Today some institution/fund purchased 25,075 contracts of August 17 strike calls (or the right to buy 2,507,500 shares of Freeport McMoRan FCX at $17). The open interest was just 175 prior to this purchase. Continue reading “Unusual Options Activity”

Earnings Update

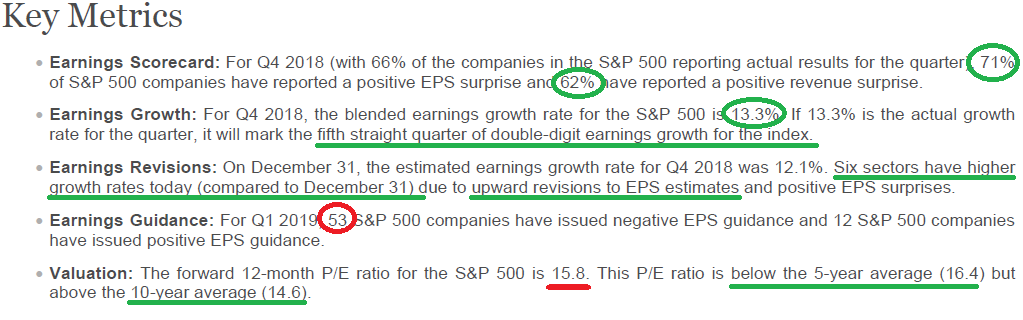

Per Factset:

EPS and revenues continue to beat by 71% and 62% respectively (after 66% of S&P 500 companies have reported). The earnings growth rate has increased to 13.3% for Q4 2018 from 12.4% last week (and 12.1% on 12/31). Continue reading “Earnings Update”

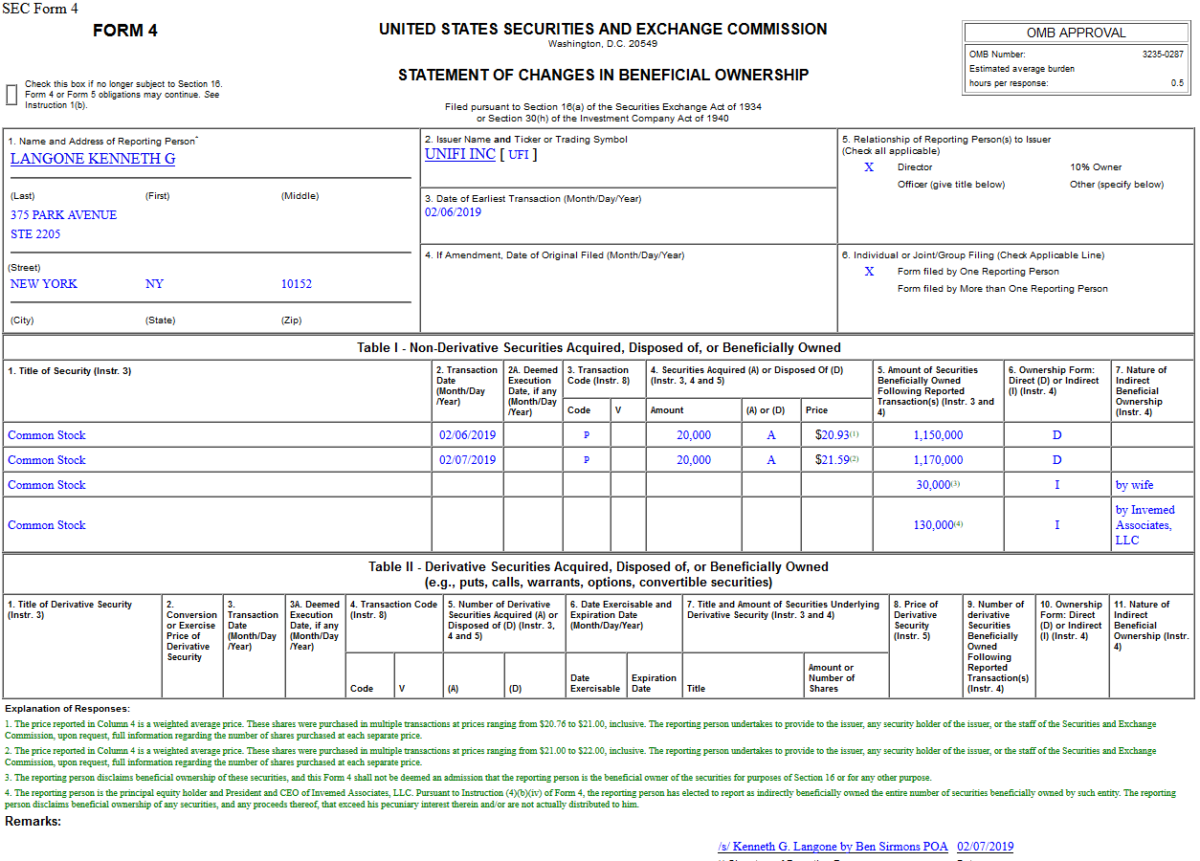

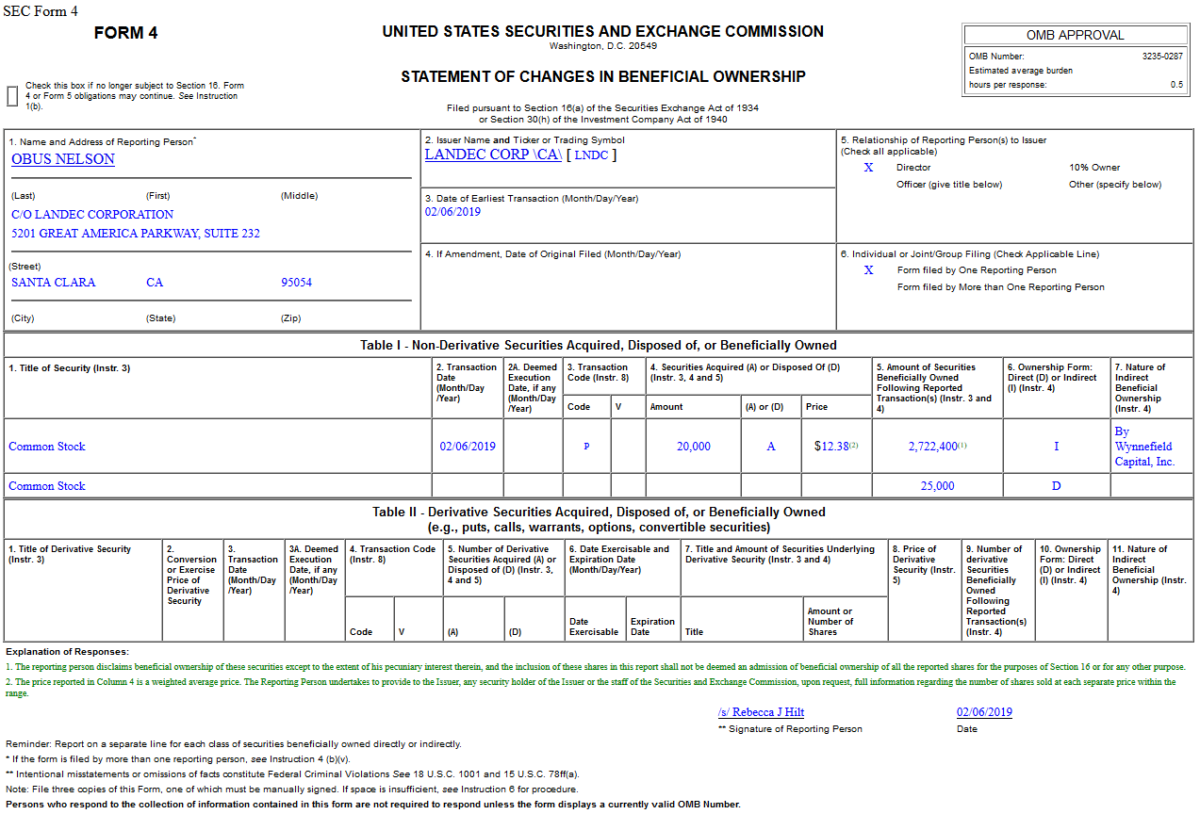

Insider Buying

Be in the know. 7 key reads for Friday…

- How Facebook’s Tiny China Sales Floor Helps Generate Big Ad Money (New York Times)

- New White House message on China is that there’s a long way to go before striking trade deal (Market Watch)

- How the European economy is raising fresh global growth fears (Market Watch)

- Buying the Dow Stocks With the Highest Dividends Is a Winning Strategy (Barron’s)

- The Hedge-Fund Bond Trade That Keeps on Giving (Bloomberg)

- Trump is reportedly expected to ban Chinese telecommunication equipment from US networks (CNBC)

- Merrill Lynch Has 5 Safe Growth Stocks to Buy That All Yield 5% or More (24/7 Wall Street)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Insider Buying

Unusual Options Activity

Today some institution/fund purchased 10,015 contracts of August 12.50 strike calls (or the right to buy 1,001,500 shares of Antero Resources AR at $12.50). The open interest was just 170 prior to this purchase. Continue reading “Unusual Options Activity”

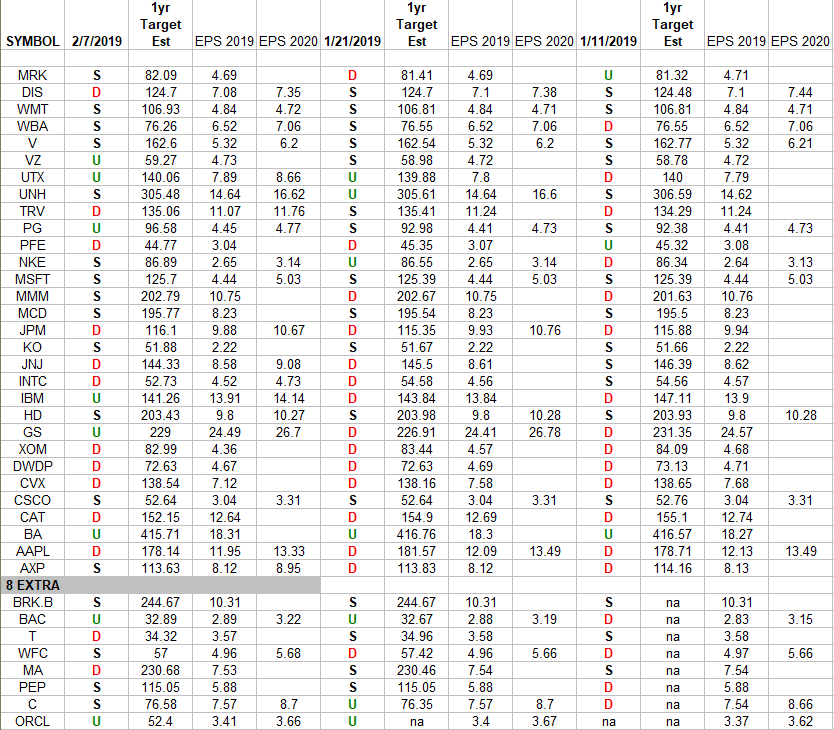

DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. The new 8 companies are at Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip – Position Idea Notification (PIN)

Be in the know. 8 key reads for Thursday…

- Twitter stock falls after light outlook, plans to phase out monthly-active-user metric (Market Watch)

- Why liberal billionaire Warren Buffett is not likely to be a big fan of the new Democratic Party war on stock buybacks (CNBC)

- Trump Loves the New Nafta. Congress Doesn’t. (New York Times)

- Theresa May’s demands to renegotiate Brexit deal rejected by EU (Business Insider)

- Tesla Cuts the Model 3 Price Again (Wall Street Journal)

- Pound Tumbles After BOE Slashes GDP Forecast, Warns Of Rising Brexit Damage (Zero Hedge)

- Trump Preparing Plan to Boost AI, 5G Technology (Wall Street Journal)

- NXP Semiconductors Falls After ‘Worse-Than-Feared’ Forecast (Bloomberg)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

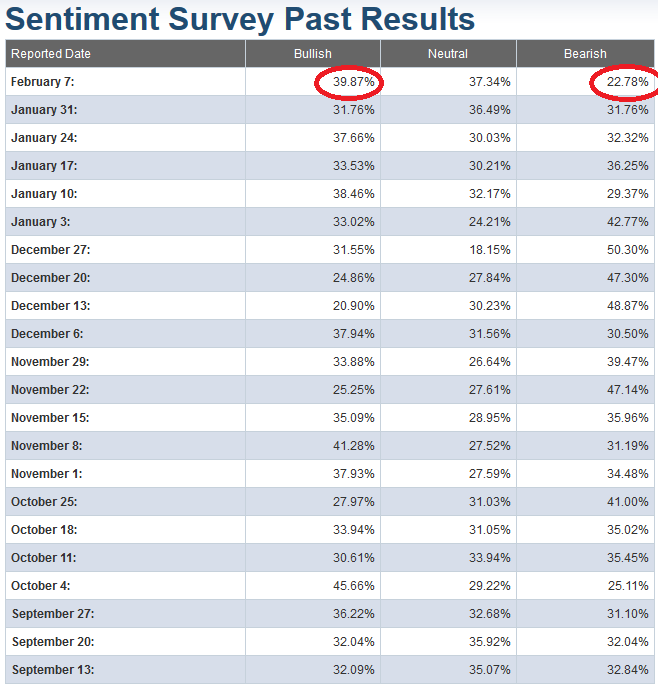

AAII Sentiment Indicator

Last week we said we wanted to see an AAII sentiment reading ~40 in order to lighten up longs and add some shorts: https://www.hedgefundtips.com/aaii-sentiment-indicator-4/#more-703. This morning we got that read Continue reading “AAII Sentiment Indicator”