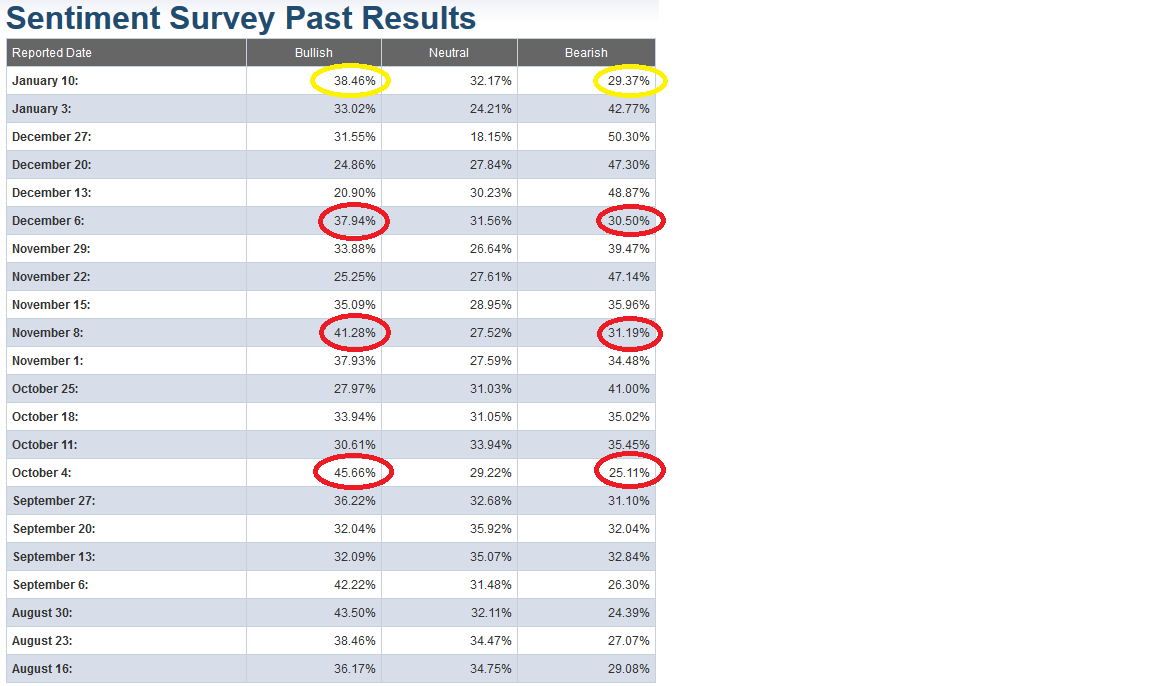

AAII sentiment results are out this morning. The implication is the markets may need a few days/week rest before resuming higher. The last instances that Bullish sentiment/Bearish sentiment were in these ranges were Dec 6, Continue reading “AAII Sentiment indicator”

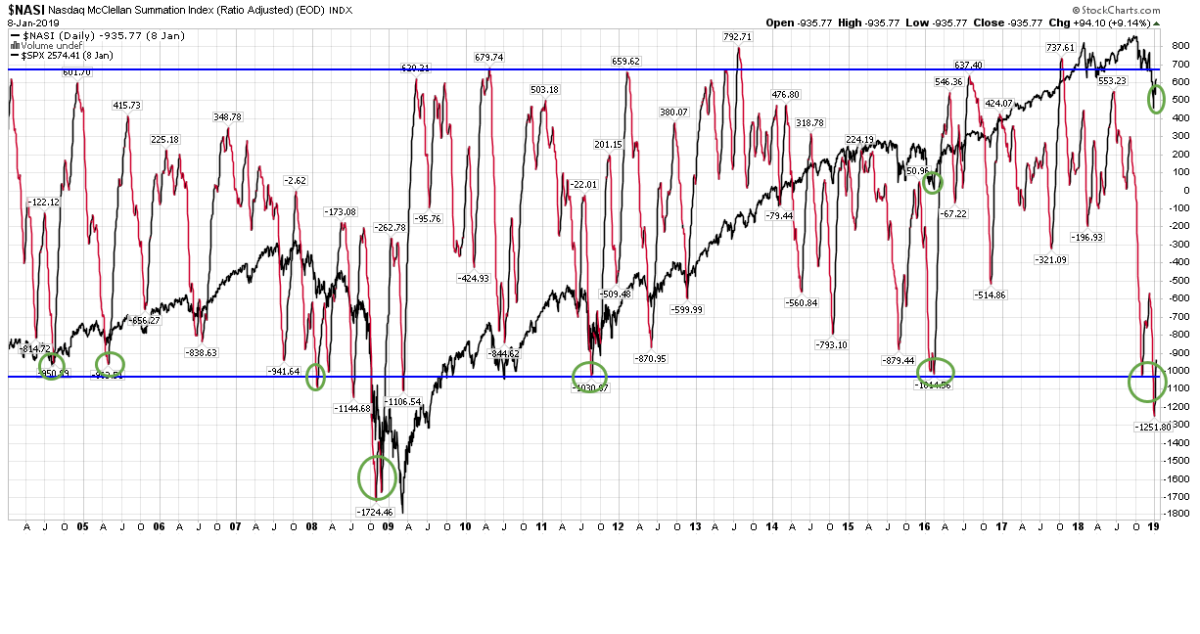

NASI indicator

I’ve always used the Nasdaq McClellan Summation Index as a barometer for risk in the market. The McClellan Summation Index is a breadth indicator derived from the McClellan Oscillator, which is a breadth indicator based on Continue reading “NASI indicator”

Quote of the day…

What I’m reading today…

- Disney CEO Bob Iger Says Spending Billions on Theme Parks Is a No-Brainer (Barron’s)

- Best Income Investments for 2019 (Barron’s)

- Cancer Deaths Decline 27% Over 25 Years (Wall Street Journal)

- Small-Cap Stocks Take On New Shine as Markets Slump (Wall Street Journal)

- S., China Negotiators Narrow Differences on Trade (Walll Street Journal)

- Big hedge funds make gains, most slump in 2018 returns (New York Post)

- This Activist Investor Should’ve Believed More in His Plan (Bloomberg)

- Trump Wants Trade Deal With China to Boost Stocks (Bloomberg)

- Trump is probably going to get his way with the Federal Reserve this year (CNBC)

- Hedge fund managers are betting big against these 12 stocks, Bank of America says (Business Insider)

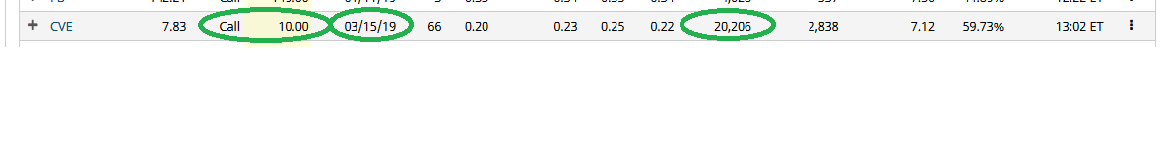

Unusual Option Activity

Today some institution/fund purchased 20,205 contracts of March $10 strike calls (or the right to purchase 2,020,500 shares of Cenovus Energy at $10). This is an abnormally sized bet for this stock and contract as the open Continue reading “Unusual Option Activity”

What I’m reading today…

- Stocks Climb as Investors Look to China-U.S. Trade Talks (New York Times)

- Annual Tech Show To Tout 5G Wireless (Investor’s Business Daily)

- Larry Ellison invest $1Billion in Tesla (Bloomberg)

- Saudis Plan New Export Cuts in Hopes of Lifting Oil to $80 a Barrel (Wall Street Journal)

- Investors Are Counting on the ‘January Effect’ to Revive the Bull Market (Barron’s)

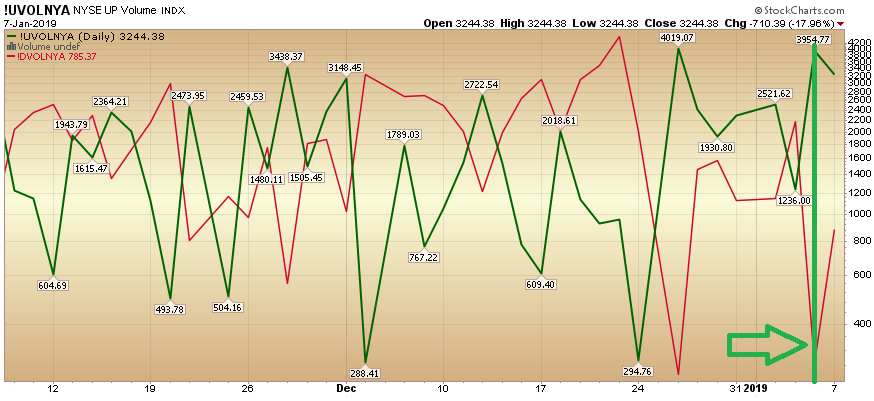

Zweig up/down bottoming indicator triggered

In his book “Winning on Wall Street,” the legendary Marty Zweig explained the value of volume ratios. A ratio of 9:1 or greater of up/down volume is considered to be very bullish and 9:1 down/up volume is considered to be very bearish. Continue reading “Zweig up/down bottoming indicator triggered”

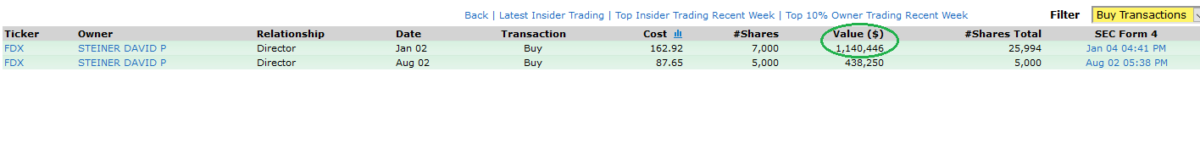

Insider Buying

David Steiner, a Director of FedEx (FDX) did some bargain shopping last week – picking up 7000 shares of FedEx in the bargain bin. Wall Street is one of the few places that when they hold a big sale, no one shows up! David Steiner did and bet $1,140,446 of his own money that the future is a lot brighter than the street thought in December.

What I’m reading today…

- Four Low P/E Stocks That Look Like Good Bets (Barron’s)

- The 4 Most Important Things for the Stock Market This Year (Barron’s)

- More First-Time Home Buyers Are Turning to the Bank of Mom and Dad (WSJ)

- Apple’s Biggest Problem? My Mom (NY Times)

- Who Wants a Market Downturn? These Investors Actually Do (NY Times)

- Beijing says both sides have expressed a desire to hammer out a deal (CNBC)

Inspiration

As I embark on this additional chapter in my professional career, I am reminded of one of the proddings from an early life mentor of mine, Mr. Jim Rohn. Jim Rohn was a world renowned business philosopher Continue reading “Inspiration”