Where is money flowing today?

Unusual Options Activity – Encana Corporation (ECA)

Today some institution/fund purchased 12,073 contracts of Aug $6 strike calls (or the right to buy 1,207,300 shares of Encana Corporation (ECA) at $6). The open interest was 4,743 prior to this purchase. Continue reading “Unusual Options Activity – Encana Corporation (ECA)”

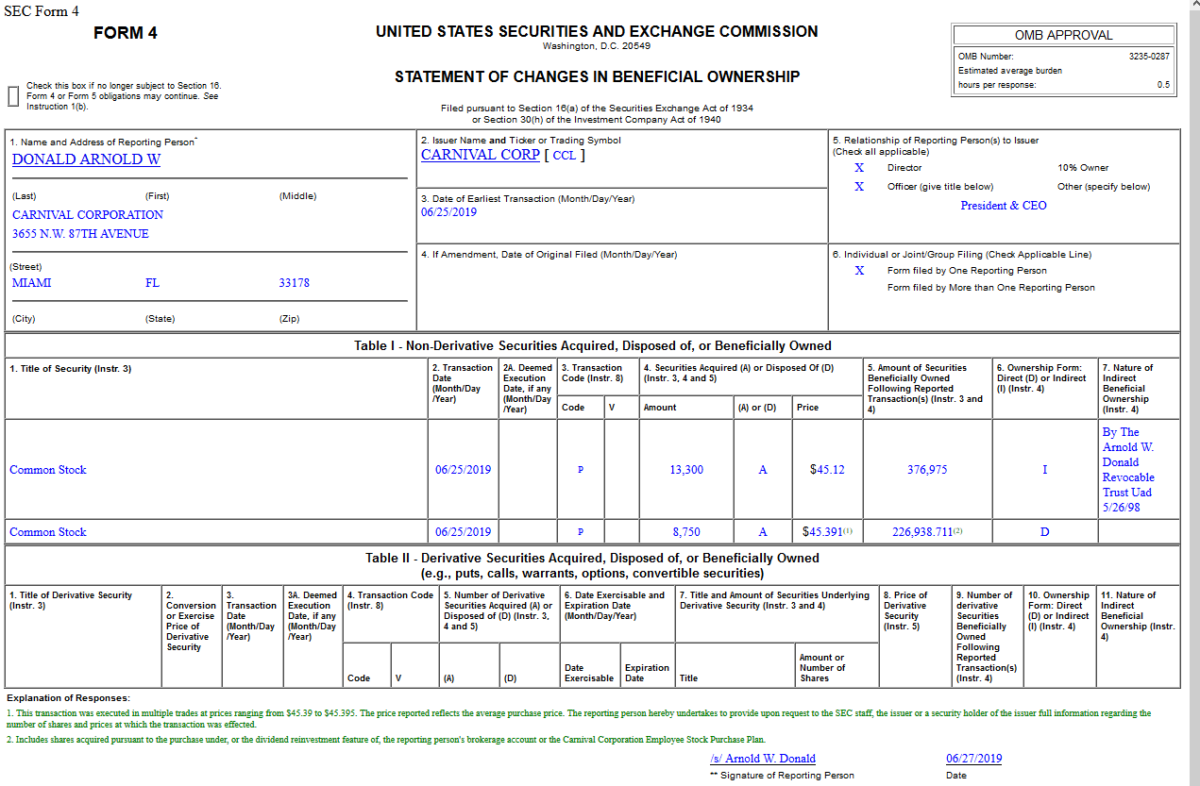

Insider Buying in Carnival Corporation (CCL)

Quote of the Day…

Hedge Fund Trade Tip (PMN) – Position Management Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Thursday…

- China urges U.S. to lift sanctions on Huawei as Trump-Xi meeting looms (Reuters)

- First-quarter GDP left at 3.1% as stronger business investment offsets weaker consumer spending (MarketWatch)

- G-20 preview: Facing faltering economies, Trump and Xi likely to agree to a cease-fire of trade war (MarketWatch)

- American Tariffs on China Are Being Blunted by Trade Cheats (Wall Street Journal)

- Trump Wants to Cut Regulations That Block New Housing (New York Times)

- Carl Icahn Seeks to Replace Four Occidental Directors (Wall Street Journal)

- Do Wall Street Price Targets on Stocks Really Matter? What Investors Need to Know. (Barron’s)

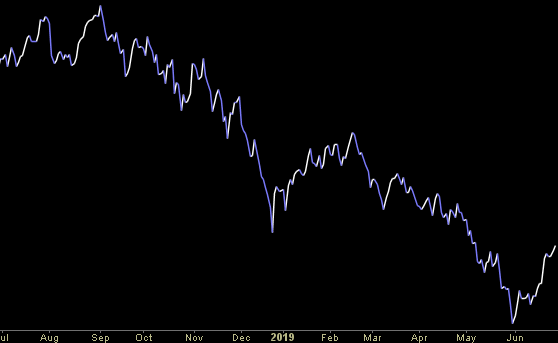

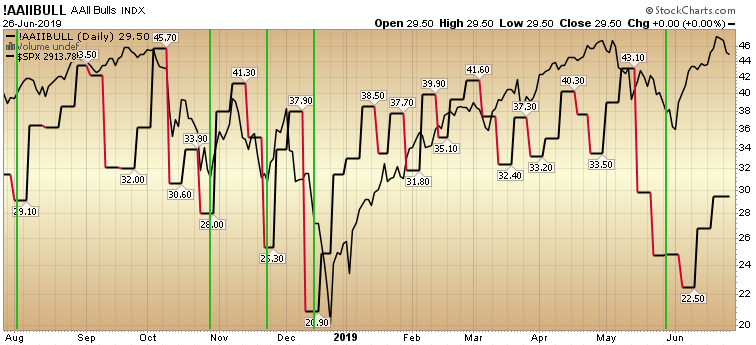

AAII: As Pessimism Persists, The Wall of Worry (to climb) Remains Intact.

Waking up today I had fully expected the “bullish percent” to move well above 30 and the “bearish percent” to drop since last week. This would have caused us to look for places to lighten up, and if there was a euphoric read, start to look for a few shorts… Continue reading “AAII: As Pessimism Persists, The Wall of Worry (to climb) Remains Intact.”