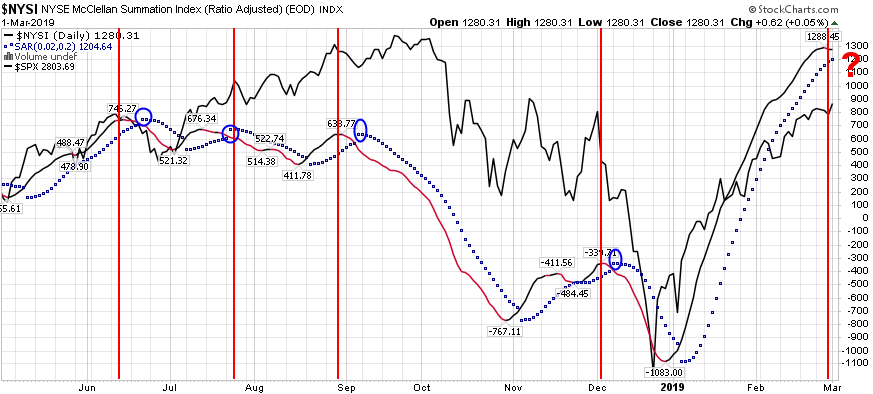

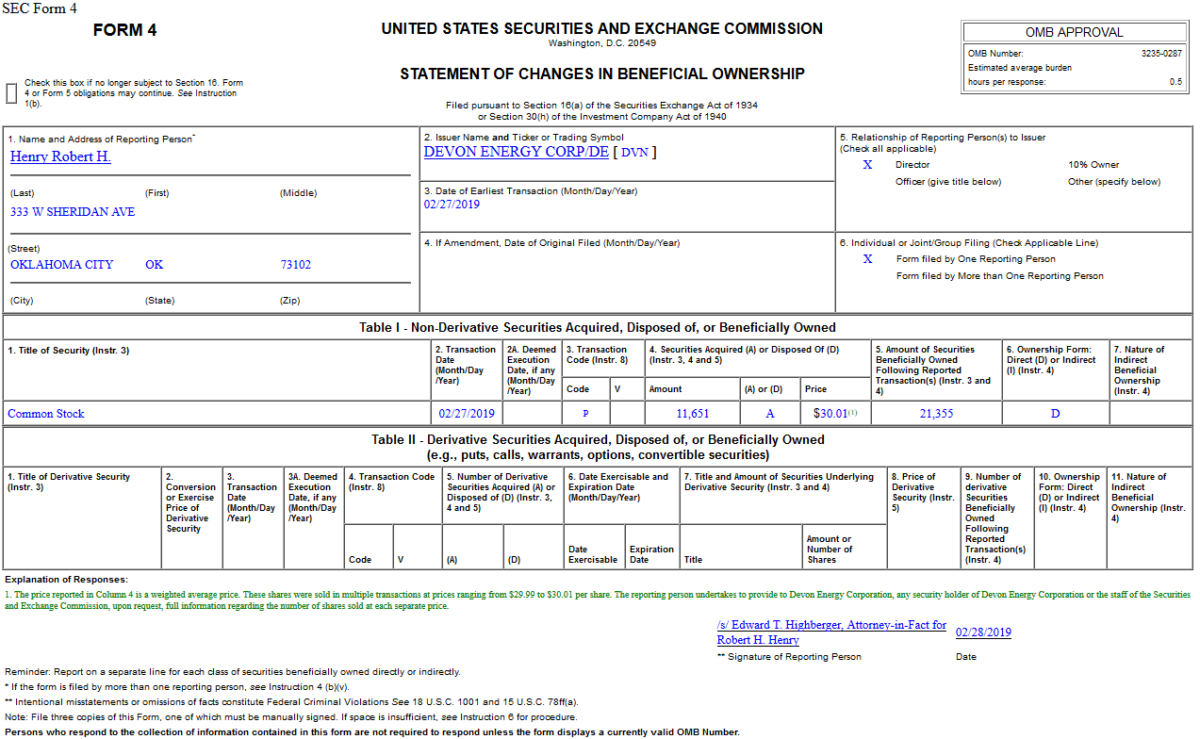

The McClellan Summation Index above is a breadth indicator derived from the McClellan Oscillator, which is a breadth indicator based on Net Advances (advancing issues less declining issues). The Summation Index is Continue reading “(100% recent accuracy) NYSI McClellan Summation Index + Parabolic SAR”

Unusual Options Activity

Today some institution/fund purchased 16,545 contracts of October $60 strike calls (or the right to buy 1,654,500 shares of Qualcomm Inc (QCOM) at $60). The open interest was just 2,926 prior to this purchase. Continue reading “Unusual Options Activity”

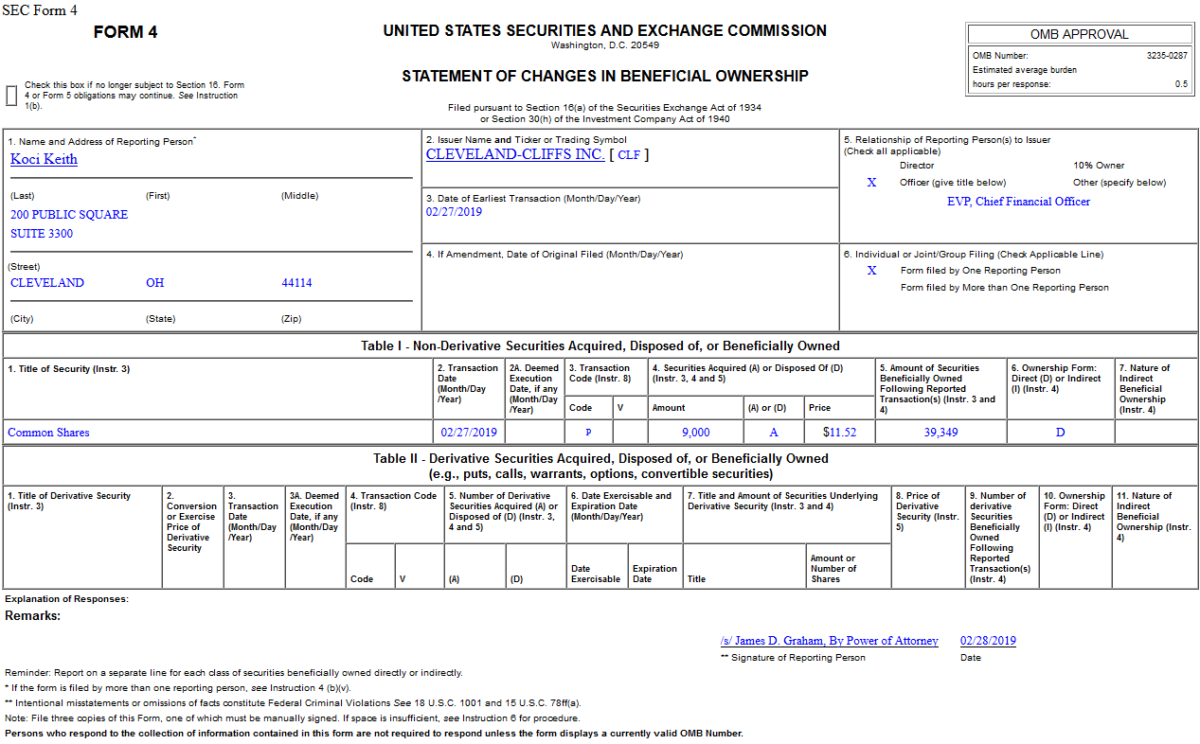

Insider Buying

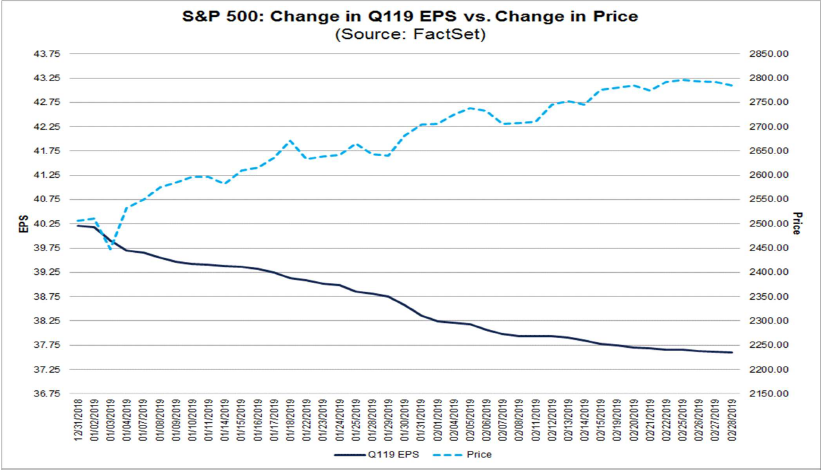

Earnings Estimates Down, Price Up

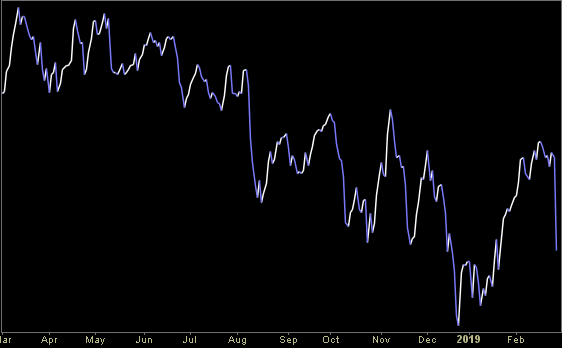

Chart/Data Source: FactSet

As you can see in the above chart, the S&P 500 climbed for the first two months of the year while earnings estimates for Q1 and 2019 full year declined. CY 2019 Earnings Estimates are currently as follows: Continue reading “Earnings Estimates Down, Price Up”

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 10 key reads for Friday…

- One of Wall Street’s Most Popular Trading Strategies Is Now Failing (Bloomberg)

- Trade of the Day: Boeing Stock Hits Record Overbought Level (Yahoo)

- Trump warns he could abandon China trade deal as advisers tout progress (Reuters)

- Tesla stock soft after Elon Musk warns it won’t be profitable in Q1 (Business Insider)

- Tesla announces long-promised $35,000 Model 3 (USA Today)

- These two charts suggest the rally could go from good to bad in the short term (CNBC)

- Uber and Lyft Said to Offer Drivers a Chance to Participate in I.P.O.s (New York Times)

- Mattel Insiders Are Buying Up the Toy Maker’s Stock (Barron’s)

- Gap to Split Into Two Public Companies (Wall Street Journal)

- David Einhorn, hedge-fund manager says he will make fewer, bigger bets (Wall Street Journal)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 40,962 contracts of April $18 strike calls (or the right to buy 4,096,200 shares of Marathon Oil Corp. (MRO) at $18). The open interest was just 3,402 prior to this purchase. Continue reading “Unusual Options Activity”