- Joe Tsai and Eddie Wu’s 2024 Letter to Shareholders (alizila)

- Alibaba’s convertible bond sale to fund buy-backs ‘oversubscribed’ (scmp)

- Alibaba raises $5bn for share buybacks (ft)

- JPMorgan is ‘positive’ on China stocks and ‘constructive’ on its real estate (cnbc)

- BofA’s Hartnett Says Stock Rally Is Moving Closer to Sell Signal (bloomberg)

- “Looking beyond to the next 4-6 quarters, we believe a decline in demand for Nvidia compute is inevitable, as model providers shift toward focusing on driving computational efficiency and their largest customers…all develop their own silicon,” Luria wrote in a research note. (barrons)

- Hello Nvidia, Goodbye Intel? What the AI Stock’s Split Could Mean for the Dow. (barrons)

- Do companies’ stocks tend to outperform after they are removed from the Dow Jones index? (ai)

- Cathie Wood sees a Great Depression-like search for safety in the stock market (marketwatch)

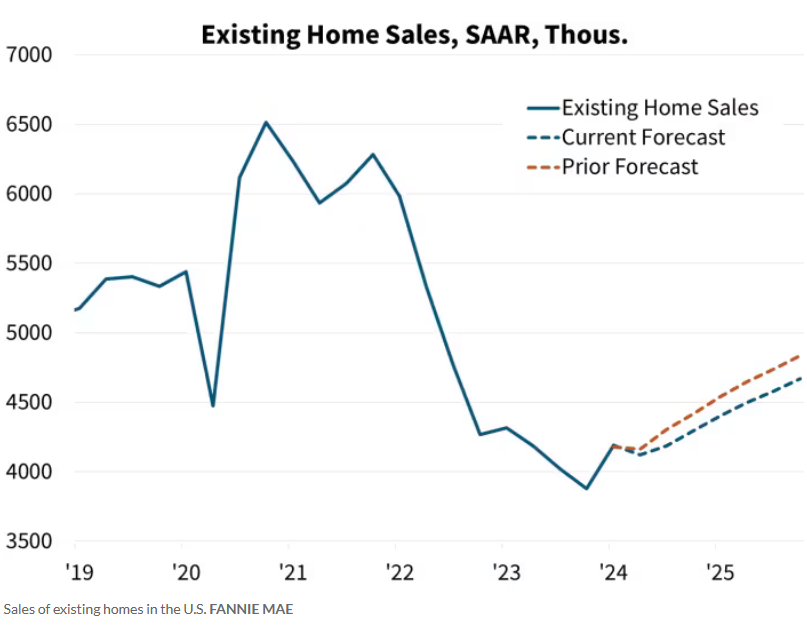

- Home builders are slashing prices to lure home buyers, but it may not be enough (marketwatch)

- Treasury Bills Are the Best Place to Park Your Cash. Just Ask Warren Buffett. (barrons)

- SEC Widens Accessibility of Crypto Investing With Approval of ETFs for Ether (wsj)

- How Singapore Got Rich, and Can It Last (bloomberg)

- Carry Trade Is All the Rage Across Global Bond and FX Markets (bloomberg)

- Rate Cuts Will Trigger Flood of Bond Buying, PGIM Says (bloomberg)

- Goldman Axes Bet on July Fed Rate Cut (bloomberg)

- A Hedge-Fund Volatility Trade Risks Getting Crushed by the Crowd (bloomberg)

- Reuben Brothers Bet on $2 Billion Puerto Rico Development (bloomberg)

- Lululemon Shares at Bottom of S&P 500 as Sales Concerns Grow (bloomberg)

- A global labor shortage will send tech stocks soaring, with the sector poised to grow to 50% of the total stock market, Fundstrat says (businessinsider)

- Sam Altman’s time as the golden child of tech might be coming to an end (businessinsider)

- China’s Second Special Ultra-Long Bond Sale Sees Solid Demand (bloomberg)

- This is how stock splits are performing 12 months after announcement (streetinsider)

- China’s mutual funds top record with US$4.1 trillion invested (scmp)

- Chinese sovereign bond trading suspended after frantic retail buying (ft)

Where is money flowing today?

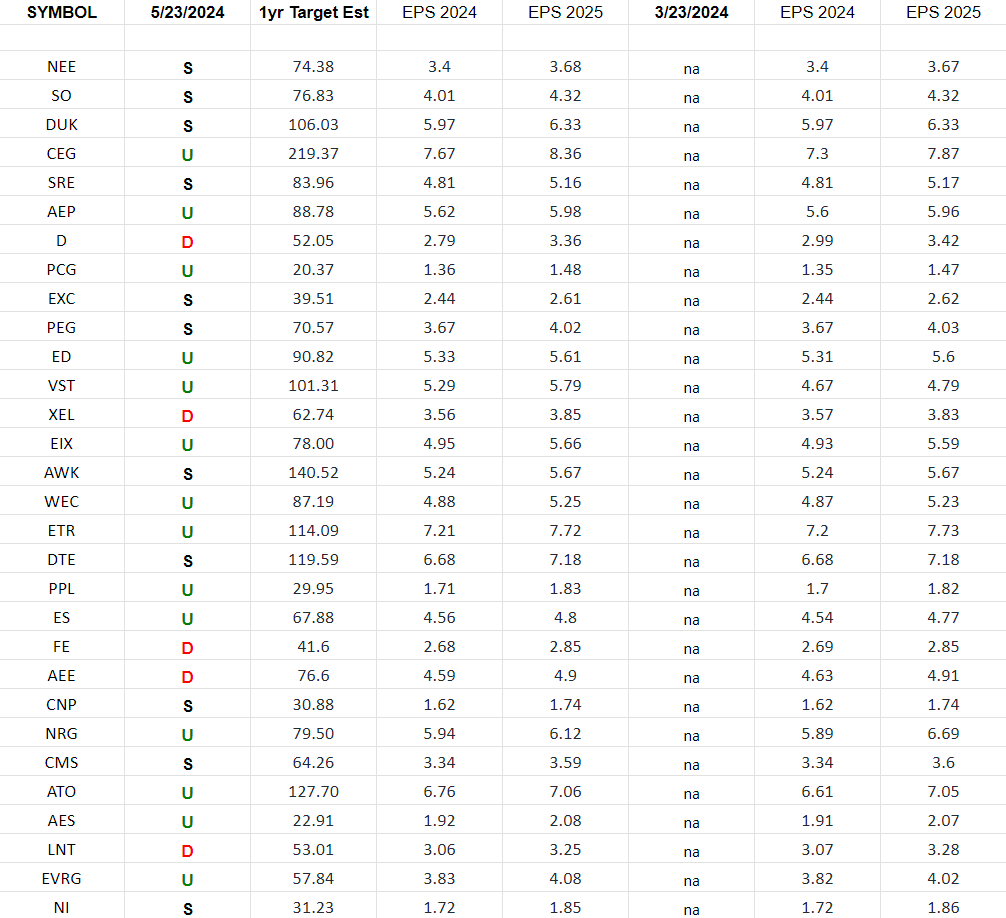

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks.

REIT Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “REIT Earnings Estimates/Revisions”

Be in the know. 17 key reads for Thursday…

- Alibaba has spoken with investment banks about selling bonds that can be converted into US-listed stock, the people said, asking not to be identified discussing private information. The aim is to fund share repurchases and growth, the people said. (yahoo)

- Alibaba bets on AI to fuel cloud growth as it expands globally to catch up with U.S. tech giants (cnbc)

- Washington’s Pivot on Bank Rules Could Free Up Tens of Billions (wsj)

- Retail-investor stock appetite has not yet fully recovered (marketwatch)

- One of the biggest U.S. lenders is offering 0%-down-payment mortgages for first-time home buyers. Here’s the catch. (marketwatch)

- Jobless claims fall again to 215,000. Strong labor market fuels U.S. economy. (marketwatch)

- Xi urges hard work to improve people’s well-being (cn)

- Ford (F) new Buy at Bernstein amid ‘clear path to significant operating leverage’ (streetinsider)

- Fed Minutes Show Officials Were Wary About Inflation at May Meeting (nytimes)

- The race for an AI-powered personal assistant (ft)

- Nvidia Is Booming. Here’s What Could Slow It Down. (wsj)

- Hims & Hers Is Selling Copycat Weight-Loss Drugs. Here’s How. (barrons)

- Carmakers Dangle Big Discounts as Inventory Swells (bloomberg)

- JPMorgan says China can’t be ignored: ‘You have to do business there’ (cnbc)

- Pfizer aims to save $1.5 billion by 2027 in first wave of new cost cuts (cnbc)

- Elon Musk predicts smarter-than-humans AI in 2 years. The CEO of China’s Baidu says it’s 10 years away (cnbc)

- This Is What Hedge And Mutual Funds Did In Q1: Goldman’s HF and MF Monitors (zerohedge)

Boring Business Stock Market (and Sentiment Results)…

While most managers/investors like to talk about their winners (in hindsight), we prefer to spend the bulk of our time on ideas that have not yet left the station or are stalling before takeoff. In other words, things we can make money with prospectively versus ideas we have already made big money from. Continue reading “Boring Business Stock Market (and Sentiment Results)…”

Where is money flowing today?

Be in the know. 20 key reads for Wednesday…

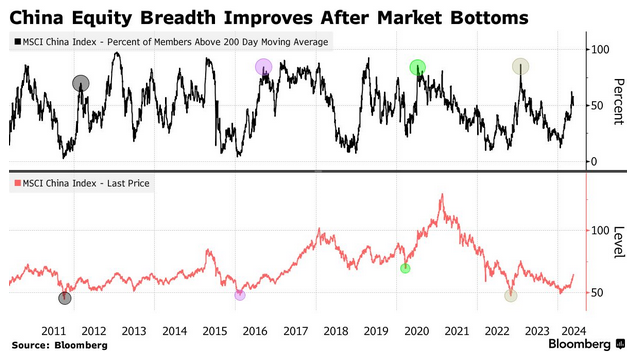

- China’s Improving Market Breadth Is Good News for Stock Bulls (bloomberg)

- China’s online retail sales up 11.5 pct in January-April period (cn)

- China’s 618 shopping festival: Alibaba touts early sales after withholding data last year, a sign of brighter outlook (scmp)

- China’s property stimulus bazooka fuels instant rebound in sentiment as inquiries, home sales in Shanghai, Beijing jump (scmp)

- China stock rally far from over as Beijing doles out stimulus: Alpine Macro (streetinsider)

- Hedge Funds Trim Big Tech Exposure in Hunt for Other AI Winners (bloomberg)

- The SEC’s T+1 settlement rule will transform stock trading: Here’s what you need to know. (marketwatch)

- Risky Bonds Join Everything Rally (wsj)

- The Highest Paid CEOs of 2023 (wsj)

- Biogen to Pay Up to $1.8 Billion for Immune Drug Developer (bloomberg)

- The last bear on Wall Street: Why JPMorgan’s Marko Kolanovic is sticking by his forecast for a 20% market sell-off (businessinsider)

- ‘Not a good sign:’ Lululemon (LULU) stock down after CPO departs (streetinsider)

- A tidal wave of cash is headed for markets post-Nvidia results, this strategist argues. (marketwatch)

- Several Chinese cities slash down payments, mortgage rates to boost property demand (yahoo)

- Meta AI chief says large language models will not reach human intelligence (ft)

- Japan’s 10-year yield tops 1% for first time in 11 years (ft)

- Time to Pounce: 2 Ultra-High-Yield S&P 500 Dividend Stocks That Are Screaming Buys Right Now (fool)

- BABA-SW Pumps US$230M into Lazada (aastocks)

- Chinese premier stresses financial support for real economy (cn)

- It’s not your imagination. Pickleball courts are everywhere (cnbc)