Data source: Finviz

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Friday…

- Hiring rebounds in June as U.S. creates 224,000 jobs, unemployment rises to 3.7% (MarketWatch)

- OPEC’s Latest Move Shows It’s ‘Drawing a Line in the Sand’ on Falling Oil Prices (Barron’s)

- The 2020 Election Is Heating Up and That Makes the Trade War More Complicated (Barron’s)

- Deutsche plans separate ‘corporate bank’ in multi-billion dollar revamp (Reuters)

- ‘Kind of Blingy’: The Tricked-Out Golf Carts of the Villages, Fla. (New York Times)

- Farmers Built a Soybean Export Empire Around China. Now They’re Fighting to Save It. (Wall Street Journal)

- Lagarde Likely Would Keep ECB on Current Course (Wall Street Journal)

Be in the know. 8 key reads for Independence Day!

- Trump officials say U.S.-China trade talks to resume next week (Reuters)

- OPEC, allies waging a battle to keep oil prices supported amid trade tensions (MarketWatch)

- Brevan Howard Main Hedge Fund Posts Best First Half in a Decade (Bloomberg)

- U.S. Farmers See the Light (Wall Street Journal)

- Bill Gates doesn’t believe that everyone should take vacations and weekends off (MarketWatch)

- What’s the Bottle Cap Challenge? Here’s what you need to know about the latest viral trend (USA Today)

- Earnings Season Is Coming and Expectations Couldn’t Be Much Lower (Barron’s)

- Trump, VIP Guests and Critics Prepare for July 4 ‘Show of a Lifetime’ (Wall Street Journal)

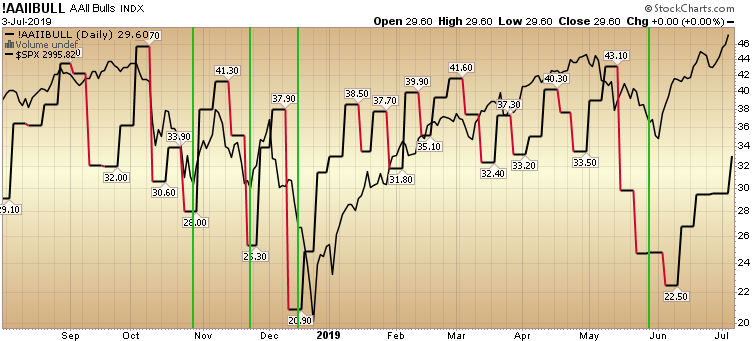

AAII Sentiment Survey: The Wall of Worry is Steep. Keep climbing!

The AAII sentiment survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market short term; individuals are polled from the AAII Web site on a weekly basis. Continue reading “AAII Sentiment Survey: The Wall of Worry is Steep. Keep climbing!”

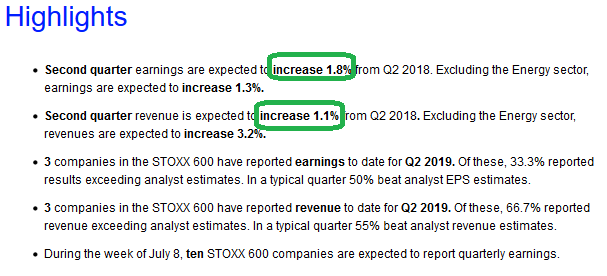

European (Stoxx 600) Q2 Earnings Estimates

Data Source: Thomson Reuters

In contrast to the S&P 500 (US Earnings) which are estimated to be -2.6% yoy for Q2, European earnings estimates are positive for Q2. Q2 earnings are expected to increase by 1.8% yoy for the Stoxx 600.

Continue reading “European (Stoxx 600) Q2 Earnings Estimates”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Wednesday…

- Oil prices rise after crude stockpile drop (Reuters)

- A Top Chinese Official Just Lowered the Temperature in the Trade War (Barron’s)

- Trump Picks Two Fed Nominees Likely to Support Easier Policy (Bloomberg)

- Tesla Stock Jumps On Record Second-Quarter Deliveries (Barron’s)

- Aaron Paul hints at ‘Breaking Bad’ movie (New York Post)

- Jobs Report Holds Make-or-Break Sway Over Fed Rate Strategy (Bloomberg)

- Christine Lagarde, managing director of the IMF, was just nominated for the top job at the European Central Bank (Business Insider)

- Formula E New York: Everything to Know, From the Cars to Nearby Bars (Bloomberg)

- Scientists Are Giving Dead Brains New Life. What Could Go Wrong? (New York Times)

- Hedge Fund and Insider Trading News: Daniel Och, Bill Ackman, Warlander Asset Management, FrontPoint Partners, Morphic Holding Inc (MORF), Acorn Energy Inc (ACFN), and More (Insider Monkey)

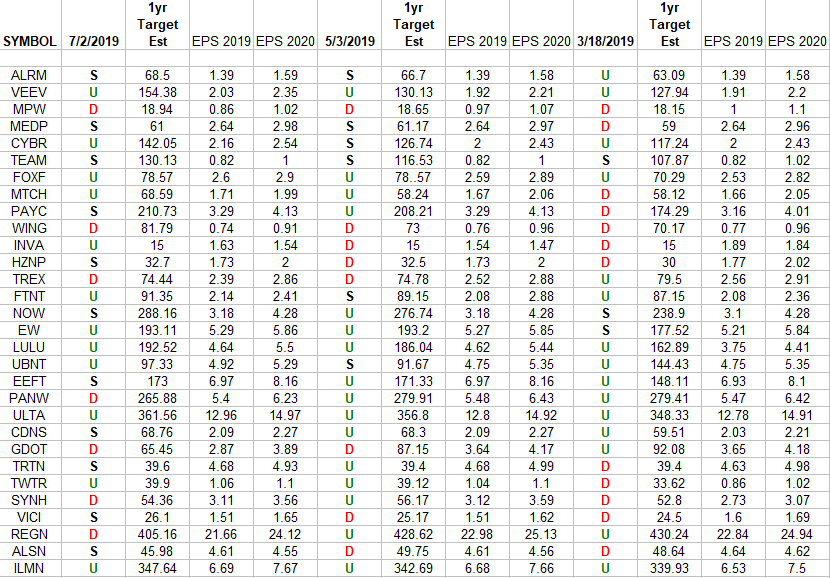

IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) [That are not included in our Dow+8, Nasdaq, and Russell spreadsheets in earlier posts]. Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions”