Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Today some institution/fund purchased 9,905 contracts of Jan $75 strike calls (or the right to buy 990,500 shares of JPMorgan Chase & Co. (JPM) at $75). The open interest was just 2,590 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”

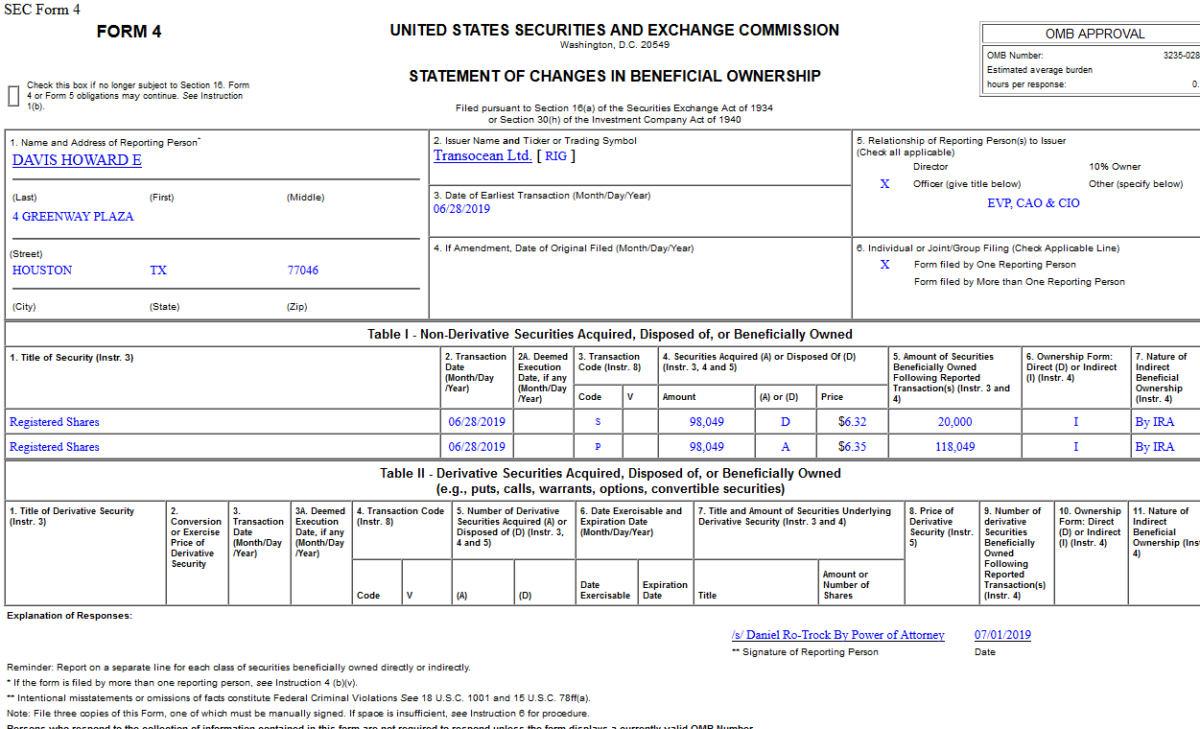

Insider Buying in Transocean Ltd. (RIG)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 7 key reads for Tuesday…

- Hey Dave, “Where’s the Beef?” (ZeroHedge)

- American Suburbs Swell Again as a New Generation Escapes the City (Wall Street Journal)

- OPEC and allies extend oil supply cut in bid to boost prices (Reuters)

- China’s Deleveraging Is Over (Wall Street Journal)

- Goldman Sachs Has 4 Top Pick Energy Stocks to Buy as OPEC Cuts Remain in Place (24/7 Wall Street)

- Hedge Funds Are Tracking Private Jets to Find the Next Megadeal (Bloomberg)

- Why Goldman Sachs Could Be a New Safety Stock (Wall Street Journal)

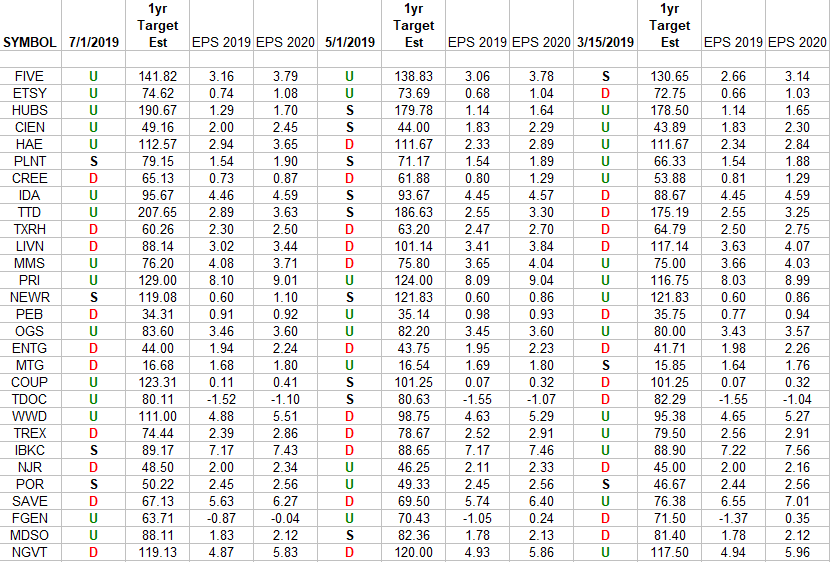

Russell 2000 (top weights) Earnings Estimates Climb Higher

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2019 and 2020 estimates (if available) were: 3/15/2019, 5/1/2019 and today. The Continue reading “Russell 2000 (top weights) Earnings Estimates Climb Higher”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Unusual Options Activity – Range Resources Corporation (RRC)

Today some institution/fund purchased 7,176 contracts of Jan $10 strike calls (or the right to buy 717,600 shares of Range Resources Corporation (RRC) at $10). The open interest was 3,234 prior to this purchase. Continue reading “Unusual Options Activity – Range Resources Corporation (RRC)”