Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 12 key reads for Thursday…

- Fed’s Bullard expects a total of a half-point ‘insurance’ rate cut by year end, largely owed to trade jitters (MarketWatch)

- When the Fed cuts rates without a recession, stocks go higher 100% of the time (CNBC)

- 4 habits that self-made billionaires practice nearly every day (MarketWatch)

- Here’s how many points a U.S.-China trade deal is worth to the S&P 500, according to J.P. Morgan’s top strategist (MarketWatch)

- Going to check this out on Saturday: Zero to 60 on 250 Kilowatts (in a Zippy 2.8 Seconds) (New York Times)

- Alibaba Stock Will Benefit from Strong Consumer Spending in China (Barron’s)

- The Best Offense May Be Great Defense Stocks: 5 Top Picks to Buy Now (24/7 Wall Street)

- White House kills rule aimed at ending Medicare drug rebates (StreetInsider)

- Boris Johnson says he finds it ‘hard to disagree’ with Trump’s attack on May (Business Insider)

- Mnuchin urges US suppliers to seek approval to resume selling to blacklisted Huawei, new report claims (Business Insider)

- France approves digital tax on American tech giants, defying US trade threat (CNBC)

- Rice Brothers Win Control of EQT (Wall Street Journal)

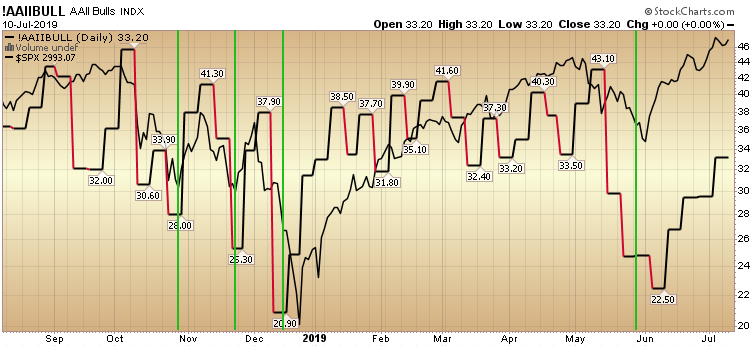

AAII Sentiment Survey Results: Bulls Just Warming Up…

As was the case last week, the wall of worry is so high that the Bullish Percent continues to remain subdued at a paltry 33.61% – barely moving up from last week despite hitting 3000 on the S&P 500 yesterday. Continue reading “AAII Sentiment Survey Results: Bulls Just Warming Up…”

Unusual Options Activity – Dell Technologies Inc. (DELL)

Today some institution/fund purchased 5,444 contracts of Oct $55 strike calls (or the right to buy 544,400 shares of Dell Technologies Inc. (DELL) at $55). The open interest was just 793 prior to this purchase. Continue reading “Unusual Options Activity – Dell Technologies Inc. (DELL)”

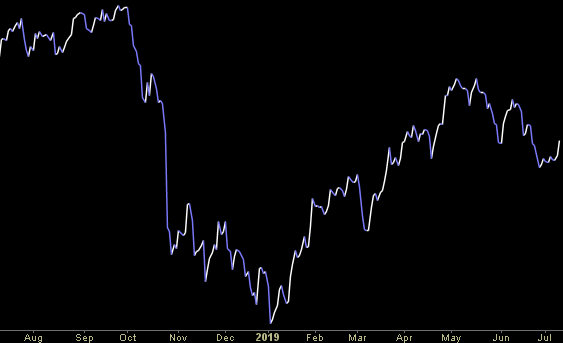

Where is money flowing today?

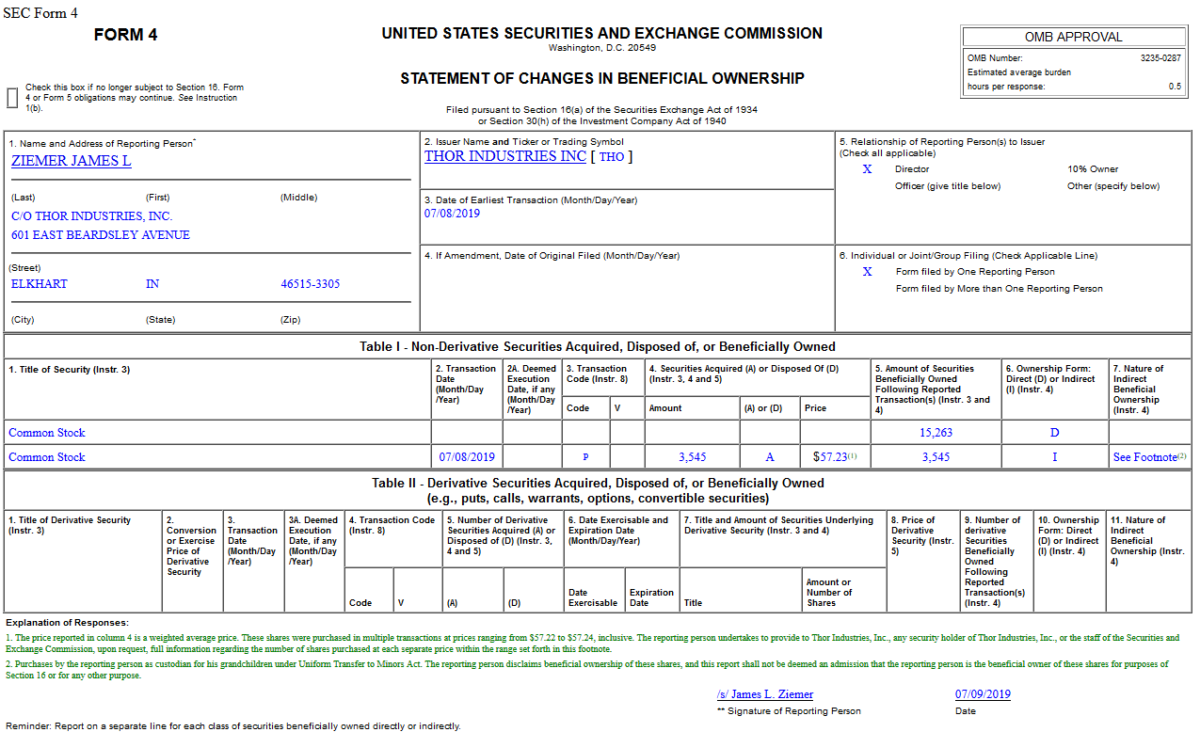

Insider Buying in Thor Industries, Inc. (THO)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

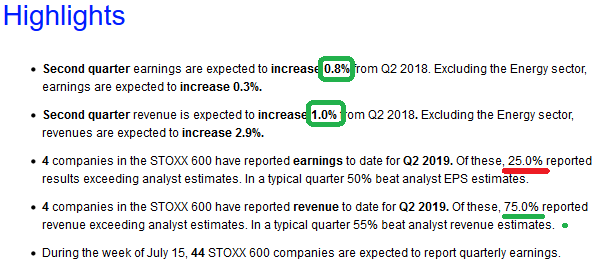

European (Stoxx 600) Q2 Earnings Estimates Down

Data Source: Thomson Reuters

While it’s still early in Q2 reporting – with only 4 companies in the European Stoxx 600 reporting, estimates came down in the past week. Continue reading “European (Stoxx 600) Q2 Earnings Estimates Down”