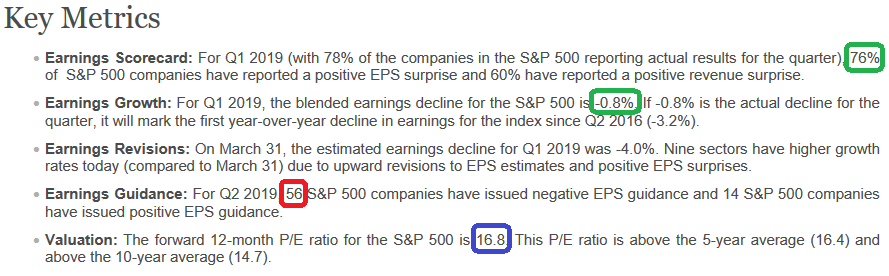

Q1 Earnings Better and Better…

Data Source: Factset

This was a big week for earnings. Q1 earnings estimates bumped up again from -2.3% last week to -0.8% today. This puts a flat to positive year on year result on the table. We’re at a 76% beat rate which is above the long term average. Continue reading “Q1 Earnings Better and Better…”

Where is money flowing today?

Unusual Options Activity – Freeport-McMoRan Inc. (FCX)

Today some institution/fund purchased 11,087 contracts of June $13 strike calls (or the right to buy 1,108,700 shares of Freeport-McMoRan Inc. (FCX) at $13). The open interest was 8,951 prior to this purchase. Continue reading “Unusual Options Activity – Freeport-McMoRan Inc. (FCX)”

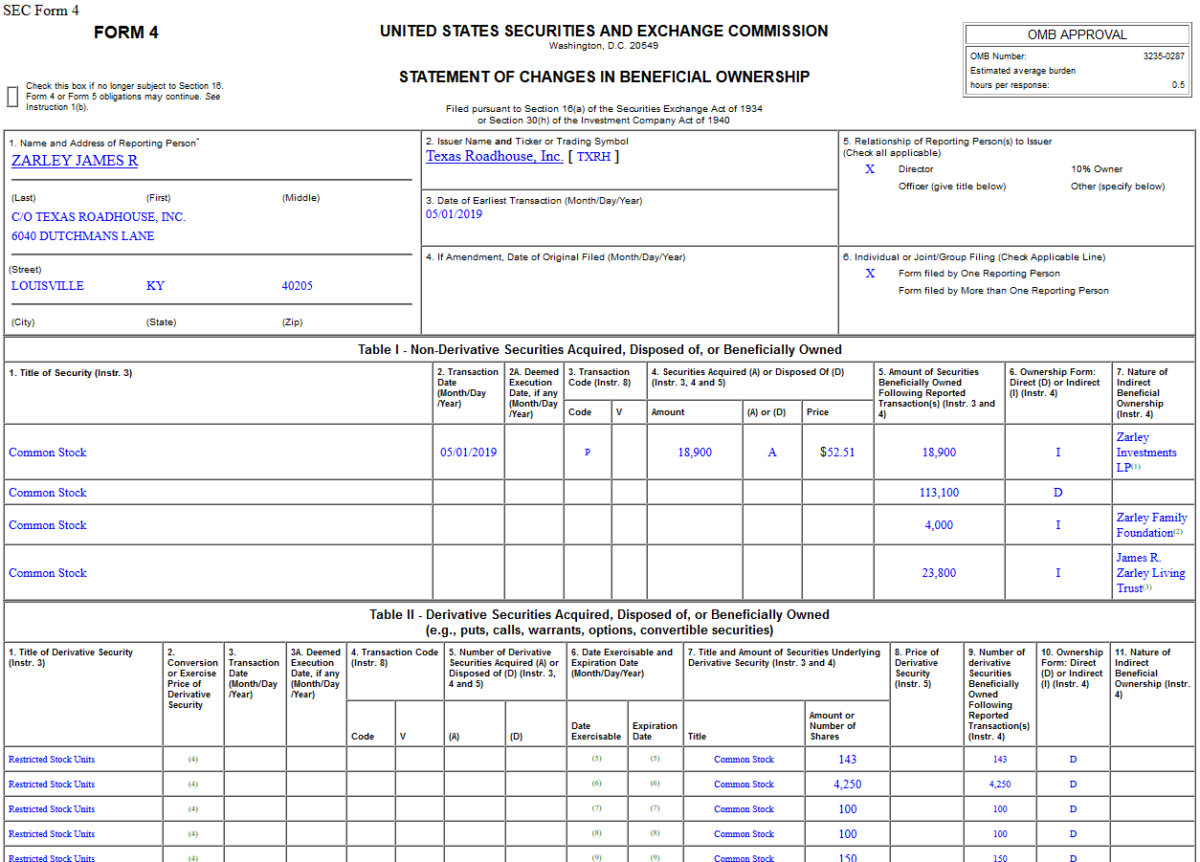

Insider Buying in Texas Roadhouse, Inc. (TXRH)

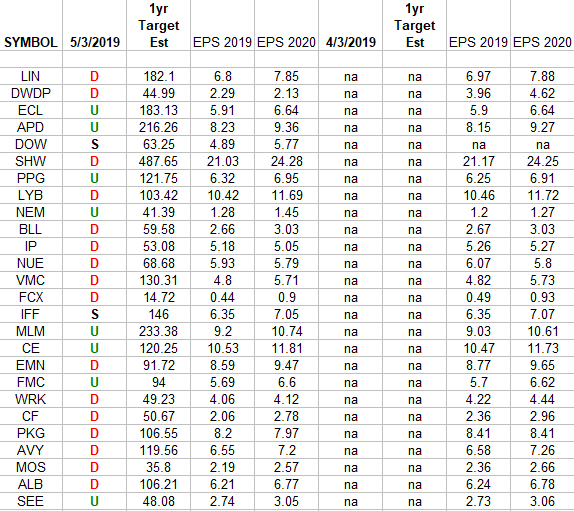

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2019 and 2020 estimates were: 4/3/2019 and today 5/3/2019. The column Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

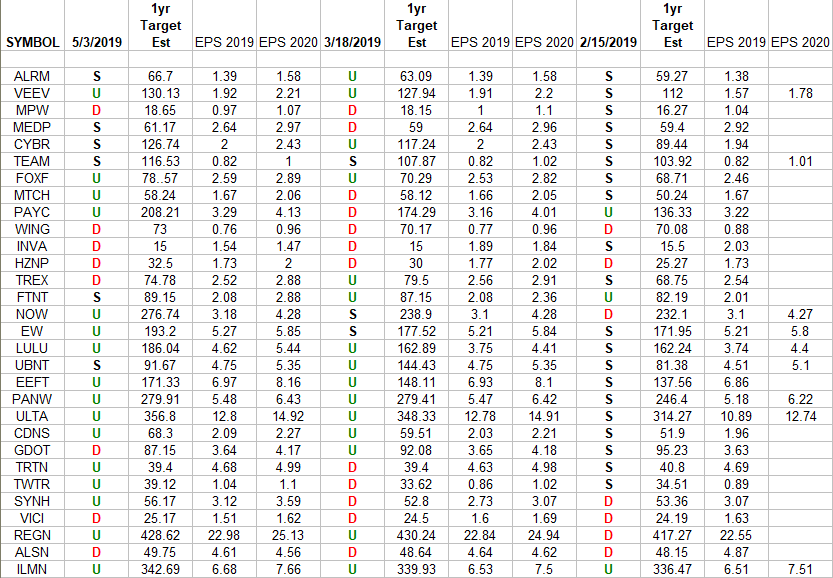

IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) [That are not included in our Dow+8, Nasdaq, and Russell spreadsheets in earlier posts]. Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 10 key reads for Friday…

- The MyRaceHorse app makes it possible to buy a minority stake in race horses (New York Post)

- Why Wages Are Finally Rising, 10 Years After the Recession (New York Times)

- ‘We would like to get to yes:’ Lawmakers signal growing concern on Trump’s Mexico-Canada trade deal (USA Today)

- Euro-Area Inflation Accelerates After String of Upbeat Data (Bloomberg)

- Buffett Finally Embraces Amazon as Berkshire Acquires Stake (Bloomberg)

- At Milken, investors place their late-cycle bets (Financial News)

- Bristol-Myers upgraded to Overweight from Equal Weight at Barclays. (TheFly)

- Highest Paid CEOs at America’s Largest Companies (24/7 Wall Street)

- Amazon Keeps Hitting Trucking Stocks. But It’s Not Actually a Threat. (Barron’s)

- Buffett’s 2,472,627% Return Fueled Berkshire Billionaire Families (Bloomberg)