- Wall Street’s biggest bear flips, raises S&P 500 price target by 20% (yahoo)

- Deck Maker’s $450 Million Bet on America’s Renovation Boom (wsj)

- Alibaba Shares Rise as Investors Grow Confident in Long-Term Outlook (wsj)

- ‘Dumb Money’ Loses $13.1 Billion In Latest GameStop Stock Mania (investors)

- Chinese stocks see ‘golden cross’ in latest sign rally could continue (marketwatch)

- <Research>G Sachs Raises 12-Mth Target of MSCI China Index to 70 pts, CSI 300 to 4,100 pts (aastocks)

- BABA’s Taobao Tmall ‘618’ To Offer RMB200B Rapid Repayment Quota to Merchants (aastocks)

- Will China’s plan for housing buys help smooth the road to economic recovery? (scmp)

- China’s capital markets set for ‘renewed growth for many years to come’ after Beijing’s rescue actions: investors (scmp)

- Florida’s 125% Surge in Property-Insurance Bills Sows Havoc (bloomberg)

- Opinion: Corporate insiders at these companies are telling us that consumers are cruising (marketwatch)

- Dollar rally falters as falling inflation raises hopes of rate cuts (ft)

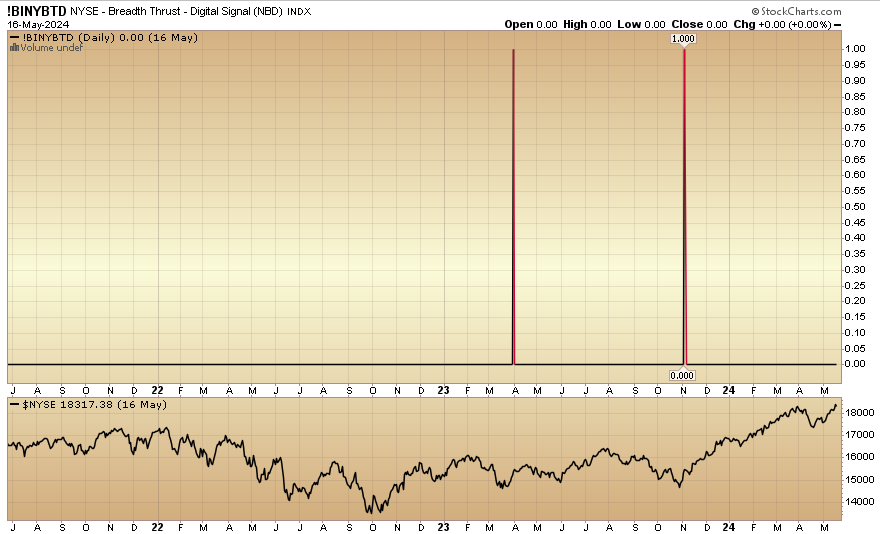

Indicator of the Day (video): NYSE Panic Thrust

Be in the know. 7 key reads for Sunday…

- S&P Profit Recovery Revs Up on Big Tech and Strong Consumer (bloomberg)

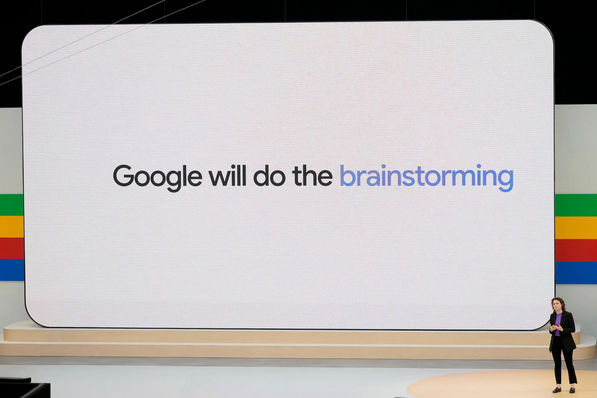

- Google Is Hitting Back in the AI Race. Travel Could See the First Big Change. (barrons)

- AI companies seek big profits from ‘small’ language models (ft)

- The PBOC (“Big Momma”) Releases Real Estate Policy Bazooka, Week in Review (chinalastnight)

- China abolishes mortgage floor rates, cuts minimum down payment ratios to boost property market (cn)

- How Spirit AeroSystems fits into Boeing’s rebound plan (cnbc)

- Can Google Give A.I. Answers Without Breaking the Web? (nytimes)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 239

Article referenced in VideoCast above:

BABA Bad or BABA Beautiful? Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 239

Article referenced in podcast above:

BABA Bad or BABA Beautiful? Stock Market (and Sentiment Results)…

Quote of the Day…

Be in the know. 15 key reads for Saturday…

- BlackRock’s Rieder: Federal Reserve Rate Cuts Needed to Tame Inflation (cnbc)

- Companies are leaning into opportunity in China (cnbc)

- China’s industrial output up 6.7 pct in April (cn)

- 3 Reasons to Buy Alphabet Stock Like There’s No Tomorrow (fool)

- Buy Nestlé Stock. Despair Is Turning to Hope. (barrons)

- A Cheap Dividend Aristocrat to Buy Before It Bounces Back (morningstar)

- Weekly Leading Economic Index (advisorperspectives)

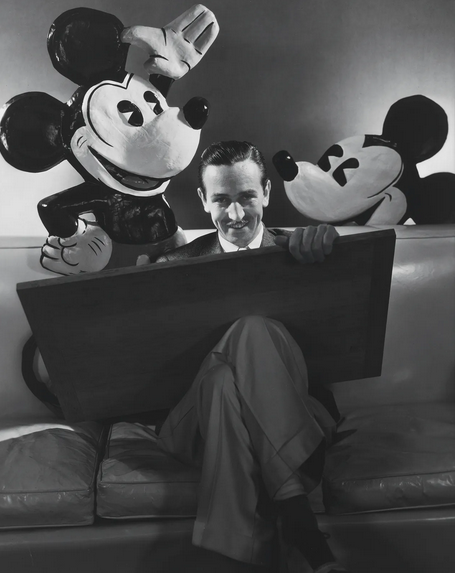

- Inside Disney’s Hunt to Replace Bob Iger as CEO: Bibbidi Bobbidi Who Will It Be? (vanityfair)

- Alibaba sees steady revenue increase, GMV and order numbers on Taobao and Tmall return to double-digit growth track (technode)

- AI creates level playing field, can provide most people with equal opportunities, says Sundar Pichai (firstpost)

- The highs and lows of US rents (npr)

- Google Puts AI in Its Search Engine (inc)

- Charts with a message (scottgrannis)

- Alibaba Back on Growth Track with GMV Up Double Digits, Extra Dividend to Shareholders (alizila)

- Alibaba Overhauls Taobao Website Ahead of Revamped 6.18 Sale (alizila)

Where is money flowing today?

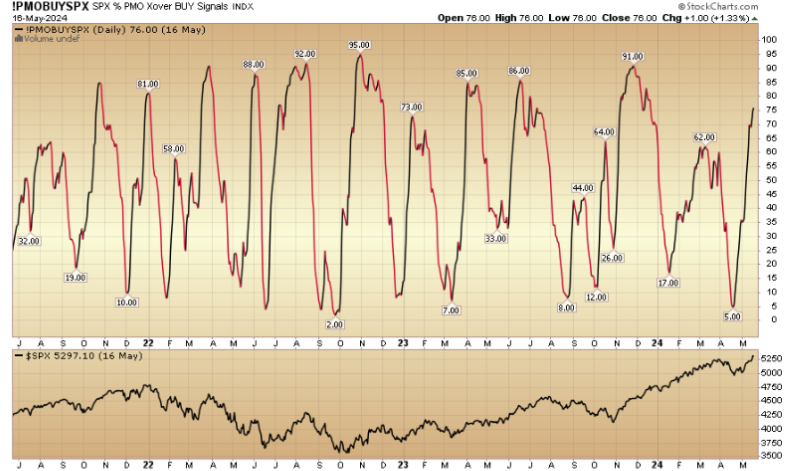

Indicator of the Day (video): PMO Buy SPX

Be in the know. 17 key reads for Friday…

- Chinese vice-premier calls on cities to buy back residential land, unsold homes (scmp)

- China’s e-commerce market still has ‘ample room’ for growth: JPMorgan analyst (scmp)

- Emerging-Market Stocks Are Breaking Out, and Could Beat the S&P 500 From Here (barrons)

- China Attempts to End Property Crisis With Broad Rescue Package (bloomberg)

- Vietnam’s Economy Is Humming. 3 Growth Stocks to Play. (barrons)

- Utilities Are Meant to Be Sleepy. They’re the New Growth Stocks. (barrons)

- Is PayPal a Millionaire Maker? (yahoo)

- China Is Finally Getting Serious About a Housing Rescue (wsj)

- Walgreens and CVS Are Trying to Fix America’s Flailing Pharmacies (bloomberg)

- David Tepper Scoops Up Alibaba as Hedge Funds Hunt for Bargains in China (bloomberg)

- PBOC Earmarks $42 Billion for State Buying of Unsold Homes (bloomberg)

- Intel Inside Ohio (bloomberg)

- Canada Goose jumps 16% after the company reports growth surge in China (cnbc)

- China just unveiled the strongest remedies yet for its troubled housing market (businessinsider)

- Openwashing (nytimes)

- Alibaba rallies to 7-mth high as ‘Big Short’ investor Burry increases stake (streetinsider)

- After bumping S&P 500 target, BMO is also turning more bullish on Canada (streetinsider)