Today some institution/fund purchased 5,171 contracts of Jan $72.50 strike calls (or the right to buy 517,100 shares of Gilead Sciences, Inc. (GILD) at $72.50). The open interest was 3,751 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

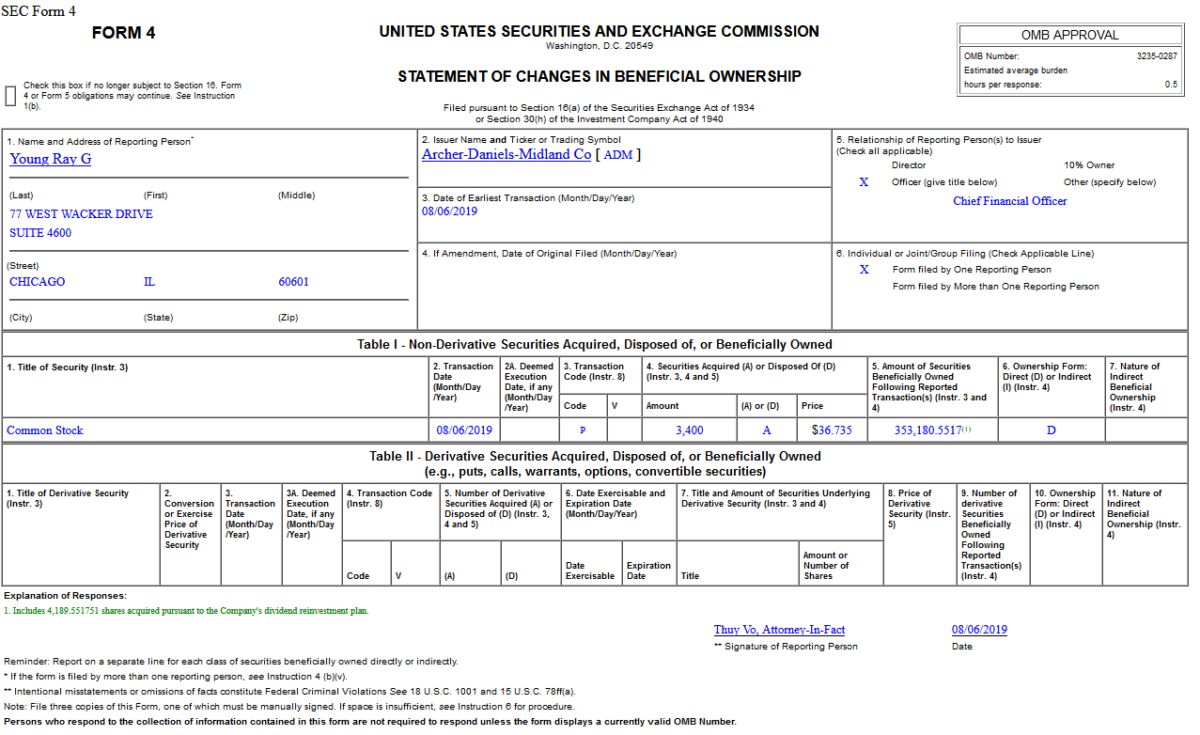

Insider Buying in Archer-Daniels-Midland Company (ADM)

Where is money flowing today?

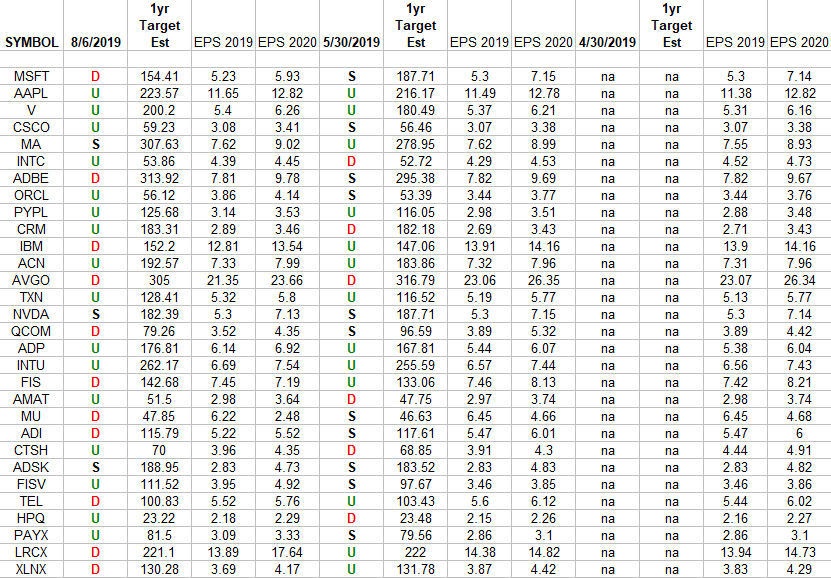

Technology Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 12 key reads for Tuesday…

- Regeneron Earnings Easily Beat Views (Investors)

- Hedge Fund and Insider Trading News: Steven A. Cohen, Kyle Bass, BlueMountain Capital Management, Moore Capital Management, Equitrans Midstream Corp (ETRN), J & J Snack Foods Corp (JJSF), and More (Insider Monkey)

- Ford returns to dual-clutch transmission for 760-hp Shelby GT500 supercar (USA Today)

- 6 Internet Stocks Best Positioned for China’s Post-Growth Era (Barron’s)

- Ford Executive Chairman Bill Ford Loaded Up on Stock After It Tumbled (Barron’s)

- Oil Massively Underperforms the S&P 500: Buy These 4 High-Yielding Giants (24/7 Wall Street)

- Fundstrat’s Tom Lee tells investors to ‘back-up the truck’ and buy this trade war-induced sell-off (CNBC)

- Goldman Sachs sees no trade deal before 2020 U.S. election, now expects three rate cuts (Reuters)

- My Lyft driver taught me so much about his Tesla Model 3, I feel way more compelled to buy one. Here are the 10 most interesting features I discovered. (Business Insider)

- China’s Central Bank Tells Foreign Firms Yuan Won’t Keep Falling (Bloomberg)

- Kudlow: Trump is flexible on China tariffs depending on how trade talks go (CNBC)

- Australia Looks to Siphon U.S. Oil Stockpile to Avoid Running Out of Gas (Wall Street Journal)

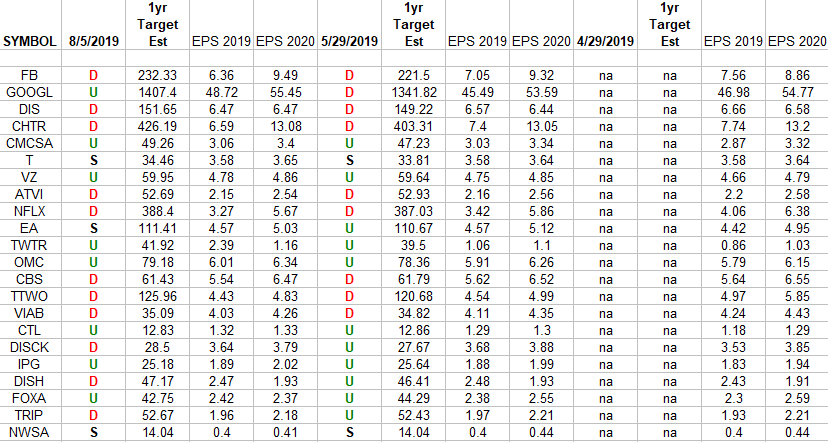

Communication Services Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Today some institution/fund purchased 21,670 contracts of Jan 2020 $155 strike calls (or the right to buy 2,167,000 shares of Alibaba Group Holding Limited (BABA) at $155). The open interest was just 2,259 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”