- The Richest Person In Every Country, Visualized (digg)

- 10 Great Rosé Wines Worth Sipping This Summer (Maxim)

- Who are these people who write thousands of Amazon product reviews? (Vox)

- Sega does the retro console right with the fantastic Genesis Mini (The Verge)

- Pulse of the nation: How Beyond Meat could turn this humble pea into Canada’s new gold (Financial Post)

- Animal Spirits (Planet Money)

- Better Memory through Electrical Brain Ripples (Scientific American)

- Jeff Bezos Says People With High Intelligence Do This 1 Thing Often. (Now, Amazon Just Proved His Point) (Inc.)

- How ‘Shaft’ Brought the 1971 Chevy Chevelle SS Into 2019 (Popular Mechanics)

- Oil Inches Higher On Falling Rig Count (OilPrice)

- U.S. Navy official sees more orders for Boeing P-8A in coming months (Reuters)

- JGB Bulls Look to Kuroda to Keep Rally Going as Inflation Wanes (Bloomberg)

- Economy Breaks Record on Trump’s Watch. He Wants All the Credit (Bloomberg)

- Five things to watch in the pivotal Fed meeting (MarketWatch)

- Saudi Energy Minister hopes OPEC agrees to extend production cut ‘early July’ Reuters)

Bullish Percent – What it says about the Nasdaq/Risk Appetite

The Bullish Percent Index, or BPI, is a breadth indicator that shows the percentage of stocks on Point & Figure Buy Signals. There is no ambiguity on P&F charts because a stock is either on a P&F Buy Signal or P&F Sell Signal. The Bullish Percent Index fluctuates between 0% and 100%. Continue reading “Bullish Percent – What it says about the Nasdaq/Risk Appetite”

What the Commitments of Traders says about Copper Futures

The Commitments of Traders is a weekly market report issued by the Commodity Futures Trading Commission (CFTC) enumerating the holdings of participants in various futures markets in the United States. It is collated Continue reading “What the Commitments of Traders says about Copper Futures”

Be in the know. 20 key reads for Saturday…

- Saudi Arabia Seeks to Balance Global Crude Markets Before 2020 (Bloomberg)

- Why Alzheimer’s Treatment Hopes Endure Despite High-Profile Drug Failures (Investor’s Business Daily)

- Tips for Spotting a U.S. Recession Before It Becomes Official (Bloomberg)

- Drugmakers Sue Trump Administration to Halt Advertising Rule (Bloomberg)

- As Trump demands major concessions, Beijing wants the world to think that the US will blink first (CNBC)

- Trump is threatening sanctions on Germany over its Russian gas pipeline, opening a new front in the trade war that the Kremlin calls ‘blackmail’ (Business Insider)

- The automotive industry has not reached ‘peak car’ as some Wall Street analysts suggest. Here’s what’s really going on. (Business Insider)

- As China exports slow, government might face growing labor unrest, researcher says (MarketWatch)

- Here’s who keeps investors abreast of the opaque leveraged loan market and possible systemic risk (MarketWatch)

- Boeing Makes Another Vertical Leap As It Looks For Fatter Profits (Investor’s Business Daily)

- McLaren’s Customer Racing Program Gets Drivers on the Track (Barron’s)

- Week in review: How Trump’s policies moved stocks (TheFly)

- Boeing lands $6.5B contract with US Air Force (yesterday): (DoD)

- Schlumberger: Has This Oil Services Giant Fallen Too Far? (TheStreet)

- Hedge Fund and Insider Trading News: Anthony Scaramucci, Dan Loeb, Elliott Management, Kirkland’s, Inc. (KIRK), Sharps Compliance Corp. (SMED), and More (InsiderMonkey)

- NBC Sports posts record NHL ratings (NewsTimes)

- The New McLaren GT Is a Race Car Built for Road Tripping (Robb Report)

- Why Attitude Is More Important Than IQ (Forbes)

- Hip-Hop’s Next Billionaires: Richest Rappers 2019 (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

Where is money flowing today?

Unusual Options Activity – Micron Technology, Inc. (MU)

Today some institution/fund purchased 10,663 contracts of July $32 strike calls (or the right to buy 1,066,300 shares of Micron Technology, Inc. (MU) at $32). The open interest was just 2,949 prior to this purchase. Continue reading “Unusual Options Activity – Micron Technology, Inc. (MU)”

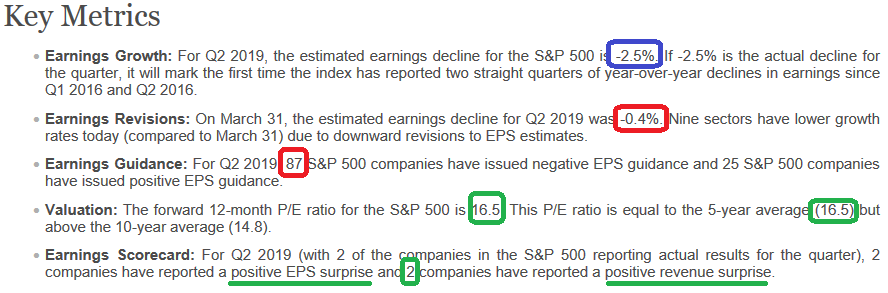

Q2 Earnings Estimates Remain Subdued (Positive Timing?)

Data Source: Factset

The good news is that estimates have come down materially for Q2 – just as they did in Q1 and then dramatically beat the lowered expectations. Continue reading “Q2 Earnings Estimates Remain Subdued (Positive Timing?)”

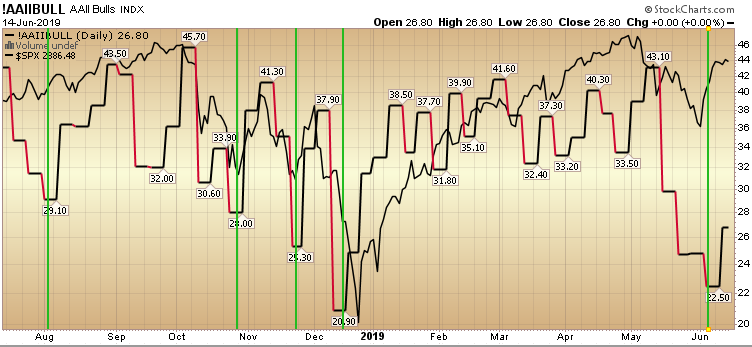

Updated Sentiment Chart

Data Source: AAII

This updated chart gives a nice visual of the data we presented yesterday. As you can see above, it has not paid to get short below the high 30’s (bullish percent), but it has paid to get long below 30 (when pessimism was still high). The print from yesterday was 26.84%. There is still a wall of worry to climb. Continue reading “Updated Sentiment Chart”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Friday…

- The Fed May Have Shrunk Its Balance Sheet Too Quickly (Barron’s)

- A Nudge From Dan Loeb Could Pay Dividends for Sony (Wall Street Journal)

- Juice for China’s Economy Is Coming (Wall Street Journal)

- United States and China suspend intellectual property litigation at WTO (Reuters)

- St. Louis Blues Break NHL Sales Record After Winning Stanley Cup (Bloomberg)

- An entrepreneur who interviewed 21 billionaires says the same 6 habits helped make all of them successful (Business Insider)

- 600-plus US companies urge Trump to end China tariffs (Washington Examiner)