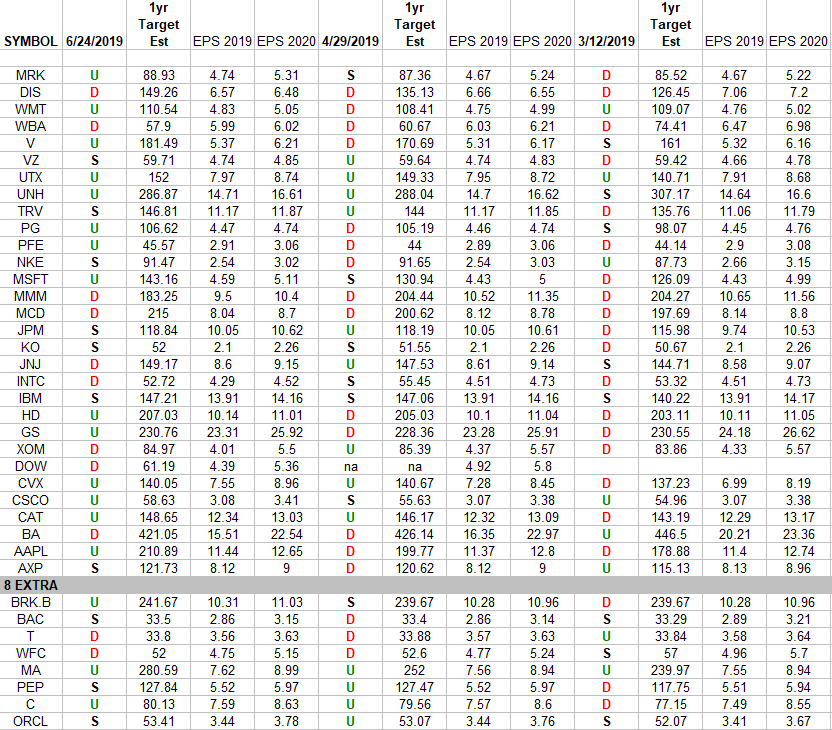

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. The 8 companies are at the Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

Be in the know. 5 key reads for Monday…

- Dow 30,000 Could Come Sooner Than You Think (Barron’s)

- Bank of America CEO Brian Moynihan on Why the U.S. Will Avoid a Recession (Barron’s)

- Eviation unveils electric airplane and plans flight tests in central Washington state (GeekWire)

- China says both U.S., China should make compromises in trade talks (Reuters)

- McDonald’s started using fresh meat. Here’s what happened to sales (CNN Business)

Bonus Weekend Reads

- Daniel Craig Can’t Outrun His James Bond Fate (The Ringer)

- Ford Announces Just How Insanely Powerful the 2020 Mustang Shelby ST500 Will Be (Maxim)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- 12 Habits Of Genuine People (Forbes)

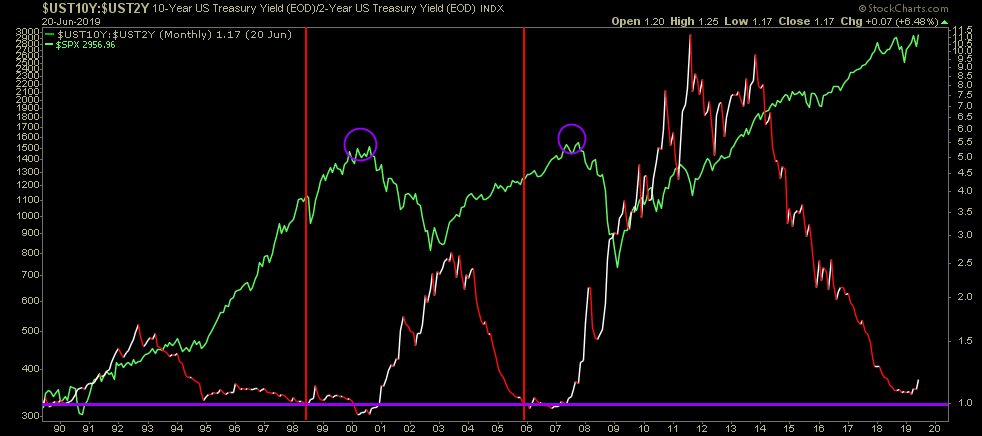

- Interest Rates Could Bottoming After 35% Decline, Says Joe Friday (Kimble Charting Solutions)

- Will it hold? (The Reformed Broker)

- Chris Brightman Discusses the Investment Industry (Podcast) (Bloomberg)

- ‘My Whole Life Is a Bet.’ Inside President Trump’s Gamble on an Untested Re-Election Strategy (Time)

- Box Office: ‘Toy Story 4’ Flies High Friday With $47.4 Million (Variety)

- Pain Trade By Locals and Prop Groups In Eurodollar Options (Futures Mag)

- How I Built This: Allbirds: Tim Brown & Joey Zwillinger (NPR)

- Trump Says Didn’t Threaten to Demote Fed’s Powell But Has Right (Bloomberg)

Be in the know. 8 key reads for Sunday…

- Trump says US will impose ‘major additional sanctions’ against Iran on Monday (CNBC)

- Billionaire Leon Cooperman Interview –“We Live in Abnormal Times”, But The Stock Market Is Still In Its “Zone of Fair Value” (Insider Monkey)

- U.S. Existing-Home Sales Rose in May (Wall Street Journal)

- Sunday Strategist: This $200,000 Grill Is a Masterpiece of Arbitrage (Bloomberg)

- An Extreme In Investor Fear And Pessimism (The Fat Pitch)

- Before Iran Shot It Down, the US’s $130M Drone Spied on the World (Futurism)

- Hedge Funds Hold Out Hope for Kiwi Even as Second Rate Cut Looms (Bloomberg)

- The No. 1 most reliable appliance brand in America, according to Consumer Reports (MarketWatch)

Quote of the Day…

Hedge Trade Fund Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Saturday…

- Opinion: Believing all this talk about a stock market bubble can land you in real trouble (MarketWatch)

- OPEC readies for ‘critical’ meeting, decision on oil output cuts (MarketWatch)

- Fed officials face weak inflation, but split over what it means (Reuters)

- Soybeans Could Be Next Market to Surge as U.S. Showers Drag On (Bloomberg)

- Kashkari Says He Wanted Half-Point Rate Cut at Fed Meeting (Bloomberg)

- Star Athletes Become Trophies Banks Covet as Salaries Skyrocket (Bloomberg)

- The ECB Is Talking Stimulus Again. Is It Bluffing? (Barron’s)

- Big Banks Ace First Round of Federal Reserve’s Stress Tests (Wall Street Journal)

- Taylor Swift’s Real-Estate Portfolio, Revisited (Architectural Digest)

- Japanese Security Companies Benefit From U.S.’s China Concerns (Wall Street Journal)

Q2 Earnings Expectations Remain Low. When Does Recession Come?

Data Source: Factset

As we mentioned last week, it looks like Q2 will set up similarly to Q1 with very low expectations and an opportunity to easily beat to the upside. The difference will be Q2 will comp positively year on year versus Q1 which was slightly negative. Continue reading “Q2 Earnings Expectations Remain Low. When Does Recession Come?”

Where is money flowing today?

Updated Sentiment Chart

Data Source: AAII

This updated chart gives a nice visual of the data we presented yesterday. As you can see above, it has not paid to get short below the high 30’s (bullish percent), but it has paid to get long below 30 (when pessimism was still high). The print from yesterday was 29.51%. There is still a wall of worry to climb. Continue reading “Updated Sentiment Chart”