Be in the know. 7 key reads for Monday…

Cartoon: Rainer Hachfeld

- Hedge funds chart course through ‘IMO 2020’ storm (Reuters)

- The U.S. Is Overflowing With Natural Gas. Not Everyone Can Get It. (Wall Street Journal)

- Iran’s Oil Output Plunges to More Than Three-Decade Low (Bloomberg)

- BlackRock sees economic outlook worsening for the second half, but stocks doing well anyway (CNBC)

- It’s Never Going to Be Perfect, So Just Get It Done (New York Times)

- Instagram Turns Obscure U.S. Sights Into Social-Media Destinations (Wall Street Journal)

- Where to Invest When the Fed Cuts Rates (Wall Street Journal)

Sunday Inspiration…

On the first post of this blog , in January of this year, I gave credit to Jim Rohn – who was a mentor to me in my early 20’s. His teachings had an irreversible positive impact on my life and are largely responsible for much of what I’ve been able to do. Continue reading “Sunday Inspiration…”

Be in the know. 20 key reads for Sunday…

- Bank Stock Dividends Are Getting Bigger. Much Bigger. (Barron’s)

- Habits vs. Goals: A Look at the Benefits of a Systematic Approach to Life (Farnam Street)

- Plan on More Pharma Megamergers ()

- How the U.S. Secret Service Works (howstuffworks)

- Inside the Geeky, Quirky, and Wildly Successful World of Quant Shop Two Sigma (Institutional Investor)

- They Told Me to Get an MBA. I Started a Billion-Dollar Company Instead (Inc.)

- Deutsche Bank is about to undergo its biggest restructuring ever. Here’s what we know about what’s going on at the German bank. (Business Insider)

- The Lamborghini SC18 Alston is an 800-hp, one-off wonder (CNET)

- Iran, the Strait of Hormuz, and the Ever-Complex Geopolitics of Oil (Council on Foreign Relations)

- A look at the assets and liabilities of the American colonies on the eve of revolution. (NPR Planet Money)

- A Timeless History of the Swatch Watch (MentalFloss)

- Rio is a riot in the early hours (Economist)

- The Next Phase of Trump’s Trade War with China (Project Syndicate)

- New Method for Tackling Stroke Restrains an Overactive Immune System (Scientific American)

- The Best Sandwich in Every State and Washington, D.C. (People)

- Seinfeld Sails on a Segway in New Trailer for ‘Comedians in Cars Getting Coffee (RollingStone)

- Ray Dalio says anyone who wants to understand today’s world should read this 32-year-old book about empires (Business Insider)

- Bill Gates Just Revealed the 1 Eye-Opening Thing Steve Jobs Had That He Didn’t (Clue: It’s Not Creativity) (Inc.)

- Before-and-after photos show dramatic differences in presidents and first families after time spent in White House (Business Insider)

- OPEC output hits new low on Trump’s sanctions, supply pact (Arab News)

Quote of the Day…

Be in the know. 20 key reads for Saturday…

- 5 Beaten-Down Stocks Worth Considering (TheStreet)

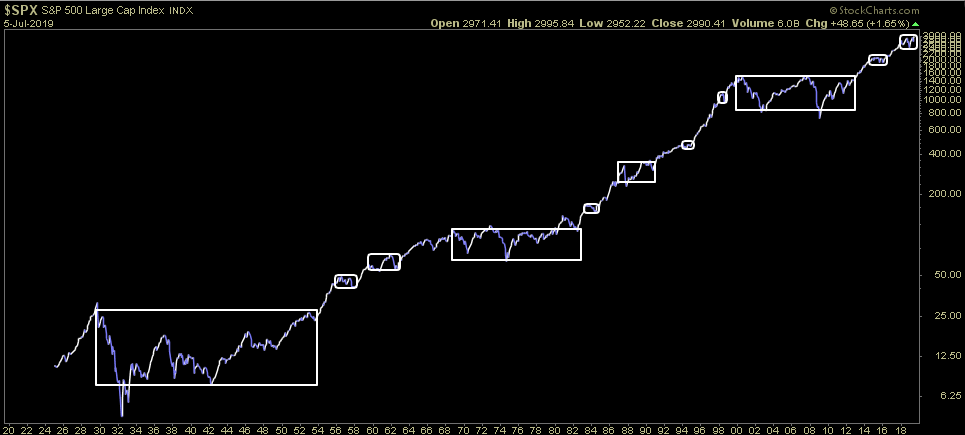

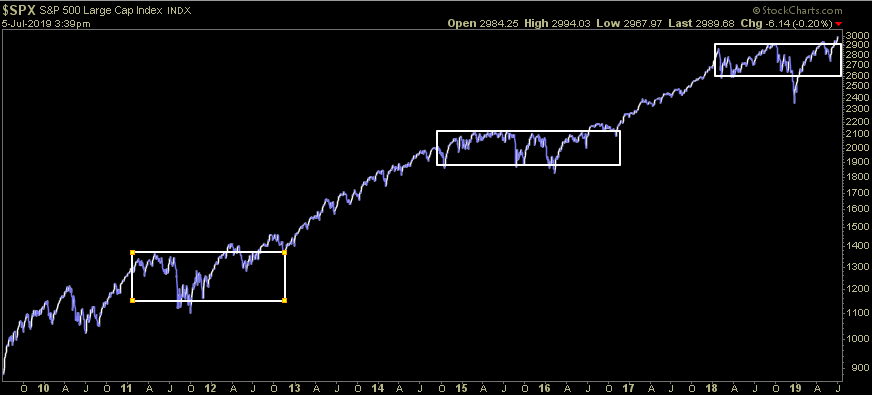

- No one is writing about this: Perspective…(ZeroHedge)

- 11 Cheap Stocks to Buy as the Market Hits New Highs (Barron’s)

- How to Invest at Every Age: Cramer’s ‘Mad Money’ Recap (Friday 7/5/19) (TheStreet)

- A Physicist and His Son Are 3D-Printing a Full-Scale Lamborghini (Futurism)

- Taylor Swift, the Universal Backlot Fire, and Why Masters Are the Next Battleground in Music (Vanity Fair)

- Ford will sell a $1.2 million supercar that won’t be street-legal (CNN)

- Kudlow says Fed should ‘take back’ interest-rate hike (MarketWatch)

- Civilians (The Reformed Broker)

- Mortgage rates haven’t been this low since 2016 — here’s how to decide whether to refinance your home loan (MarketWatch)

- Get National Fried Chicken Day deals (USA Today)

- Strong Jobs Report Eases Fears of Damage From Trade War (New York Times)

- Aston Martin CEO Woos Investors With Supercars at Goodwood Gala (Bloomberg)

- Fast-Track Drug Approval, Designed for Emergencies, Is Now Routine (Wall Street Journal)

- 5 Mediterranean Islands the Tourist Mobs Haven’t Invaded Yet (Wall Street Journal)

- How to Have the Ultimate Summer Lake Day (Men’s Journal)

- Hsieh Su-wei Is a Lock No One Can Quite Pick (New York Times)

- We Test Drove the Majestic McLaren 600LT Supercar on the Sunset Strip (Maxim)

- Hedge Fund and Insider Trading News: Renaissance Technologies, Bain Capital, BridgeBio Pharma Inc (BBIO), Carnival Corp (CCL), and More ()

- Credit Suisse Best Ideas List Still Has 50% Implied Upside for 8 Stocks (24/7 Wall Street)

No one is writing about this: Perspective…

On the heels of my post earlier today and the concept of consolidation followed by expansion – both in earnings and price, I decided to look at it from a long term perspective.

Continue reading “No one is writing about this: Perspective…”

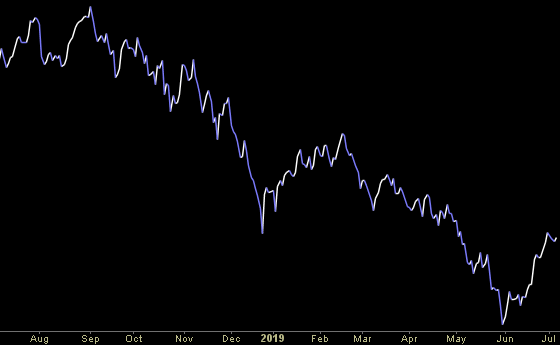

Forward Earnings Estimates Look Solid

Since there was no change in Q2 EPS estimates since my post last Friday, I decided to post the longer view of Earnings Estimates for the remainder of CY 2019 and CY 2020. Continue reading “Forward Earnings Estimates Look Solid”