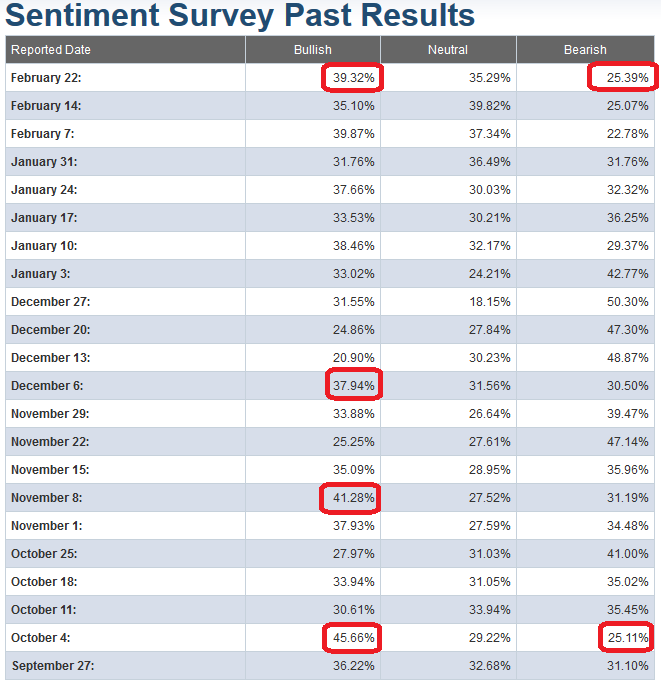

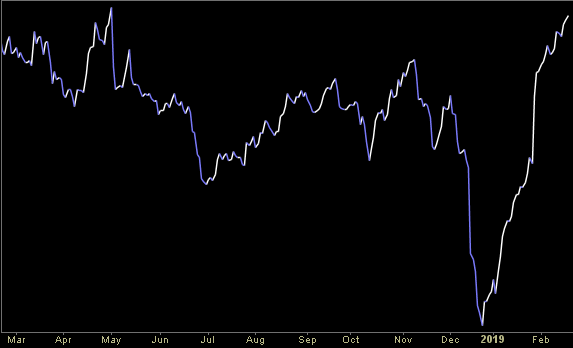

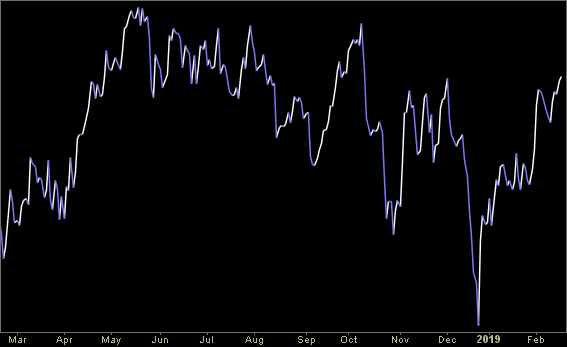

AAII Sentiment Results and Interpretation

AAII Sentiment Survey results are out this morning. Bullishness is now up to the ~40 level – which usually marks market reversals. Bearishness has collapsed. In the S&P500 chart below I have noted those dates in the recent Continue reading “AAII Sentiment Results and Interpretation”

Be in the know. 9 key reads for Thursday…

- Fed Prepares to End Balance-Sheet Runoff Later This Year (Wall Street Journal)

- Trump Continues to Weigh EU Auto Tariffs (Wall Street Journal)

- Wall Street, Seeking Big Tax Breaks, Sets Sights on Distressed Main Streets (New York Times)

- Why the $9 Trillion Stock Rally Is Beginning to Look Tired (Bloomberg)

- EU’s Juncker ‘not very optimistic’ on Brexit deal after meeting with UK leader May (CNBC)

- US and China are sketching the outlines of a deal to end the trade war (CNBC)

- BAML: Investors are freaking out about the rising prospect of a global recession (Business Insider)

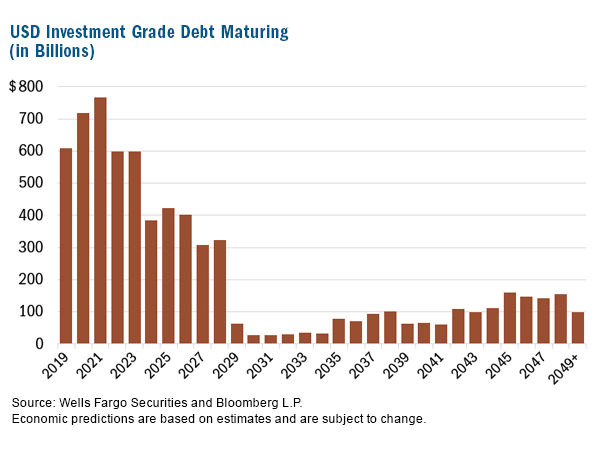

- A $3-trillion tsunami is about to flood the stock market, warns fund manager (MarketWatch)

- Stock Buybacks Are on Track for Another Record Year (MarketWatch)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

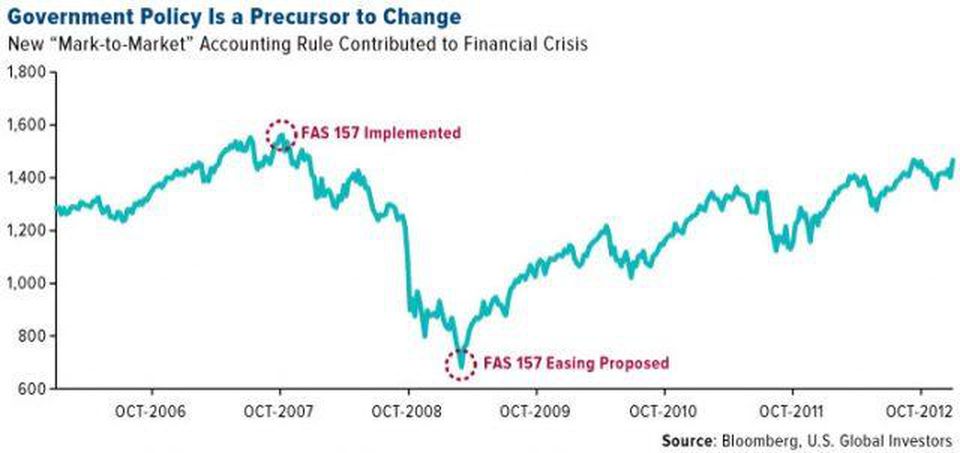

Imminent Accounting Change Rhymes with 2007 – $3 Trillion Impact

In 2007 the Financial Accounting Standards Board (FASB) made an accounting change – referred to as FAS 157. FAS 157—also known as “mark-to-market,” or “fair value accounting” was primarily responsible for Continue reading “Imminent Accounting Change Rhymes with 2007 – $3 Trillion Impact”

Unusual Options Activity

Today some institution/fund purchased 16,500 contracts of June 35 strike calls (or the right to buy 1,650,000 shares of HSBC Holdings plc (HSBC) at $35). The open interest was just 197 prior to this purchase. Continue reading “Unusual Options Activity”

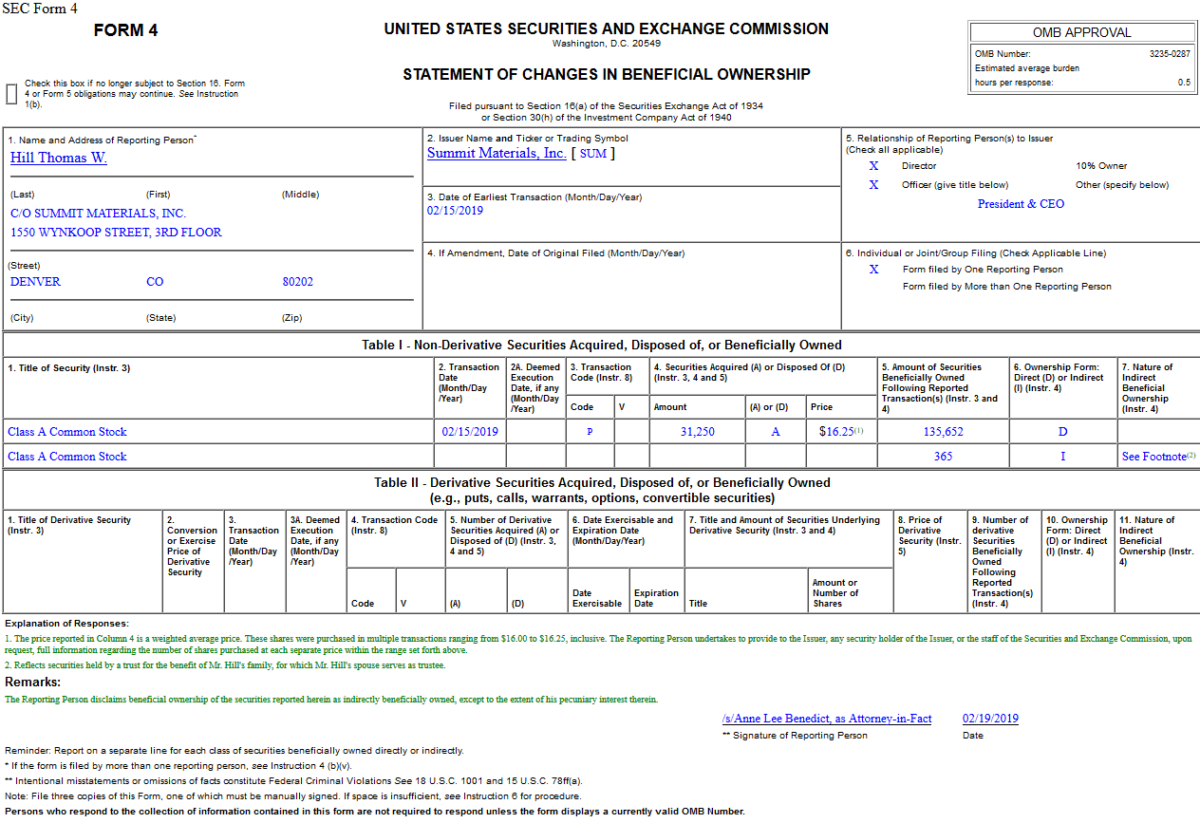

Insider Buying

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 8 key reads for Wednesday…

- Fed Minutes to Shed Light on Biggest Policy Reversal in Years (Bloomberg)

- New US tariffs on Chinese goods will be ‘catastrophic’ for global stocks: China media (CNBC)

- Japan’s exports fall most in two years as China shipments weaken (Reuters)

- DealBook Briefing: The Big Problems Facing the Trade Talks (New York Times)

- Tesla is preparing to offer Model 3 leasing to boost demand (Electrek)

- How Wealthy Parents Can Raise Responsible, Grounded Kids (Barron’s)

- SEC Wants to Make It Easier for Companies to Explore IPOs (Wall Street Journal)

- Bill Gates and Elon Musk Agree This Is the Secret to Remembering More of What You Read (Inc.)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity

Today some institution/fund purchased 13,675 contracts of March 43 strike puts (or the right to sell short 1,367,500 shares of Agnico Eagle Mines Limited (AEM) at $43). The open interest was just 197 prior to this Continue reading “Unusual Options Activity”