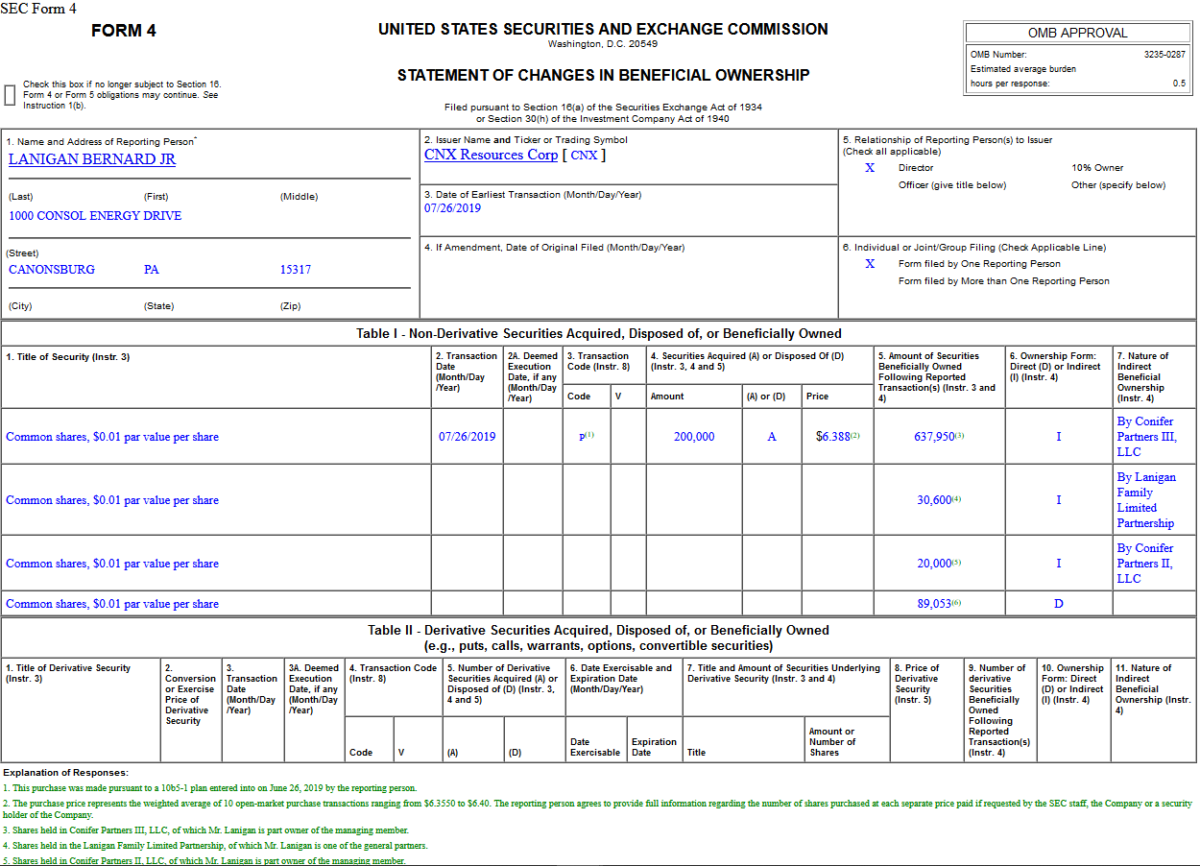

On July 26, 2019, Bernard Lanigan, Jr. – CNX Resources Corporation (CNX) – purchased 200,000 shares of CNX at $6.39. The cost was $1,277,600.

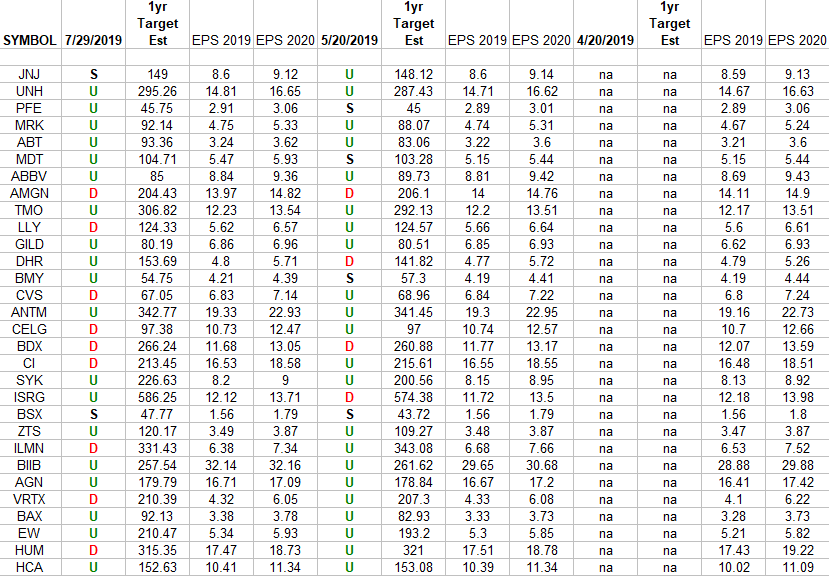

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Monday…

- What Are The World’s Next ‘Moonshots?’ (Barron’s)

- With Stocks at Fresh Highs, Investors’ Portfolios Look Alike (Wall Street Journal)

- 5G could change everything. Here’s what you need to know before you buy into the tech (USA Today)

- Hedge Funds Chasing 400% Return Show Risk in China’s Wild Market (Bloomberg)

- Quentin Tarantino nets his biggest opening weekend ever with $40.4 million take for ‘Once Upon a Time… in Hollywood’ (Business Insider)

- Former Fed Chair Janet Yellen says she’s in favor of an interest rate cut (CNBC)

- Bill Gates took solo ‘think weeks’ in a cabin in the woods—why it’s a great strategy (CNBC)

- 37-Year-Old Former School Teacher Is India’s Newest Billionaire (Bloomberg)

- Animal Spirits: Pfizer May Buy Low and Smart in Generics Gambit (Wall Street Journal)

- Financial Crisis Yields a Generation of Renters (Wall Street Journal)

Be in the know. 8 key reads for Sunday…

- Beijing says millions of tons of U.S. soy shipped to China in trade consensus (Reuters)

- Jack Ma’s $290 Billion Loan Machine Is Changing Chinese Banking (Bloomberg)

- How donuts fuelled the American Dream (Economist)

- How Two Stanford Dropouts Built a $2.6 Billion Company In Just Two Years (Entrepreneur)

- How Mary Ramos Brought 1969 to Life for Quentin Tarantino (GQ)

- Chinese LNG Imports See Strong Growth This Summer (OilPrice)

- Dyson: James Dyson How I Built This with Guy Raz (NPR)

- Land of the Giants: Why You’ll Never Quit Amazon Prime (PodCast) (Vox)

Be in the know. 15 key reads for Saturday…

- Is CVS A Value Trap Or A Fallen Angel Ready To Rise Again? (Forbes)

- Why KBW Sees BofA, Citi and Goldman Sachs Winning From Fed Rate Cuts (24/7 Wall Street)

- Hedge Fund and Insider Trading News: David Einhorn, Caxton Associates, Crown Castle International Corp (CCI), Esperion Therapeutics Inc (ESPR), and More (Insider Monkey)

- LBOs Make (More) Companies Go Bankrupt, Research Shows (Institutional Investor)

- Chevron, Exxon earnings: Shale M&A is high on the list of investor concerns (MarketWatch)

- Buffett buys more Bank of America stock, with stake’s value rising to $29 billion (MarketWatch)

- Week in review: How Trump’s policies moved stocks (TheFly)

- As electric vehicle production ramps up worldwide, a supply crunch for battery materials is looming (CNBC)

- A TV Maverick Is Going All-In on a New Wireless Bet (Wall Street Journal)

- Europe’s Bond Yields Race to the Bottom (Barron’s)

- Is a Recession Coming? Economic Indicators Say Otherwise (Barron’s)

- The 2020 Evora GT Is the Fastest, Most Powerful Lotus Ever Offered in the U.S. (DesignBoom)

- Inside the Goodwood Festival of Speed, a High-Octane Supercar Celebration (Maxim)

- SoftBank’s transformation into an investment powerhouse continues (The Economist)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

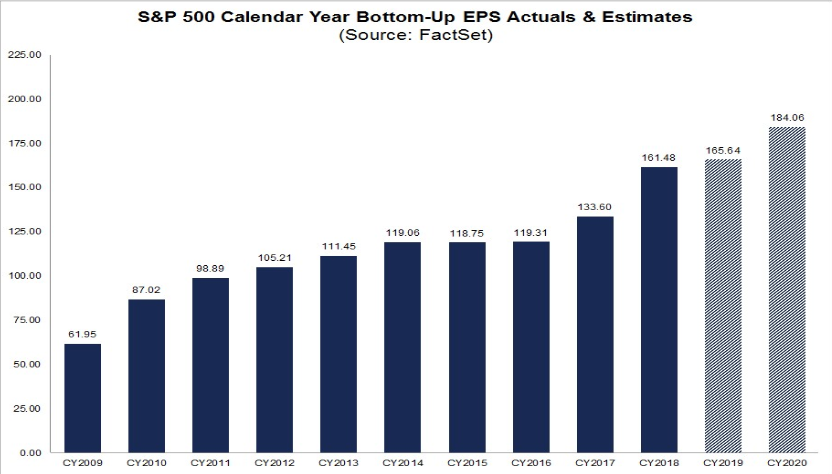

Q2 Earnings Results Update + 2020

Data Source: Factset

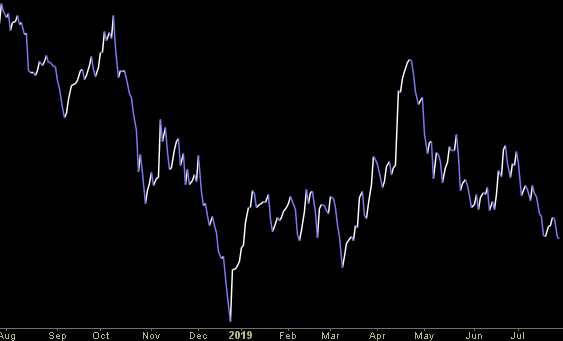

The more I look at the earnings estimates for 2020, the more this is starting to look like 2015-2017. 2015-2016 S&P 500 EPS (Earnings Per Share) was basically flat ($118.75, $119.31) as are 2018-2019 ($161.48, $165.64 est). Continue reading “Q2 Earnings Results Update + 2020”

Unusual Options Activity – Suncor Energy Inc. (SU)

Today some institution/fund purchased 633 contracts of Jan $30 strike calls (or the right to buy 63,300 shares of Suncor Energy Inc. (SU) at $30). The open interest was 391 prior to this purchase. Continue reading “Unusual Options Activity – Suncor Energy Inc. (SU)”