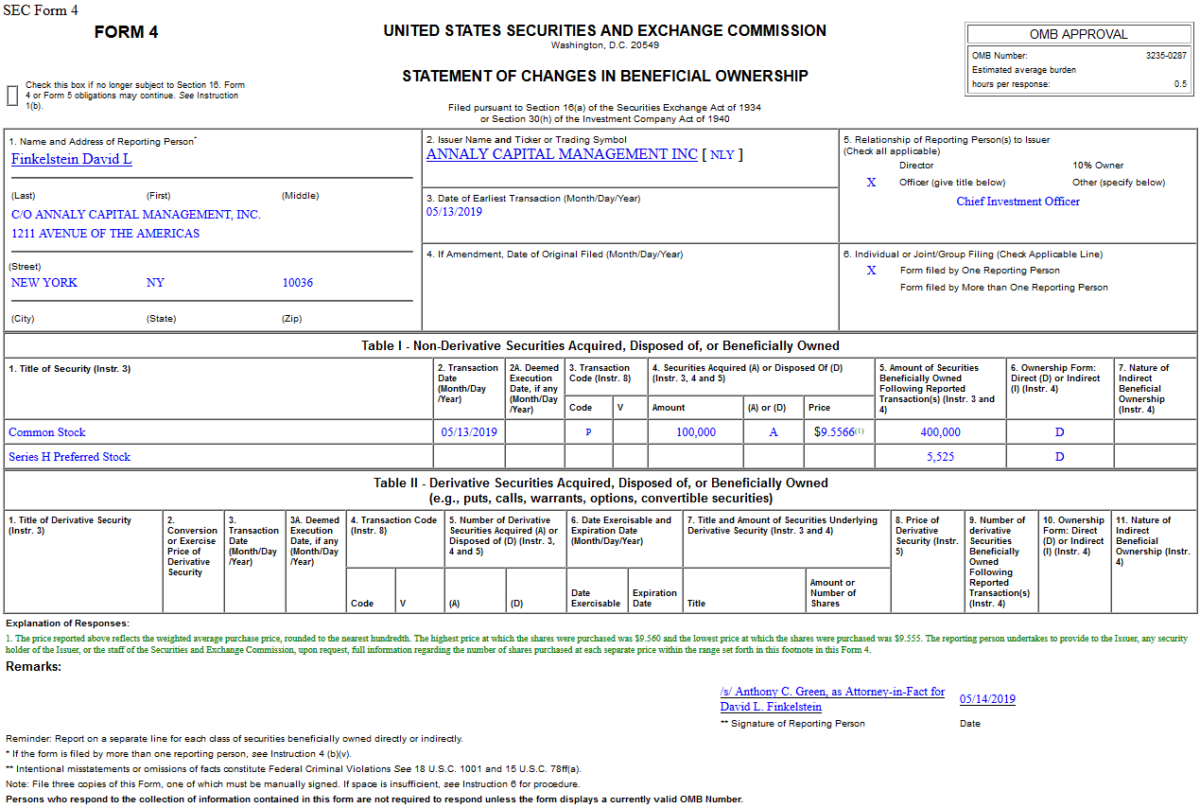

On May 13, 2019, David Finkelstein – Chief Investment Officer of Annaly Capital Management, Inc. (NLY) – purchased 100,000 shares of NLY at $9.56. His out of pocket cost was $955,660.

Where is money flowing today?

Be in the know. 10 key reads for Tuesday…

- The Real Story of the Dutch Tulip Bubble Is Even More Fascinating Than the Myth You’ve Heard (Barron’s)

- Small-business optimism index climbs to four-month high in April: NFIB (MarketWatch)

- Fed’s Williams says policymakers need to better prepare for lower interest rate world (Reuters)

- Crude Oil Prices Rise As Saudi Arabia Reports Drone Attacks On Pump Stations (Investor’s Business Daily)

- Moore’s Law Was Just the Beginning, Says This Growth Stock Investor (Barron’s)

- The Fusion Reactor Next Door (New York Times)

- Walmart Matches Amazon With Free One-Day Shipping on Many Items (Bloomberg)

- Trump defends China trade battle, vows deal will happen (Reuters)

- Howard Stern says he has changed. How much? (New York Times)

- With Oil Still Over $60 and Summer Coming, Top Energy Stocks Are a Steal Now (24/7 Wall Street)

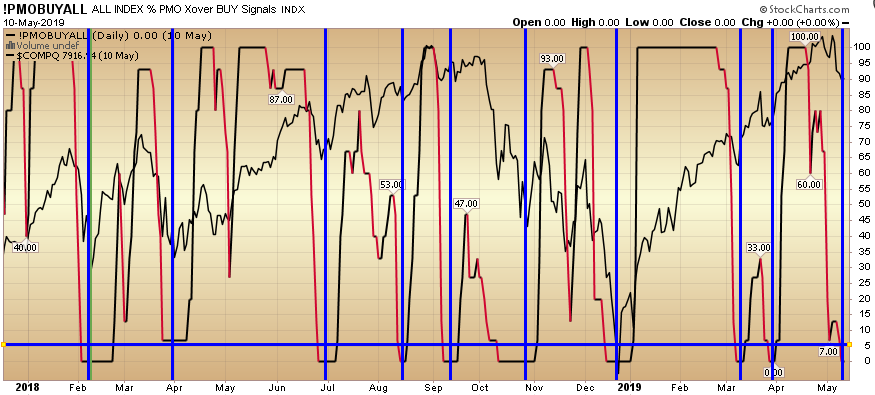

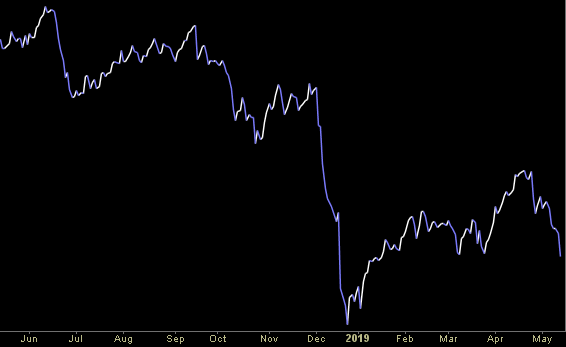

PMO BUY ALL at Extreme

The last 9 times the PMO “Buy All” indicator dropped below 5, it has paid to buy the market for a bounce. It is currently at zero. The blue vertical lines mark those spots where the indicator dipped below 5 in the past 1.5 years. Continue reading “PMO BUY ALL at Extreme”

Unusual Options Activity – Mylan N.V. (MYL)

Today some institution/fund purchased 10,588 contracts of Oct. $20 strike calls (or the right to buy 1,058,800 shares of Mylan N.V. (MYL) at $20). The open interest was just 118 prior to this purchase. Continue reading “Unusual Options Activity – Mylan N.V. (MYL)”

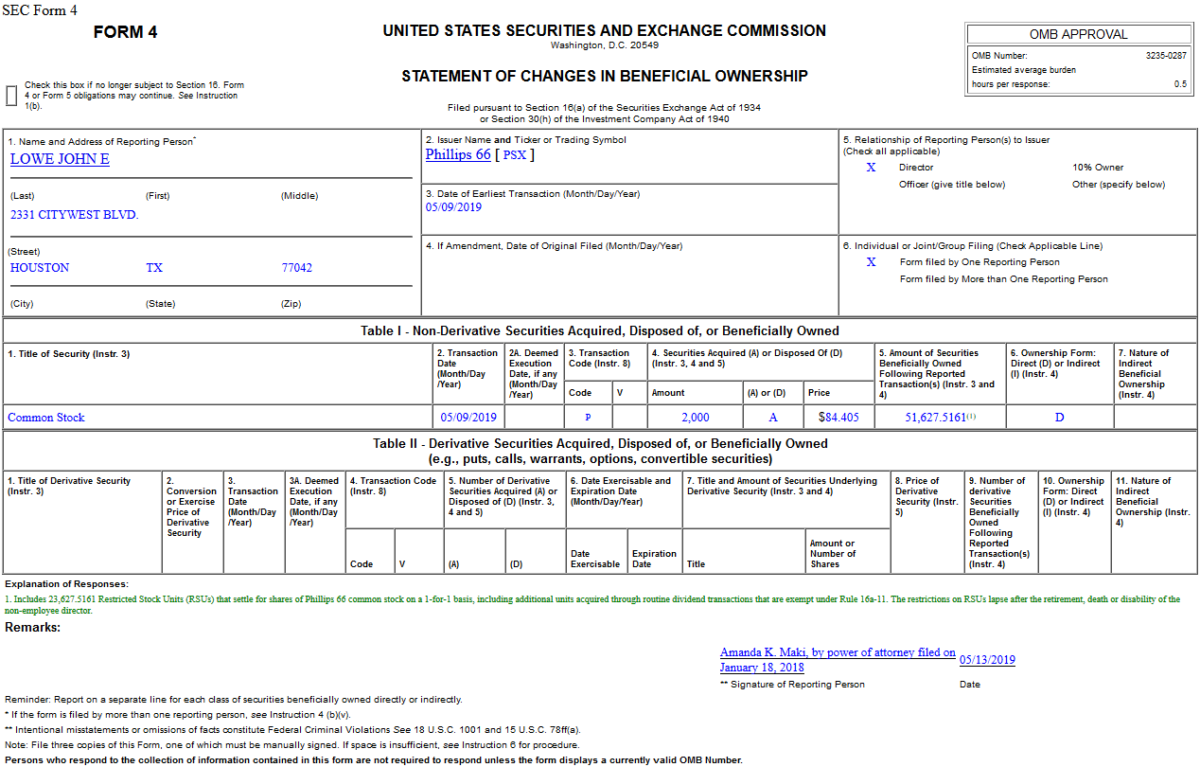

Insider Buying in Phillips 66 (PSX)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

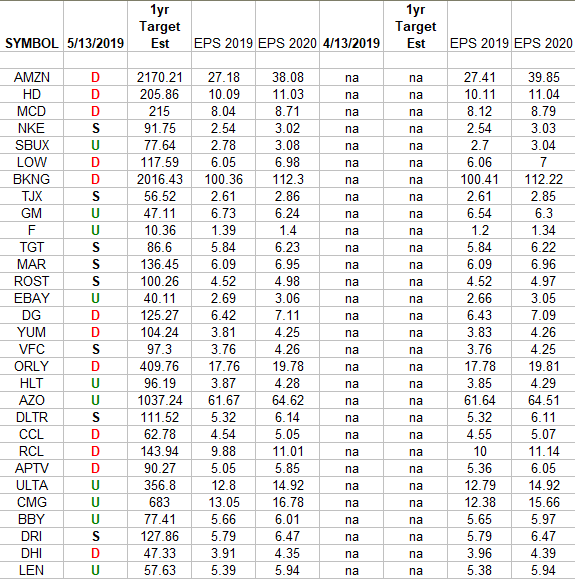

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks. The column under the date 5/13/2019 has a letter that represents the movement Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 6 key reads for Monday…

- The inside story of why Amazon bought PillPack in its effort to crack the $500 billion prescription market (CNBC)

- Tariff War Impact: 20-30 basis points (0.20%-0.30%) hit to U.S. GDP. Not ideal, but not the biggest deal either (MarketWatch)

- China raising tariffs on $60 billion in US goods (New York Post)

- How Much Money Do You Need to Be Wealthy in America? (Bloomberg)

- Billionaire Superyacht Showdown: Who’s Who At The 2019 Cannes Film Festival (Forbes)

- Mark Zuckerberg responds to cofounder’s call to break up Facebook, says it wouldn’t help anything (9to5Mac)