- Drake Has Turned a Massive 767 Cargo Plane Into a $185 Million Flying Oasis Named ‘Air Drake’ (People)

- Impossible Burger 2.0: Where to buy, availability, taste, price (CNET)

- How asteroid mining will save the Earth — and mint trillionaires (Mashable)

- Amazon Prime’s one-day shipping is already rolling out (The Verge)

- Renaissance Paragone: An Ancient Tactic for Getting the Most From People (Farnam Street)

- The Russian Revolution and Bond Bubbles (Podcast) (Bloomberg)

- An Entire 3D-Printed Neighborhood Will Be Constructed in 24 Hours (Popular Mechanics)

- Gundlach Slams Fed for Putting Brakes on Rate Hikes (CIO)

- Trump tells China to ‘act now’ on trade or face a ‘far worse’ deal in his second term (CNBC)

- Mercedes have discussed Ferrari move with Hamilton: Wolff (Reuters)

Be in the know. 20 key reads for Saturday…

- China Names Its Trade-Deal Price as Trump Sets Month Deadline (Bloomberg)

- Fed’s Bostic: Higher tariffs could result in interest-rate cuts if consumer spending suffers (MarketWatch)

- UPS Stock Is Poised to Deliver. Here’s Why (Barron’s)

- J.B. Hunt Stock Is a Bargain Play in Intermodal Shipping (Barron’s)

- We Tested 50 Men’s Hair Products. Here Are the Best (Wall Street Journal)

- ‘Titans’ missing from Las Vegas hedge fund conference (New York Post)

- Warren Buffett’s tribute to a legendary investor reveals 3 secrets to living an extraordinary life (CNBC)

- Pound Volatility a Bargain for Investors Eyeing Brexit Breakout (Bloomberg)

- CBI Hits 10+ While $SPX is in a Long-Term Uptrend (QuantifiableEdges)

- Big Little Lies Season 2 Might Somehow Be Even More Tense Than Season 1 (Vanity Fair)

- This Physicist Is Using Mayonnaise to Study Nuclear Fusion (Futurism)

- What Warren Buffett’s Teacher Would Make of Today’s Market (Wall Street Journal)

- Don Felder Discusses the Business of Rock and Roll (Podcast) (Bloomberg)

- Hedge Fund and Insider Trading News: Michael Platt, Jeff Smith, Daniel Loeb, Anthony Scaramucci, Ultra Clean Holdings Inc (UCTT), Opko Health Inc. (OPK), and More (Insider Monkey)

- New Lease Accounting: Why Is It Important For Investors And Analysts? (Value Walk)

- These 9 Spectacular Watches and Clocks Are the Top Lots at Geneva’s Spring Auctions (RobbReport)

- Flying Taxis Are Coming. Here Are 5 That Are About to Take Off (Robb Report)

- Where Top Chefs Go for the Best Late-Night Bites and Booze (Men’s Journal)

- Is ‘John Wick: Chapter 3’ A Worthy Sequel? Here’s What The Reviews Have To Say (digg)

- Amazon Is Selling a DIY Guest House You Can Build in 8 Hours (Maxim)

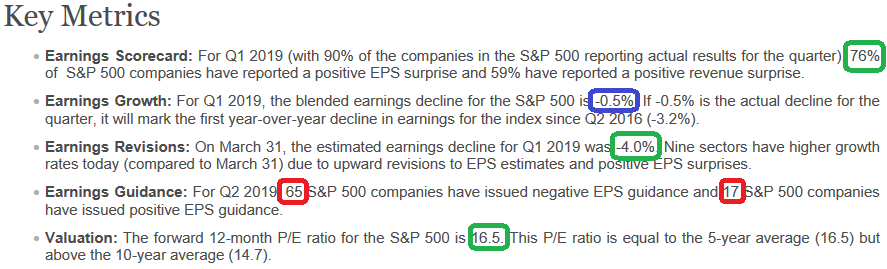

Q1 Earnings Continued Improvement. Guidance Subpar…

Data Source: Factset

Q1 Earnings Estimates bumped up to -.5% today from -.8% last week. With the pullback in the markets this week, the forward p/e multiple is back in line with the 5 year average of 16.5. This is constructive. Continue reading “Q1 Earnings Continued Improvement. Guidance Subpar…”

Where is money flowing today?

Unusual Options Activity – Scientific Games Corporation (SGMS)

Today some institution/fund purchased 3,855 contracts of July $22 strike calls (or the right to buy 385,500 shares of Scientific Games Corporation (SGMS) at $22. The open interest was 2,386 prior to this purchase. Continue reading “Unusual Options Activity – Scientific Games Corporation (SGMS)”

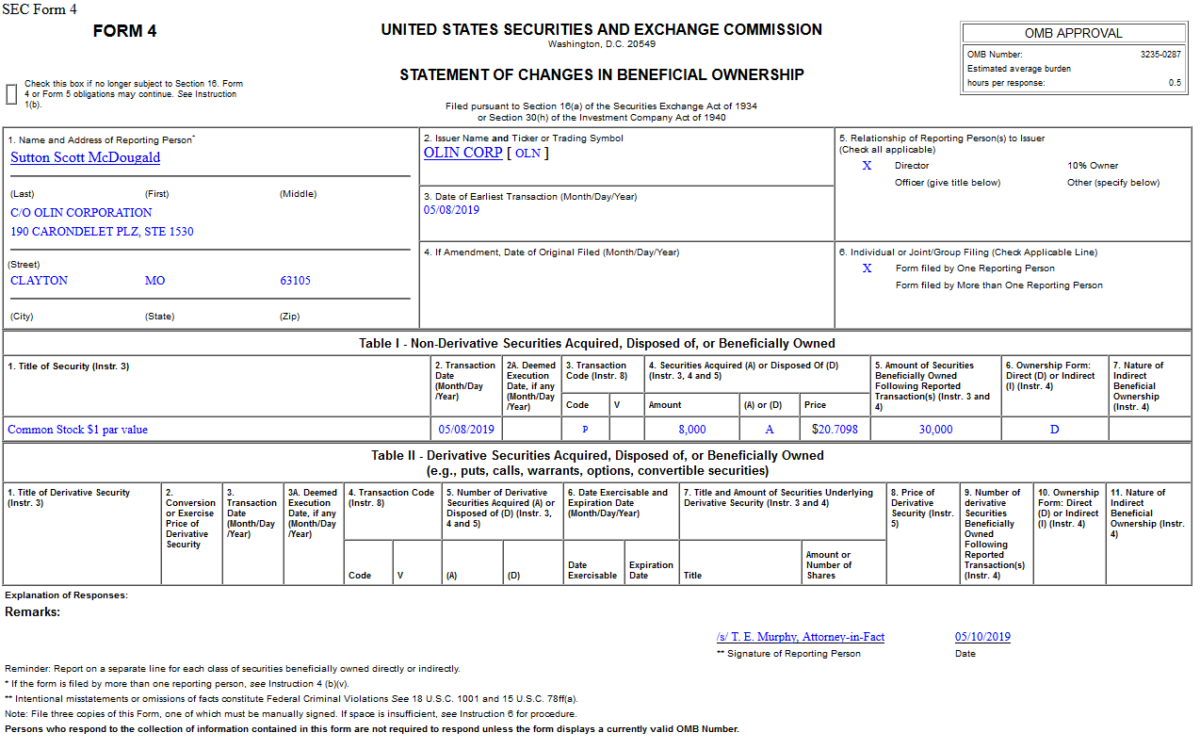

Insider Buying in Olin Corporation (OLN)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

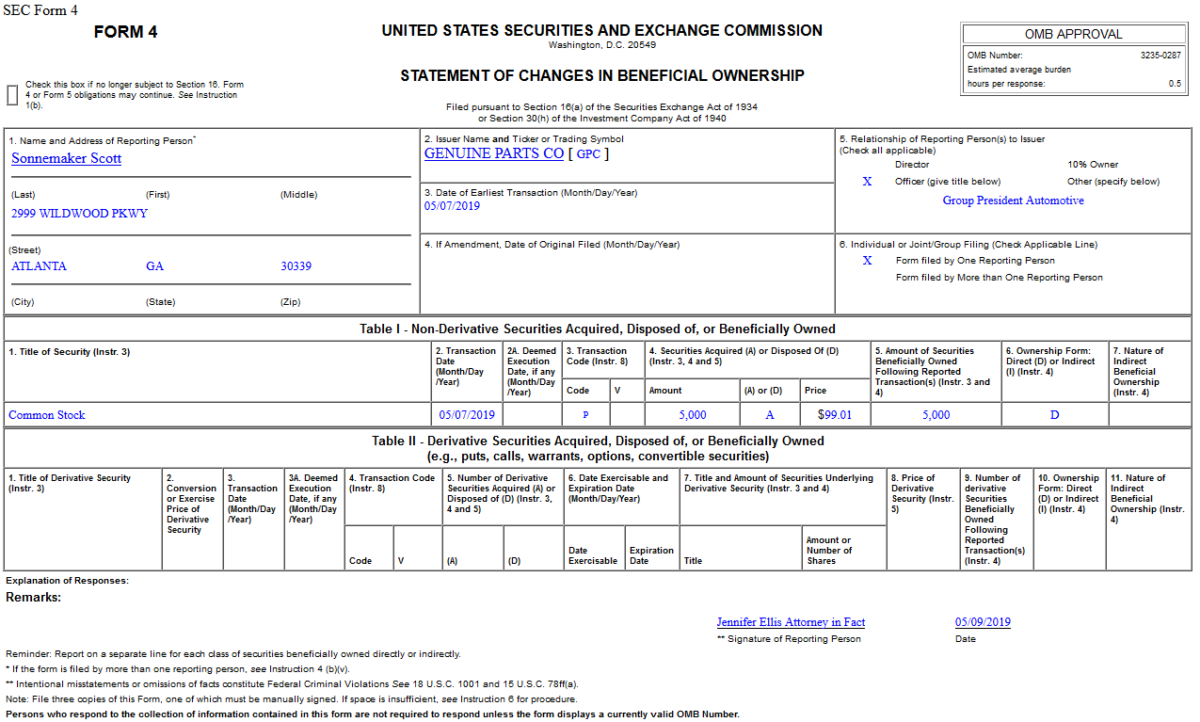

Be in the know. 12 key reads for Friday…

- 3M Stock Crashed After Earnings, but One Director Just Bought Shares (Barron’s)

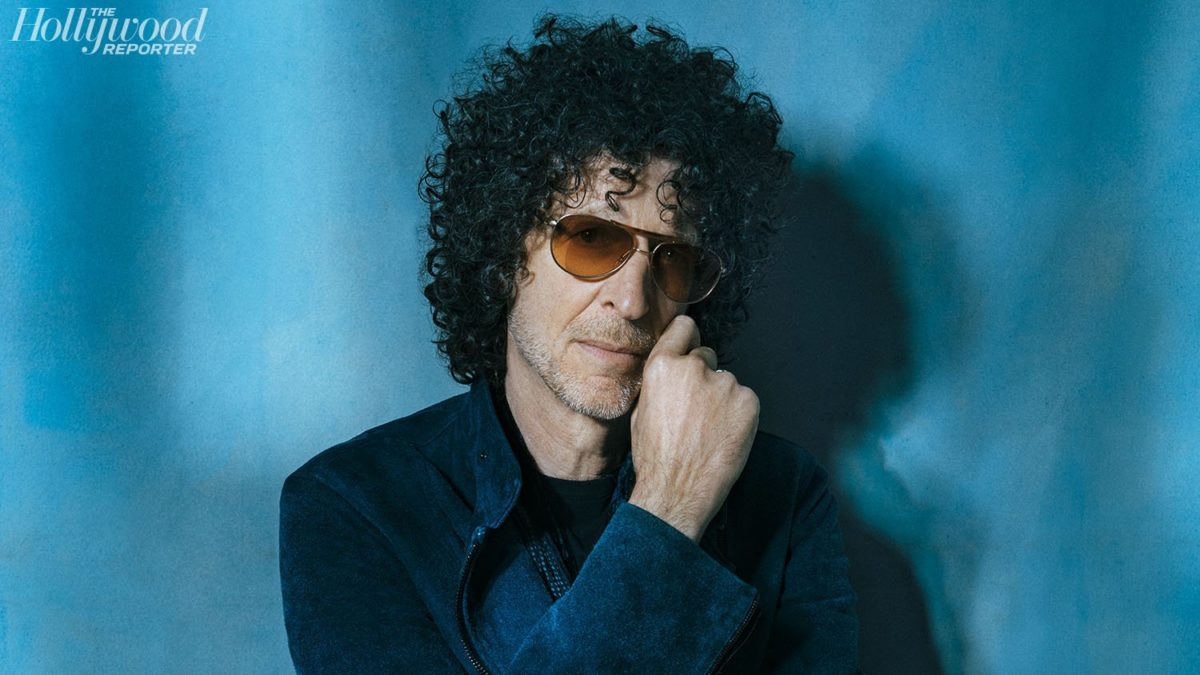

- “All I’m Thinking Is, ‘I’m Going to Die'”: Howard Stern Reveals Cancer Scare, Trump Regrets and Details of a Dishy New Book (Hollywood Reporter)

- Prescription Opioid Use Plummeted Most on Record Last Year ()

- US tariffs on China jump as deadline passes, China immediately says it will retaliate (CNBC)

- Fox unveils ‘insanely simple’ business model at Investor Day (New York Post)

- Horseman Capital’s Russell Clark has been bearish for more than seven years. And if he’s wrong? “This could be my farewell interview,†he says. (Bloomberg)

- Occidental Petroleum Emerges With the Prize in a Takeover Fight (New York Times)

- An increasing number of economists think a rate cut is coming (Business Insider)

- SEC Moves to Ease Audits for Smaller Companies (Wall Street Journal)

- Tiger Woods Has Become His Own Greatest Coach (Wall Street Journal)

- Hedge Funds No Longer Stars of Their Flashiest Conference (Wall Street Journal)

- Fed wants to target interest rates on longer term securities in next downturn (after short-rates hit zero): (Federal Reserve)

Unusual Options Activity – Occidental Petroleum Corporation (OXY)

Today some institution/fund purchased 6,212 contracts of June $60 strike calls (or the right to buy 621,200 shares of Occidental Petroleum Corporation (OXY) at $60). The open interest was 3,561 prior to this purchase.

Continue reading “Unusual Options Activity – Occidental Petroleum Corporation (OXY)”