- China investment, markets recovery should boost global economy later in the year, IMF says (MarketWatch)

- Bristol-Myers, JPMorgan, and 2 Other Dividend-Paying Stocks That Could Beat the Market (Barron’s)

- Opinion: Move over, Ferrari and Lamborghini — this Italian electric car’s 1,900 horsepower makes it faster than a Formula 1 racer (MarketWatch)

- U.S. Readies $11 Billion in Tariffs on E.U. (New York Times)

- 7 things you didn’t know you could do with Gmail (USA Today)

- ECB Keeps Policy Unchanged as Euro-Area Economy Faces New Risks (Bloomberg)

- Apple downgraded by HSBC to sell rating on concern about new services: ‘Too late to the game’ (CNBC)

- 2019 NHL Playoffs: Stanley Cup Odds for All 16 Teams in the Postseason (Newsweek)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

European (Stoxx 600) Q1 Earnings Estimates Drop Again

Data Source: Thomson Reuters

Estimates for European Q1 earnings have dropped from -1.6% to -3.2% in the past week. This puts Europe’s estimates in-line with the U.S. – which is at -3.9% for Q1 as of Friday. Continue reading “European (Stoxx 600) Q1 Earnings Estimates Drop Again”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Tuesday…

- Demand for Saudi Aramco Bonds Sails Past the Goal (New York Times)

- U.S. threatens tariffs on European wine and cheese in response to Airbus subsidies (MarketWatch)

- Fed Moves to Ease Living Wills, Allowing Large Banks to File Wind-Down Plans Less Frequently (Wall Street Journal)

- Potential U.S. auto tariffs would hurt Germany, Japan, Korea: Moody’s (Reuters)

- March Small Business Optimism Stalls on Weak Outlook for Economic Growth (24/7 Wall Street)

- 8 Levels of Financial Freedom (Forbes)

- Daniel Loeb’s Third Point hedge fund building a stake to pressure Sony, sources say (last time George Clooney wasn’t happy about it) (Japan Times)

Cotton Update: up 9.6% sans leverage

Since our post on February 19, Cotton is up 9.6% (underlying) excluding leverage. Could it have gone the other way? Of course, but the odds were in our favor – look at the data: Continue reading “Cotton Update: up 9.6% sans leverage”

Be in the know. 9 key reads for Monday…

- What self-made multimillionaires have in common (MarketWatch)

- Aramco Debt Demand Reaches $30 Billion in Deal Pitched by JPMorgan CEO (Bloomberg)

- Amazon’s Whole Foods price cuts aim to build a ‘Costco-like’ relationship with Prime members (MarketWatch)

- Boeing faces liabilities as CEO Dennis Muilenburg acknowledges ‘apparent’ 737 Max problem (USA Today)

- Dalio Says Capitalism’s Income Inequality Is National Emergency (Bloomberg)

- GE shares dive after downgrade by top analyst Tusa at JP Morgan; price target cut to $5 (CNBC)

- The price of Brexit has been £66 billion so far, plus an impending recession — and it hasn’t even started yet (Business Insider)

- Add-On Services Emerge as Car Dealers’ Profit Generator (Wall Street Journal)

- Bankruptcies Test One of Wall Street’s Favorite Trades (Wall Street Journal)

Be in the know. 20 key reads for Sunday…

- This Smart Fishing Reel Messages Your Phone When You’ve Got a Bite (Maxim)

- Why Goldman Sachs Is So Bullish on Disney After the Fox Acquisition (24/7 Wall Street)

- Boeing to Decrease 737 Max Production Starting in April (TheStreet)

- ECRI Weekly Leading Index Update: WLI Bouncing Back (Advisor Perspectives)

- You Could Have Today. Instead You Choose Tomorrow (Medium)

- 5G is still just hype for AT&T and Verizon (The Verge)

- The “New Energy Economy”: An Exercise in Magical Thinking (Manhattan Institute)

- Episode 904: Joke Theft (NPR Planet Money)

- 5 of Albert Einstein’s favorite books (Big Think)

- The Austerity Chronicles (Kenneth Rogoff) (Project Syndicate)

- How to Get What You Want (The Irrelevant Investor)

- Elon Musk and Netflix Both Use This Ancient Mental Strategy and It’s Pure Genius (Inc)

- The stock is down 91% since August. But Maiden Holdings insiders just bought at $0.78. (Whale Wisdom)

- Ferrari P80/C – The Most Epic Supercar from the Maranello manufacturer (Luxuo)

- Driving the Porsche GT3 RS and GT2 RS, the New Quickest Production Cars (Popular Mechanics)

- Adam Sandler to Host ‘Saturday Night Live’ for the First Time (Variety)

- Risk Assets Have Front-Run Reality (w/ Tian Yang) | Expert View (RealVision)

- Wall Street prepares to profit off looming global credit crunch (New York Post)

- Here’s a presidential secret all stock investors need to know (USA Today)

- New NAFTA deal ‘in trouble’, bruised by elections, tariff rows (Reuters)

Be in the know. 20 key reads for Saturday…

- Low Volume At Highs Does Not Provide The Short-Term Bearish Edge It Once Did (QuantifiableEdges)

- Michael Lewis Discusses the Culture of Finance (Podcast) (Bloomberg)

- The Intersection: Crypto and Wall Street This Week ()

- The Only Thing Going Right for Tech Companies Is the Stock Market (Bloomberg)

- Hedge Funds Just Posted Their Best Quarter Since 2009 (Bloomberg)

- ‘Corporate America Had Better Take Note.’ Fund Managers Are the New Activist Investors (Barron’s)

- The Great Sriracha Battle Is Coming to America (Bloomberg)

- Traders are waging a nearly $1 billion bet against Lyft and still have lots of ‘dry powder’ (LYFT) (Business Insider)

- Big banks to report first quarter results with lowered expectations (Reuters)

- A Rare Peek into the World’s Most Valuable Company (Equities)

- Billionaire Hedge-Fund Manager Warns a “Revolution†Is Coming (Vanity Fair)

- “The Mice Became Smarterâ€: New Treatment Restores Aging Brains (Futurism)

- The Machines That Will Read Your Mind (Wall Street Journal)

- How Successful People Handle Toxic People (Forbes)

- The Bespoke Report — Second Quarter Chart Checkup (Bespoke)

- What is Amazon? (Zack’s notes)

- Hedge Fund and Insider Trading News: Ken Griffin, Dmitry Balyasny, Ray Dalio, Walgreens Boots Alliance Inc (WBA), RumbleON Inc (RMBL), and More (Insider Monkey)

- This Fund Expects To Triple Its Money On GSE Preferred Shares (ValueWalk)

- When Will Gene Editing Help Humans? This Investor Says It’s Already Happening (Fortune)

- EIA Oil Inventory Analysis (EconMatters)

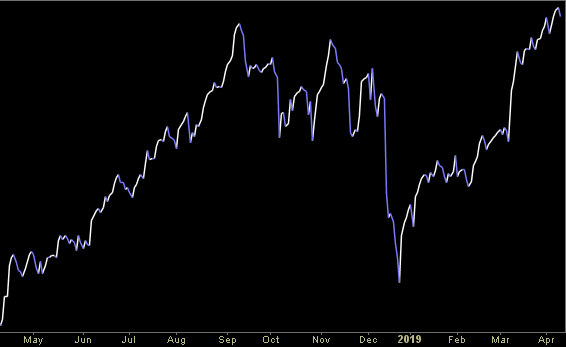

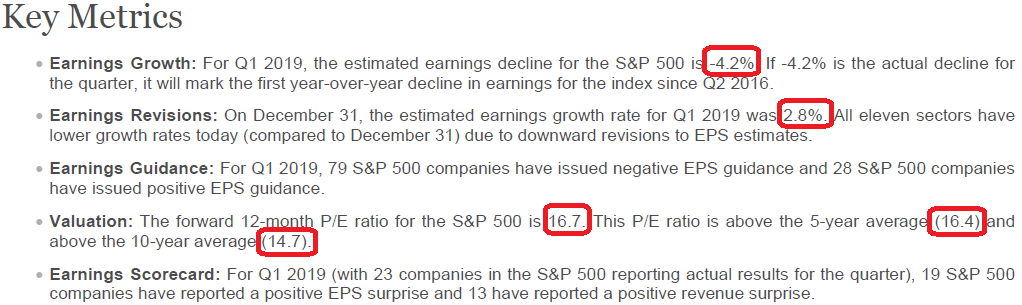

Earnings Estimates Drop Again: Good News or Bad?

Data Source (above): Factset

The bar is now so low that companies don’t even have to jump to get over it. They can stumble over like a drunken frat boy and still win. That’s the good news. Continue reading “Earnings Estimates Drop Again: Good News or Bad?”