Today some institution/fund purchased 7,606 contracts of August 12 strike calls (or the right to purchase 760,600 shares of Freeport-McMoRan FCX at $12). This is a larger sized bet for this stock and contract as the open Continue reading “Unusual Options Activity”

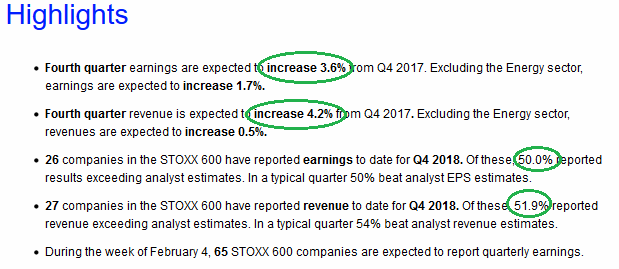

European (Stoxx 600) Earnings UP year on year

source: Thomson Reuters

With all of the pessimism about European earnings/economy, the facts are that they are UP year on year. So far Q4 2018 earnings (of those reported) Continue reading “European (Stoxx 600) Earnings UP year on year”

Be in the know. 5 key reads for Tuesday…

- In Unloved Dell, Investors Can Find a Silver Lining in Its VMware Stake (Barron’s)

- Apple iPhone outlook has nowhere to go but up: analyst (New York Post)

- A $4 Trillion Scapegoat for Market Volatility: the Fed’s Shrinking Portfolio (Wall Street Journal)

- Biogen (BIIB) Tops Q4 EPS by 25c, Offers Guidance (Street Insider)

- Experts are throwing cold water on a ‘housing collapse’ (ITB) (Business Insider)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 20,216 contracts of April 35 strike calls (or the right to purchase 2,021,600 shares of EBAY at $35). This is a larger sized bet for this stock and contract as the open interest was 4,604 Continue reading “Unusual Options Activity”

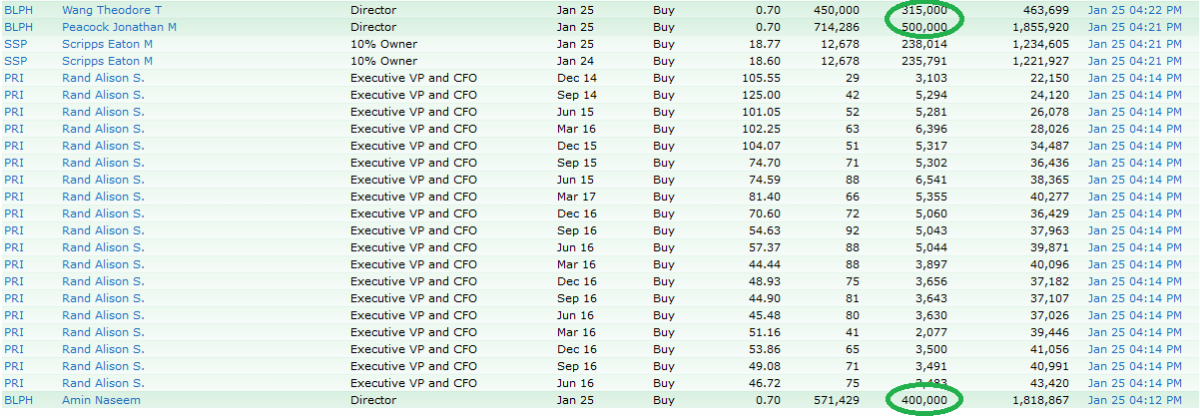

Insider Buying

Last week, 3 Directors of small biotech BLPH – Bellerophon Theraputics, Inc bought a combined $1,215,000 worth of stock with their own money. This is the first such purchase that any of these 3 directors bought stock in the open market.

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 9 key reads for Monday…

- Apple Earnings Are Coming. The Last Round Left a Mark. (Barron’s)

- Inspiring story of a guy who didn’t give up on his dreams: Geoffrey Owens, once shamed for Trader Joe’s job, featured in SAGs opener (New York Post)

- 5 Stocks That Struggled in 2018 Could Be Big 2019 Winners (Jeffries via 24/7 Wall Street)

- NVIDIA (NVDA) Cuts Q4 Guidance (Street Insider)

- Dems Warn Howard Schultz Independent Run Would “Secure Trump’s Reelection” (Zero Hedge)

- The world’s oldest Nobel Prize winner, a 96-year-old physicist, says his new invention will give everyone in the world clean, cheap energy (Business Insider)

- Grubhub rallies after Credit Suisse upgrades, tells clients to expect 60% upside (CNBC)

- Powell on the Spot After Fed’s Monetary Messages Whipsaw Market (Bloomberg)

- Drillers Are Easing Off the Gas (Wall Street Journal)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Bullish Percent – What it says about Consumer Staples right now…

Right now, Consumer Staples as a sector has the lowest percentage of buy ratings of any sector in the S&P 500 – coming in at just 41%. The above chart is the “Bullish Percent Index” for Consumer Staples (red and black Continue reading “Bullish Percent – What it says about Consumer Staples right now…”

Be in the know. 10 key reads for Sunday…

- The ultimate gearhead bucket-list car show and event guide for 2019 (CNET)

- Everything coming to Netflix in February (The Verge)

- How CRISPR lets you edit DNA (TED)

- $5 Billion to Be Wagered on the Super Bowl, Some Legally for the First Time (How Stuff Works)

- 8 Morning Routines of History’s Most Successful People (Mental Floss)

- What one Navy SEAL learned by doing Hell Week 3 times (Big Think)

- The Euro’s First 20 Years (Project Syndicate)

- When Does Your Intelligence Peak? (Scientific American)

- Everything You Need to Host a Winning Super Bowl Party (Consumer Reports)

- Will Tesla change the world or go out of business? Yes. (Recode)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

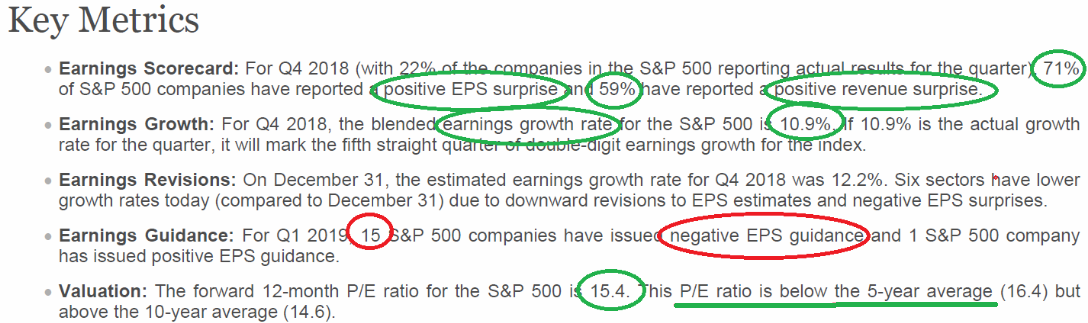

Earnings Update

Per FactSet, eps and revenues continue to beat by 71% and 59% respectively – after 22% of S&P 500 having reported Q4 earnings so far.

Guidance is a bit light but 2019 eps estimates remain ~$170.93 per share. If Continue reading “Earnings Update”