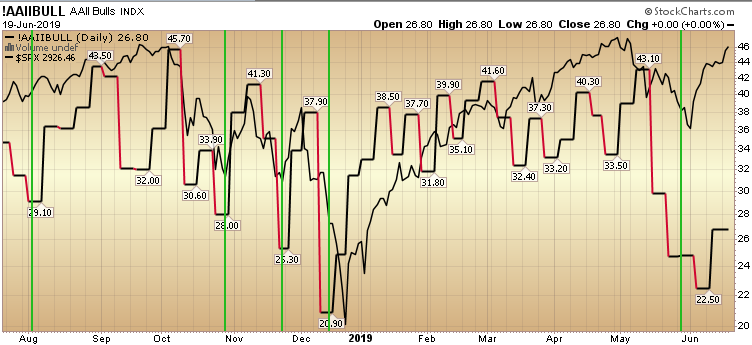

In the last few weeks – as pessimism prevailed in the AAII Sentiment Survey Results – we made the case to get long: Continue reading “AAII Sentiment: Pessimism Thawing, but Skeptics Still Abound”

Be in the know. 7 key reads for Thursday…

- Fed sees case building for interest rate cuts this year

(Reuters) - China, U.S. to resume trade talks but China says demands must be met (Reuters)

- Brazil Stocks Close at a Record High (Bloomberg)

- Lagging Dell Stock Looks Like a Bargain (Barron’s)

- How Chick-fil-A Got Big by Keeping Its Menu Small (Wall Street Journal)

- Oil Surges After Iran Downs U.S. Drone and Fed Signals Rate Cut (Bloomberg)

- One of the Most Powerful Women in Hedge Funds Doesn’t Run Money (Wall Street Journal)

Where is money flowing today?

Be in the know. 8 key reads for Wednesday…

- Stock Market Pessimism Is at Financial Crisis Levels. Why That’s Good News. (Barron’s)

- OPEC+ Sets Date for Meeting, Ending a Month of Bickering (Bloomberg)

- China says history shows positive outcome from U.S. talks possible (Reuters)

- A New Source of Stress for Banks (Wall Street Journal)

- Applied Materials CEO Gary Dickerson on the Chip Slump and the Rise of Big Data (Barron’s)

- Adobe Reports 25% Revenue Increase in Latest Quarter (Wall Street Journal)

- Fed Seen Signaling Cut by Losing Patience: Decision-Day Guide (Bloomberg)

- Opinion: What insider buying at tech companies says about stocks and the economy (MarketWatch)

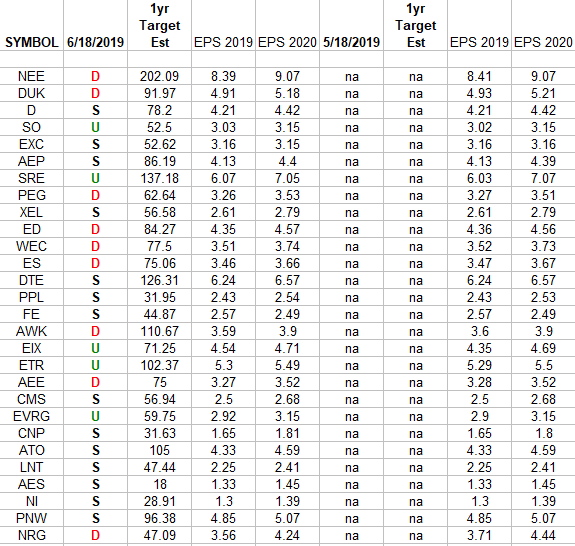

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks. Continue reading “Utilities Earnings Estimates/Revisions”

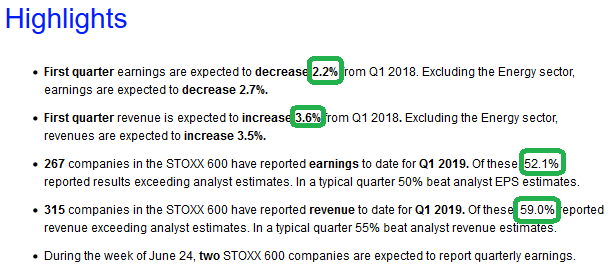

European (Stoxx 600) Q1 Earnings Beat Estimates

Data Source: Thomson Reuters

European Earnings (Stoxx 600) have improved in the last seven weeks. First quarter earnings have improved from -4.2% to -2.2%. Revenue is expected to increase 3.6% vs. 0.7% on 5/1. Continue reading “European (Stoxx 600) Q1 Earnings Beat Estimates”

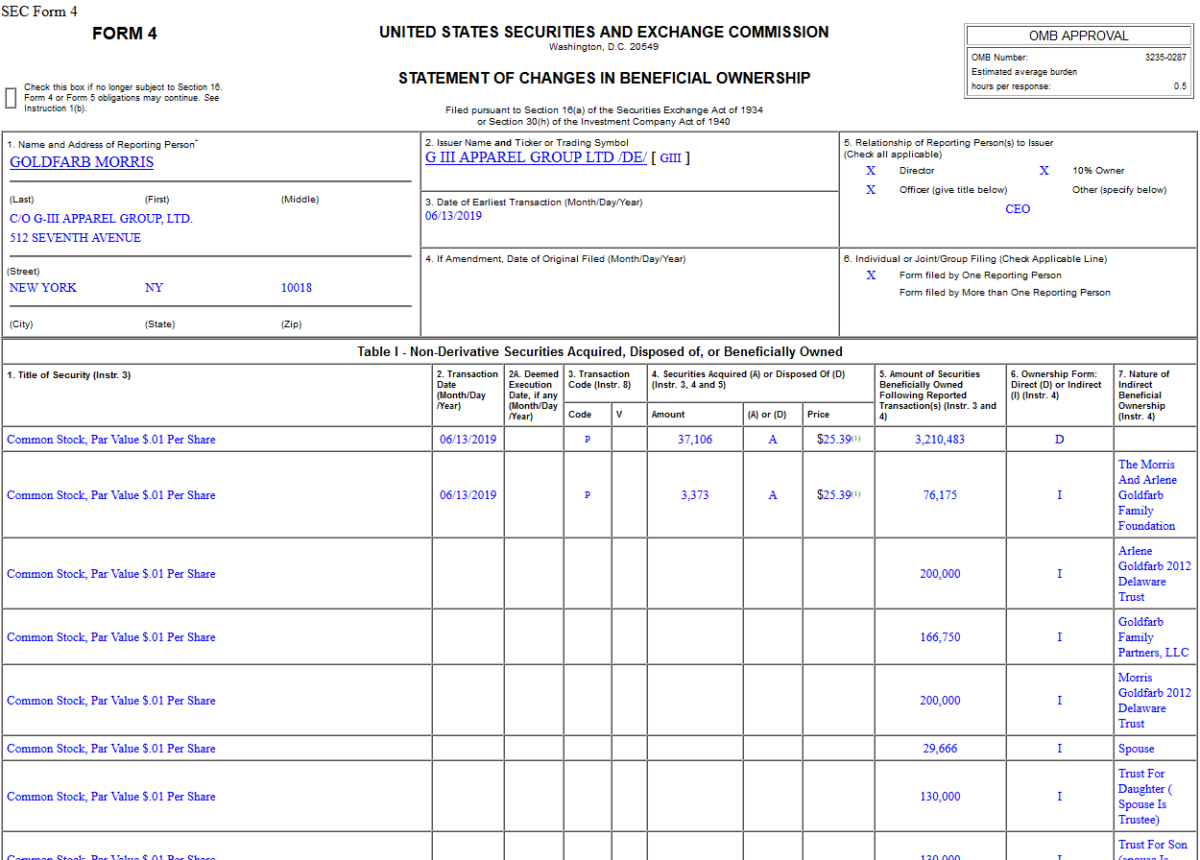

Insider Buying in G-III Apparel Group, Ltd. (GIII)

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Today some institution/fund purchased 6,590 contracts of 7/12/19 $175 strike calls (or the right to buy 659,000 shares of Alibaba Group Holding Limited (BABA) at $175). The open interest was just 133 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

Where is money flowing today?

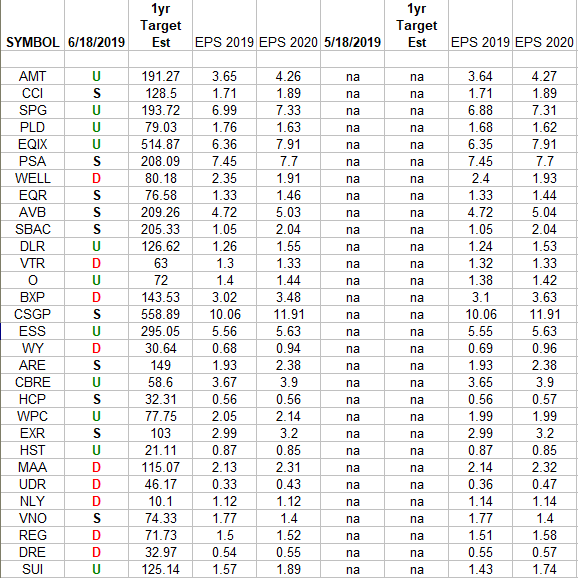

Real Estate Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “Real Estate Earnings Estimates/Revisions”