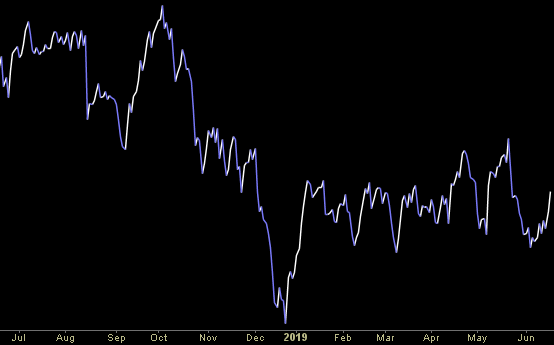

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Tuesday…

- Two ‘insurance’ rate cuts from Fed in ’90s produced no big shocks to corporate bonds, Goldman Sachs says (MarketWatch)

- Growth Is Worth Paying Up for at Pfizer (Wall Street Journal)

- Draghi puts further ECB easing firmly on the table (Reuters)

- U.S. Treasuries ‘most crowded’ as investors flee risk: BAML survey (Reuters)

- Fed Models Suddenly Call for Stronger Than Expected GDP Growth (24/7 Wall Street)

- Contra-indicator?: Investors Haven’t Been This Bearish Since 2008 Financial Crisis (Bloomberg)

- Boeing Drought Gives Way to Second-Day Slugfest: Air Show Update (Bloomberg)

- A Wall Street investment chief overseeing $26 billion breaks down why recession fears are overblown, even as the market clamors for Fed relief (Business Insider)

- Jefferies Analysts Are Out With Four Daring Summer Growth Stock Picks (24/7 Wall St.)

- What I Have To Offer You (Ray Dalio)

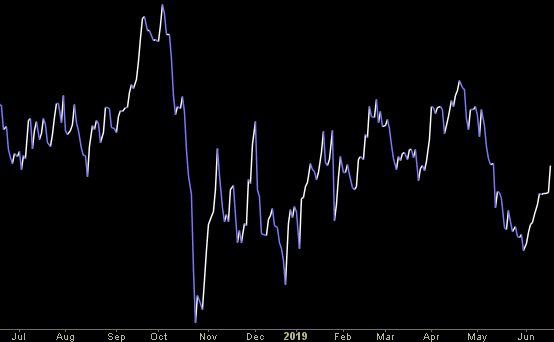

Unusual Options Activity – Transocean Ltd. (RIG)

Today some institution/fund purchased 23,090 contracts of July $6 strike calls (or the right to buy 2,309,000 shares of Transocean Ltd. (RIG) at $6). The open interest was 8,994 prior to this purchase. Continue reading “Unusual Options Activity – Transocean Ltd. (RIG)”

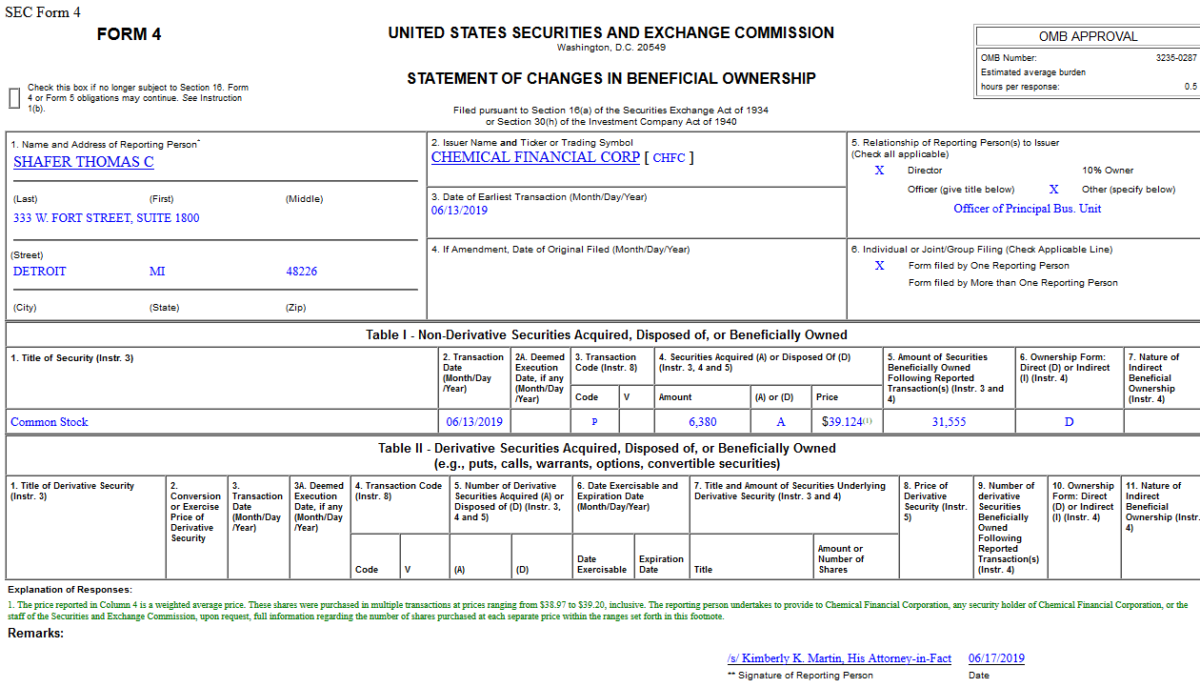

Insider Buying in Chemical Financial Corporation (CHFC)

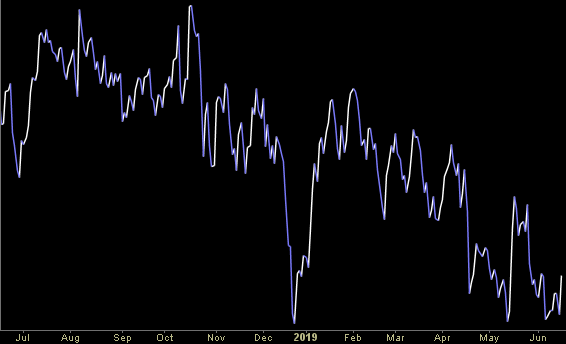

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Monday…

- Trials Near for Boeing 737 MAX Fix (Wall Street Journal)

- Boeing Says Grounded 737 Max May Resume Service This Year (Bloomberg)

- Pfizer to buy Array Biopharma for $10.64 billion ()

- The World Cries Out for Onion Derivatives (Wall Street Journal)

- The Fed is likely to drop ‘patient’ word this week, clearing way for July cut, economists say (CNBC)

- Iran, Russia talks raise hopes of progress on OPEC+ meeting date (Reuters)

- What the Fed Will Do This Week, and Why (Bloomberg)

- Case for Cutting Rates Can Be Found in Close Calls of the 1990s (Wall Street Journal)

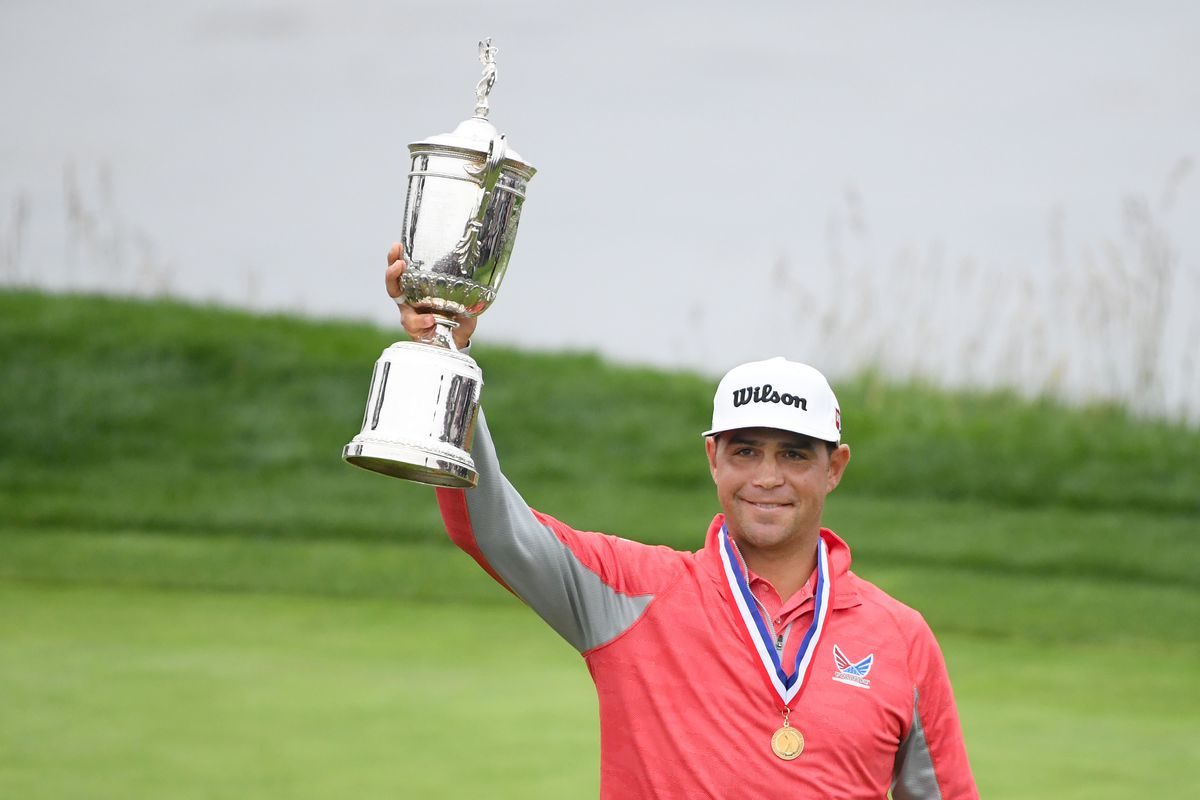

- Gary Woodland Wins U.S. Open (Wall Street Journal)

- Meet the Art World’s Rising Stars (Wall Street Journal)