Unusual Options Activity – Eli Lilly and Company (LLY)

Today some institution/fund purchased 5,316 contracts of June $120 strike calls (or the right to buy 531,600 shares of Eli Lilly and Company (LLY) at $120). The open interest was 3,199 prior to this purchase. Continue reading “Unusual Options Activity – Eli Lilly and Company (LLY)”

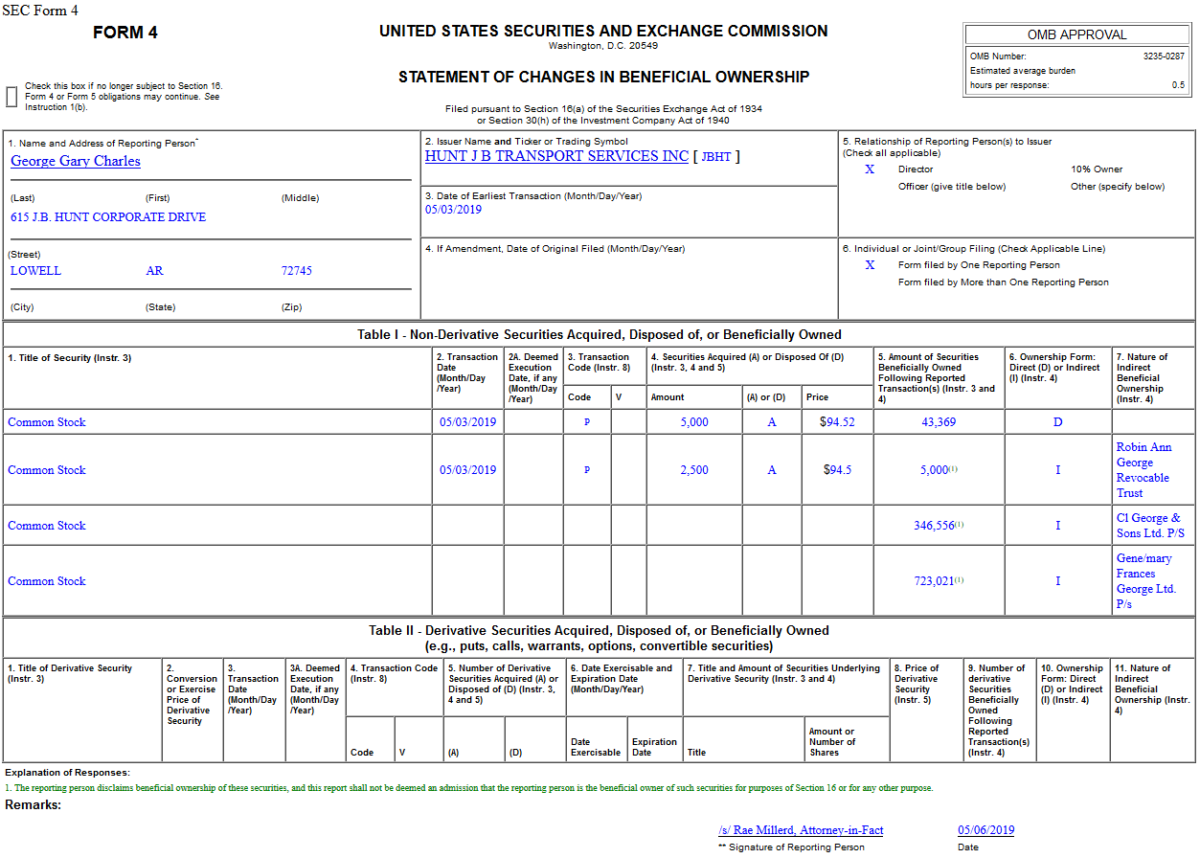

Insider Buying in J.B. Hunt Transport Services, Inc. (JBHT)

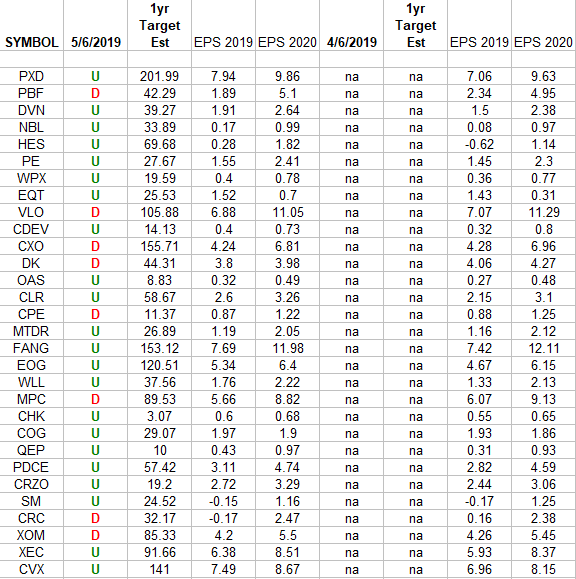

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2019 and 2020 estimates were: 4/6/2019 and today 5/6/2019. The column under Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Monday…

- Happy birthday, Gordon Gekko (MarketWatch)

- Warren Buffett’s Case for Capitalism (DealBook)

- Trump Threatens China With More Tariffs Ahead of Final Trade Talks (New York Times)

- China trade team still preparing to go for talks after Trump cranks up pressure (Reuters)

- Buffett says Berkshire plans to ‘put a lot of money’ into energy (MarketWatch)

- Biogen Stock Is Near a Multiyear Low. The CEO and a Hedge Fund Bought Millions. (Barron’s)

- Warren Buffett Talks Buybacks, Succession, Bitcoin, and 5G at the Berkshire Annual Meeting ()

Be in the know. 14 key reads for Sunday…

- How A Professional Poker Player ‘Reads’ Competitors (Podcast) (Bloomberg)

- Stanley Kubrick showed that perfectionism pays off (The Economist)

- The Ruthless, Secretive, and Sometimes Seedy World of Hedge Fund Private Investigators (Institutional Investor)

- 12 Habits Of Genuine People (Forbes)

- Hedge Fund and Insider Trading News: Carl Icahn, Anthony Scaramucci, Paul Singer, Glenview Capital, BlueMountain Capital, Hasbro Inc (HAS), Steelcase Inc. (SCS), and More (Insider Monkey)

- American Riviera: A Summer Guide to Santa Barbara and Beyond (Robb Report)

- This Man Built a $64 Million Chateau in the South of France. Now, He Has to Tear It Down (Robb Report)

- Silicon Valley (unverified) Rumors: Apple Project Titan Staff Spotted At NIO (TheLastDriverLicenseHolder)

- T. Rowe Price: Chapter 9 – The Growth Stock Theory (Value Walk)

- ECRI Weekly Leading Index Update: (Advisor Perspectives)

- Why Tom Brady Is Absolutely the Greatest Quarterback of All Time (Maxim)

- Why Do People Drink Mint Juleps at the Kentucky Derby? (Mental Floss)

- 7 big thoughts from Warren Buffett during annual Berkshire Hathaway meeting (USA Today)

- ‘SNL’: Adam Sandler Returns With Songs (NBC)

Be in the know. 10 key reads for Saturday…

- The No. 1 job billionaires and multimillionaires held before they got rich MarketWatch

- Futuristic Robot Farm Begins Selling Its First Produce (Futurism)

- Worried About the Economy? These CEOs Aren’t (Bloomberg)

- Warren Buffett wants to invest in Britain. Is that a good idea? (CNN)

- Charlize Theron and Seth Rogen Are Charming Enough in Long Shot (Vanity Fair)

- Job Growth Underscores Economy’s Vigor; Unemployment at Half-Century Low (New York Times)

- Charlie Munger is Warren Buffett’s right-hand man — here are 18 of his most brilliant quotes (Business Insider)

- 3 Takeover Scenarios That Could Boost Occidental’s Stock (Barron’s)

- Carl Icahn Has Built a Small Position in Occidental (Bloomberg)

- North Korea launched ‘several unidentified short-range projectiles,’ South Korean military says (CNBC)