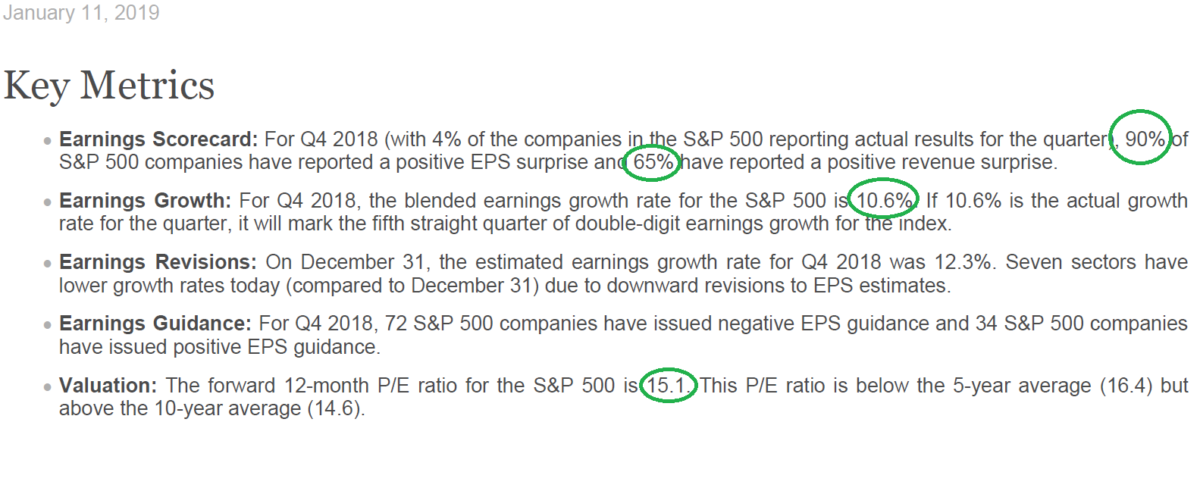

Early earnings results strong

Earnings still strong (different from 2008 & 2000) so far…

The 20 years of quarterly earnings history below are compliments of Howard Silverblatt – S&P Dow Jones Indices Senior Index Analyst. I have bolded those periods (2000 & 2007) where there was an abrupt drop in earnings (which portended a steep market correction). In 2007 we had fair Continue reading “Earnings still strong (different from 2008 & 2000) so far…”