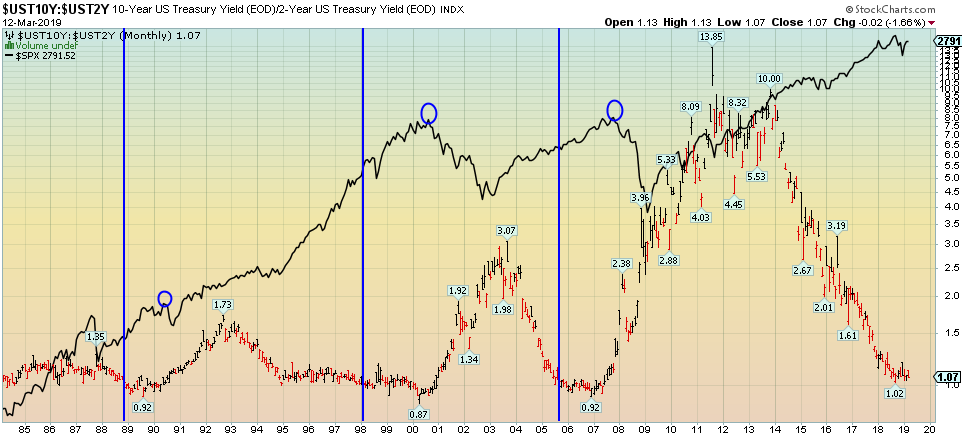

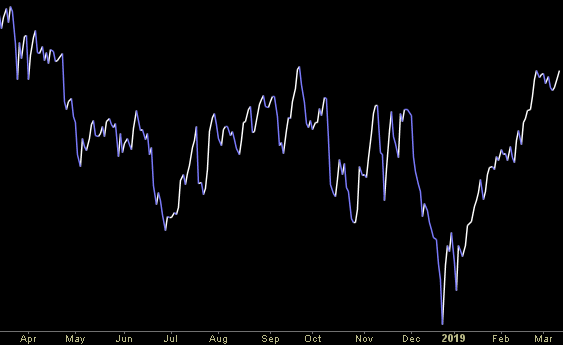

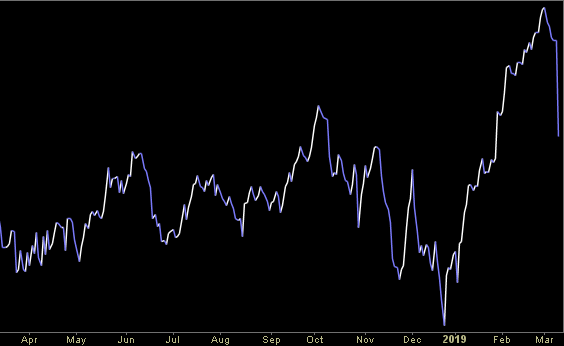

Last week I put out the article “Double Earnings Drops = Double Trouble”: Continue reading “Yield Curve vs. Earnings: Bull vs. Bear DEATH MATCH!”

Unusual Options Activity – Sirius XM Holdings Inc. (SIRI)

Today some institution/fund purchased 40,677 contracts of May $6 strike calls (or the right to buy 4,067,700 shares of Sirius XM Holdings Inc. (SIRI) at $6). The open interest was just 581 prior to this purchase. Continue reading “Unusual Options Activity – Sirius XM Holdings Inc. (SIRI)”

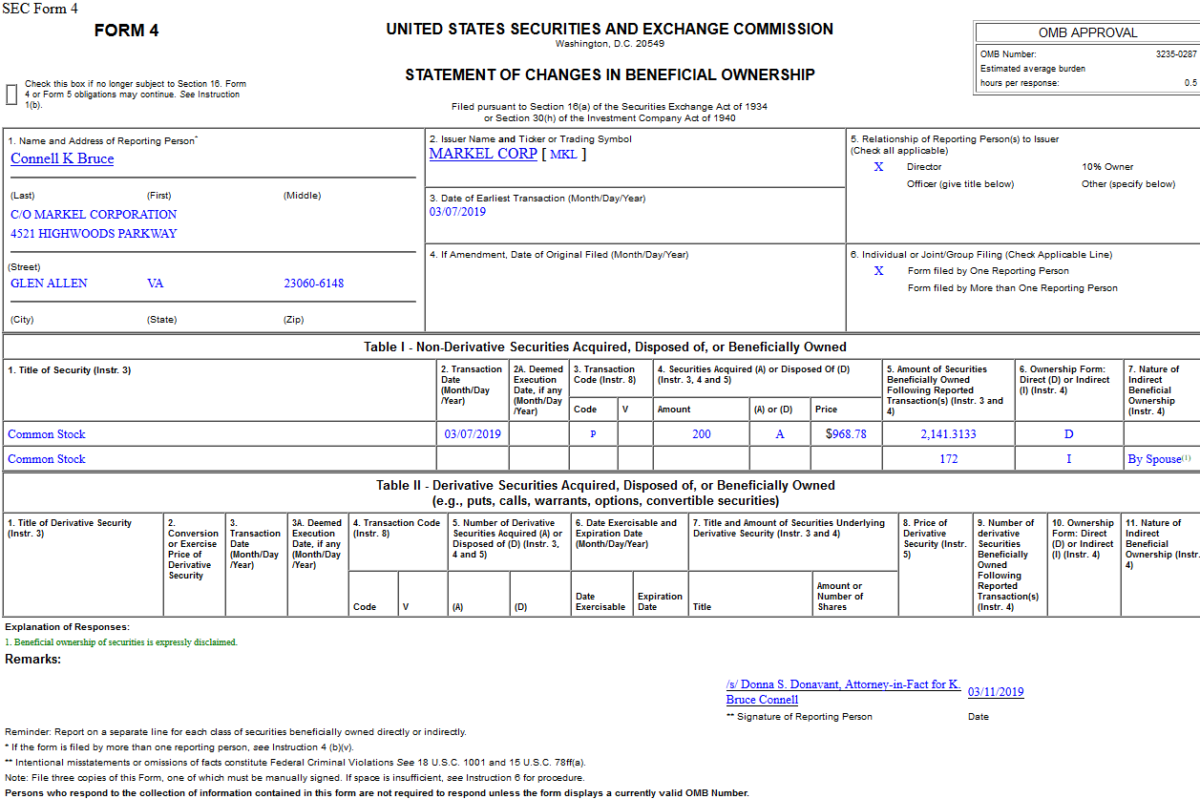

Insider Buying in Markel Corporation (MKL)

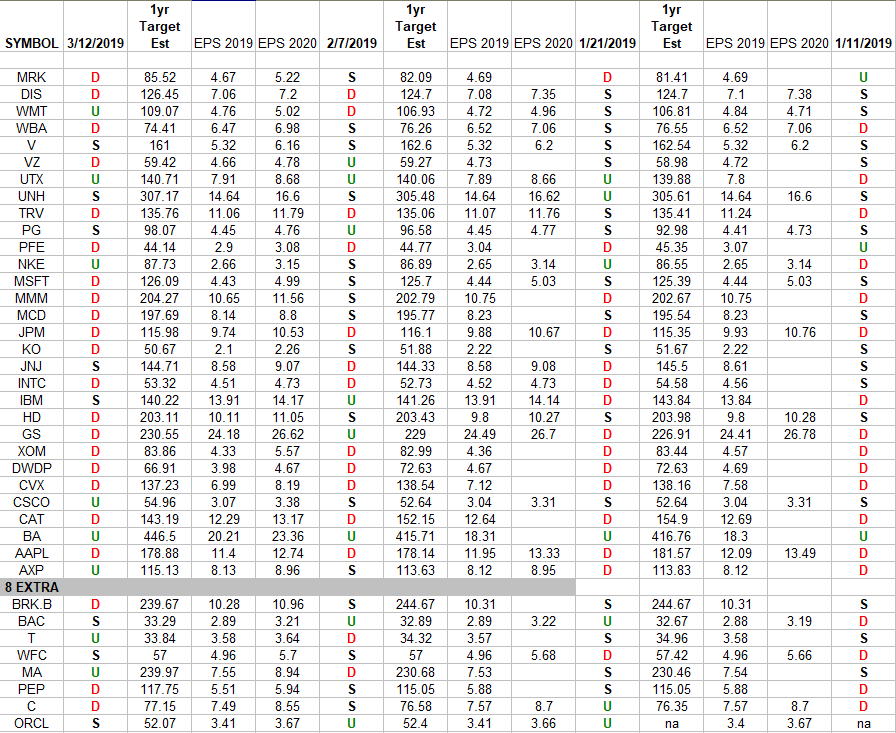

DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. The new 8 companies are at Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

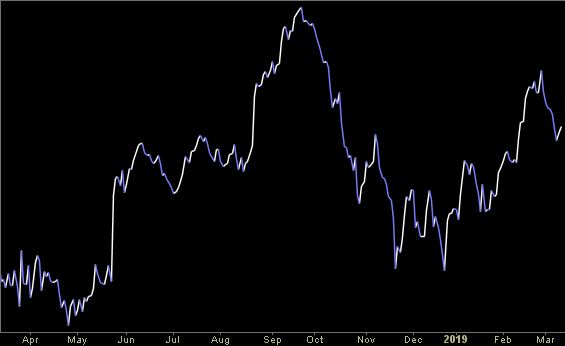

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 9 key reads for Tuesday…

- Doomed with Democrats, Trump’s budget boosts Pentagon, targets safety net (Reuters)

- Jefferies Says Buy 4 Top Tech Stocks Now as Q1 Winds Down (24/7 Wall Street)

- There’s No Sugarcoating Corporate Debt (Bloomberg)

- The Bull Market Actually Isn’t 10 Years Old (Bloomberg)

- Three Hedge Fund Favorites Command Your Attention: Taking Stock (Bloomberg)

- S. Core Inflation Unexpectedly Cools on Autos, Drug Prices (Bloomberg)

- For These Investors, It’s A ‘Very Attractive Time’ For Energy Assets (Investor’s Business Daily)

- Turkey Enters Recession, a Blow for Erdogan as Elections Near (New York Times)

- Carl Icahn increases stakes in Caesars (European Gaming)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity – Vale S.A. (VALE)

Today some institution/fund purchased 17,459 contracts of June $12 strike puts (or the right to sell short 1,745,900 shares of Vale S.A. (VALE) at $12). The open interest was just 10,149 prior to this purchase. Continue reading “Unusual Options Activity – Vale S.A. (VALE)”