Today some institution/fund purchased 20,555 contracts of July 13 strike puts (or the right to sell short 2,055,500 shares of Barrick Gold GOLD at $13). The open interest was just 6,022 prior to this purchase. Continue reading “Unusual Options Activity”

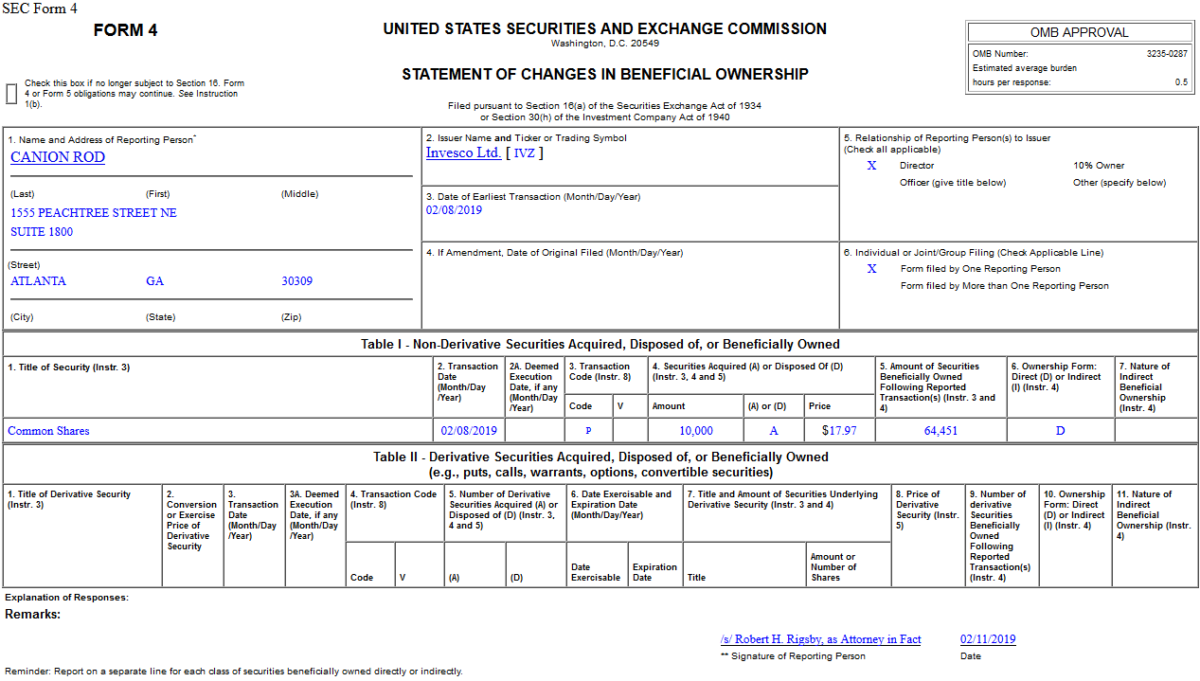

Insider Buying

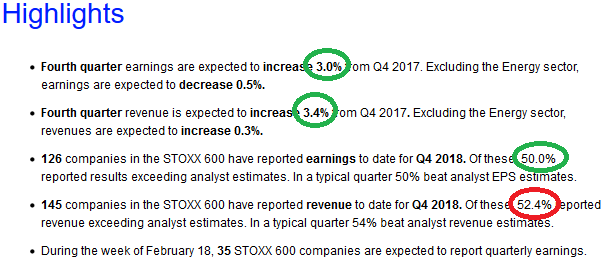

European (Stoxx 600) Earnings UP year on year (update)

source: Thomson Reuters

With all of the pessimism about European earnings/economy, the facts are that they are UP year on year. So far Q4 2018 earnings (of those 126 Continue reading “European (Stoxx 600) Earnings UP year on year (update)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 12 key reads for Tuesday…

- iPhone sales in China reportedly tanked 20 percent last quarter (New York Post)

- A Government Shutdown May Have Been Avoided, but Investors Shouldn’t Relax Just Yet (Barron’s)

- How Millennials Could Restore American Prosperity (Barron’s)

- Latest Warning Sign for Markets: A Possible ‘Earnings Recession’ (New York Times)

- Can the middle-class revival under Trump last? (USA Today)

- Traders With $515 Billion Boycott Stocks for Cash Despite Rally (Bloomberg)

- Opinion: Proof that you can outperform with the right actively managed stock fund (Market Watch)

- Here’s why hedge-fund manager Kyle Bass thinks U.S. stocks will be lower by end 2019 (Market Watch)

- Why Canaccord Genuity Sees Tesla Rising Nearly 50% (24/7 Wall Street)

- Wall Street analysts slash Nvidia price target, say recent guidance cut is ‘a splash of cold water’ (NDVA) (Business Insider)

- Anadarko selloff brings ‘compelling entry point,’ says JPMorgan (The Fly)

- GDP Now upgrades to 2.7% (from 2.5%) (Atlanta Fed)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

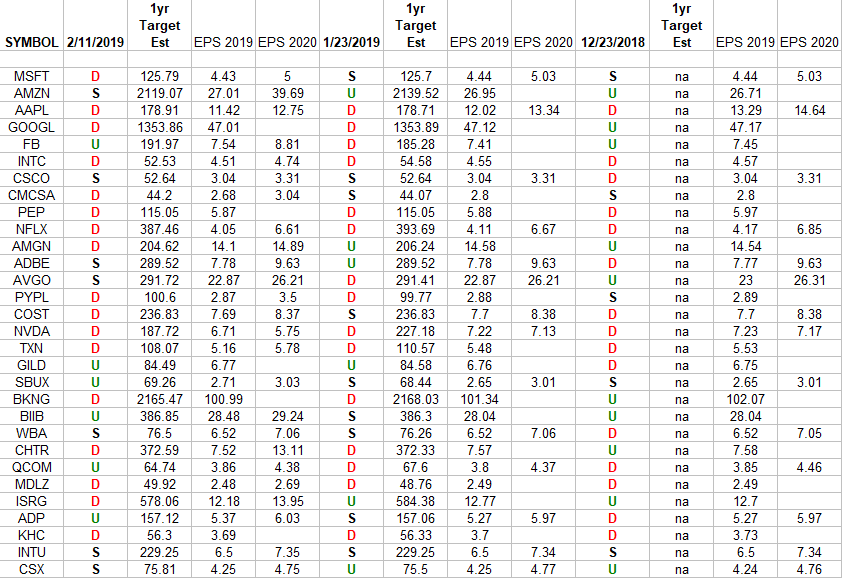

NASDAQ (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2019 and 2020 estimates (if available) were: 12/23/18, 1/23/19 and today 2/11/2019. The Continue reading “NASDAQ (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip – Position Idea Notification (PIN)

Unusual Options Activity

Today some institution/fund purchased 27,268 contracts of June 82.5 strike calls (or the right to buy 2,726,800 shares of Merck & Co. MRK at $82.5). The open interest was just 1,483 prior to this purchase. Continue reading “Unusual Options Activity”

Insider Buying

Be in the know. 8 key reads for Monday…

- Talks Over Border Security Break Down, Imperiling Effort to Prevent Shutdown (New York Times)

- Latest Round Of Trade Talks Begins In Beijing With Deal In Doubt (Zero Hedge)

- The Next Wave of ‘Unicorn’ Start-Ups (New York Times)

- Two Large Chinese Borrowers Miss Bond Payments, Sources Say (Bloomberg)

- AI Stocks To Watch: 42 Top Funds Just Invested $1.1 Billion In Splunk Stock (Investor’s Business Daily)

- High-Rollers Cool Their Bets as Chinese Economy Slows (Wall Street Journal)

- Growing economic anxiety hits Main Street as small-business confidence drops: Survey (CNBC)

- Every NFL Team’s Biggest Hole to Fill in 2019 Offseason (CNN)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.