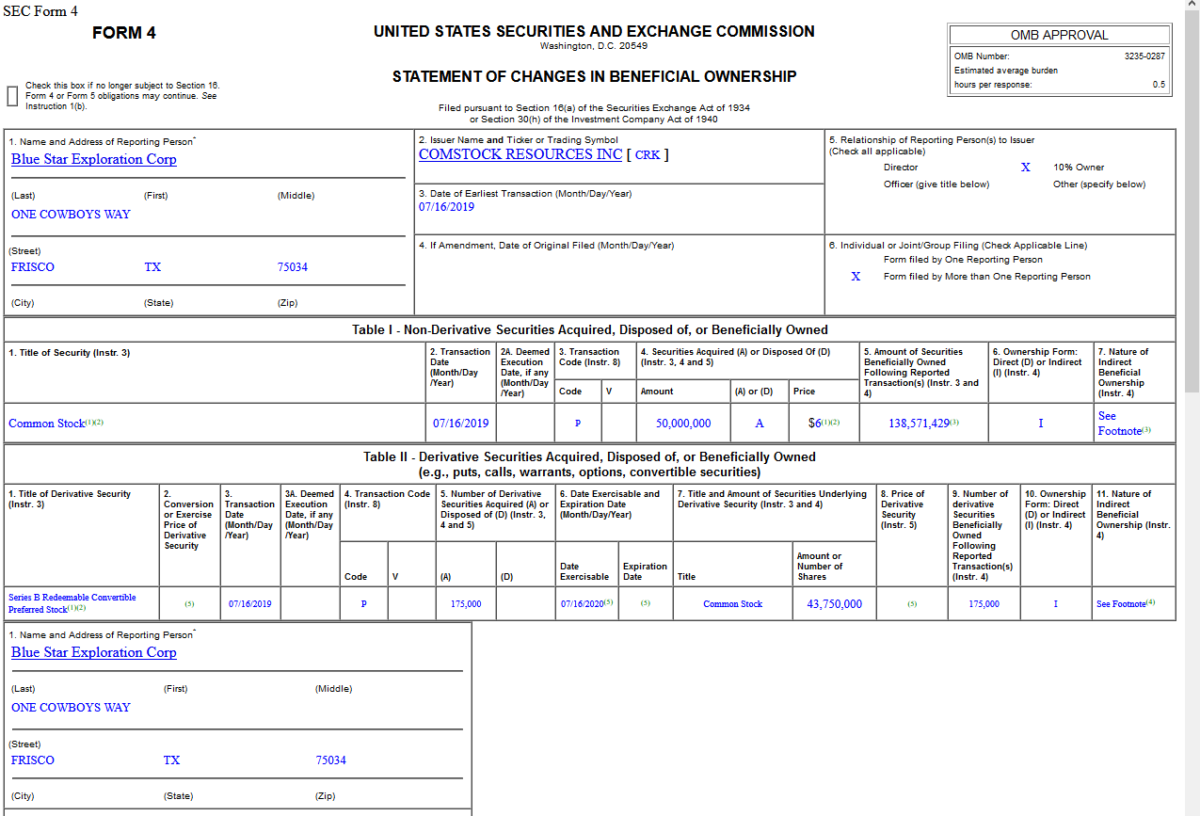

Jerry Jones – Owner of the Dallas Cowboys – (Blue Star Exploration Corp) put up $475M of his own money to do a deal in the Natural Gas Space with Comstock Resources (CRK) (2 articles explain the deal): Continue reading “Insider Buying in Comstock Resources, Inc. (CRK)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Thursday…

- Energy shares could double by 2020, so buy now, says contrarian investor (MartketWatch)

- Raymond James upgrades Apple on ‘increased conviction in a 5G iPhone’ (CNBC)

- Paradigm Shifts by Ray Dalio (LinkedIn)

- UnitedHealth lifts 2019 profit forecast after topping second-quarter estimates (MarketWatch)

- More Solid Bank Results: Morgan Stanley beats profit estimates as rising stocks benefit wealth management and fund business (CNBC)

- Mnuchin: Phone call on trade with China counterparts set for Thursday, ‘complicated issues’ remain (CNBC)

- Mnuchin says progress being made on debt limit deal (CNBC)

- There’s light at the end of the tunnel for small caps, analysts say (MarketWatch)

- Hedge Fund Beating S&P 500 on Stodgy Bets Goes All-In on Stocks (Bloomberg)

- Airline Profits Are Flying but Investors Don’t Care (Wall Street Journal)

- Frontier Markets Are on Sale — but It Could Be a Wild Ride (Barron’s)

- Here’s how the new Corvette Stingray could morph into a ‘fire-breathing monster’ (USA Today)

- Netflix Loses U.S. Subscribers as Price Increases Take a Toll (New York Times)

- Buy Luckin Coffee Stock Because Its Growth Story Is Still Going, Analyst Says (Barron’s)

- Texas Showdown Flares Up Over Natural-Gas Waste (Wall Street Journal)

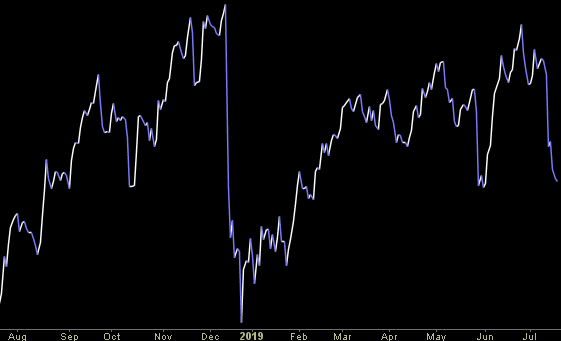

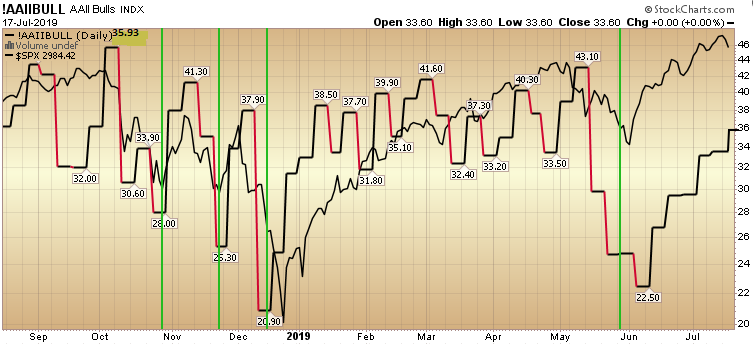

AAII Sentiment Survey Results: Slowly Climbing the Wall of Worry

Data Source: AAII

While the market indices all made new highs this week, sentiment did not. This is a hated rally because most institutions were caught offsides in May/June and raised too much cash. Continue reading “AAII Sentiment Survey Results: Slowly Climbing the Wall of Worry”

Unusual Options Activity – Freeport-McMoRan Inc. (FCX)

Today some institution/fund purchased 28,235 contracts of Nov $12 strike calls (or the right to buy 2,823,500 shares of Freeport-McMoRan Inc. (FCX) at $12). The open interest was just 5,673 prior to this purchase. Continue reading “Unusual Options Activity – Freeport-McMoRan Inc. (FCX)”

Where is money flowing today?

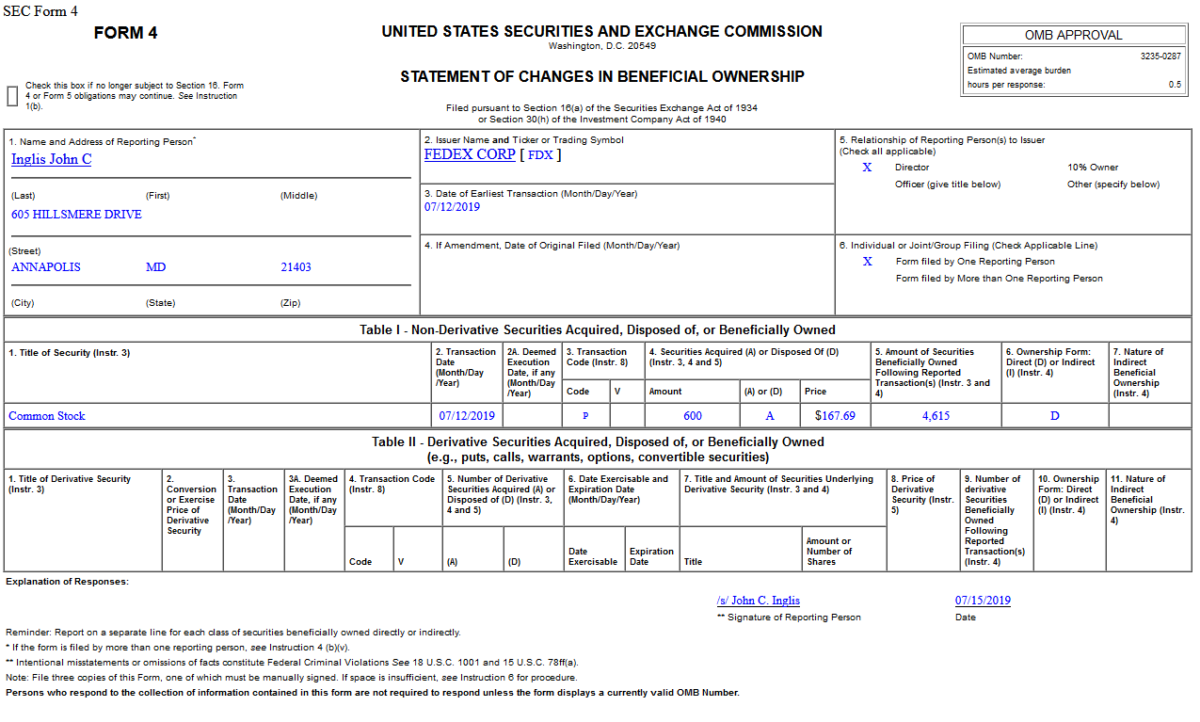

Insider Buying in FedEx Corporation (FDX)

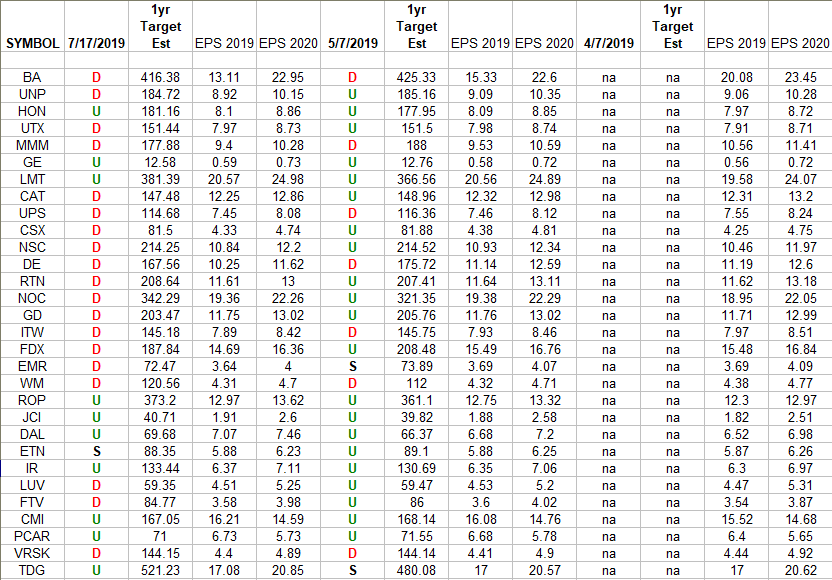

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 7/17/2019 has a letter that represents the movement in 2019 earnings Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 10 key reads for Wednesday…

- Bank of America beats analysts’ profit estimates on retail banking strength (CNBC)

- Don’t Scoff at Influencers. They’re Taking Over the World. (New York Times)

- Opposite of Conventional Wisdom (The Irrelevant Investor)

- S. Manufacturers Are Getting Out of Their Slump. Maybe. (Barron’s)

- How Much Boeing Stock Is Worth If the 737 MAX Never Flies Again (Barron’s)

- Powell Says Fed Must Pay Greater Attention to Global Developments (Wall Street Journal)

- Influencers Seek Wall Street’s Help to Manage Newfound Wealth (Bloomberg)

- Lotus’s $2.1 Million Evija Electric Hypercar Doesn’t Have Door Handles (Bloomberg)

- This chart pattern is popping up all over the market and could signal a breakout for stocks (CNBC)

- (GM’s best decision in years): ‘I Refuse to Call it a Corvette.’ GM Moves the Engine, Revs Up a Revolt (Wall Street Journal)