- Health Insurers’ Stocks Have Been Battered. Now They Look Like a Buy. (Barron’s)

- Oil Prices Face New Tests After a Big Jump (Barron’s)

- Neuroscientist Changed Thinking on Brain Function (Wall Street Journal)

- Teva Pharma Gets Approval to Market Generic Nasal Spray for Opioid Overdoses ()

- Frank Sinatra’s Favorite Hangout Is Back, but Only for Two Years (Bloomberg)

- The last time semis stocks did this they dropped 14% (CNBC)

- An Abbott Labs Analyst’s 5 Reasons To Own The Stock: ‘Near-Perfect For This Environment’ (Benzinga)

- The Church of Living Dangerously: How One of America’s Biggest Pastors Became a Drug Runner for a Mexican Cartel (Vanity Fair)

- “Television Is What Gets Senators Electedâ€: Private-Equity Mogul Leon Black Is Building a Local TV Empire to Rival Sinclair and Fox (Vanity Fair)

- Scientists Find Genetic Variants That Prevent Obesity, Diabetes (Futurism)

- William Bernstein Discusses Neurology and Investment (Podcast) (Bloomberg)

- Pre-election year Mays: Just 10th overall DJIA and S&P 500 (Almanac Trader)

- Hedge Fund and Insider Trading News: Bill Ackman, D.E. Shaw, Eddie Lampert, Facebook Inc (FB), McCormick & Company (MKC), and More (Insider Monkey)

- ECRI Weekly Leading Index Update: WLI YoY Approaching Positive (Advisor Perspectives)

- The World’s Best National Parks, Ranked 9 (Men’s Journal)

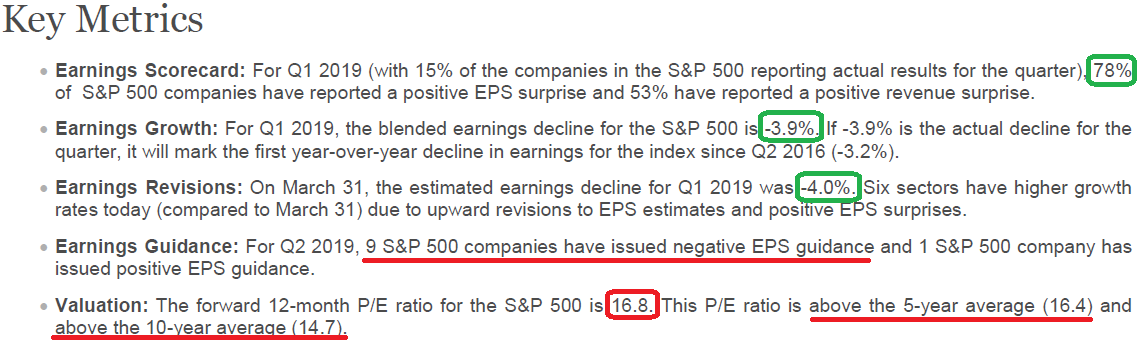

Q1 Earnings Estimates bump up again…is it enough for takeoff?

Data Source (above): Factset

Q1 earnings estimates bumped up 20bps from -4.1% last week to -3.9% this week. The 12 mo. forward multiple has expanded to 16.8x which is above the 5yr average of 16.4x and the 10 year average of 14.7x

Continue reading “Q1 Earnings Estimates bump up again…is it enough for takeoff?”

Be in the know. 8 key reads for Friday…

- Earnings deluge could make or break sentiment (Reuters)

- Former Sears company sues ex-CEO Lampert, Treasury’s Steven Mnuchin over ‘asset stripping’ (USA Today)

- More store closings coming: Pier 1 Imports could close up to 145 more stores (USA Today)

- ‘Sell in May and Go Away,’ the Investment Saying Goes. But Does That Actually Work? (Barron’s)

- 16 brilliant quotes from Bill Gross, the legendary ‘Bond King’ who retired earlier this year (Business insider)

- The Greenwich Housing Market Is Imploding As Prices Tumble As Much As 25% (ZeroHedge)

- D.E. Shaw Is to Buck Industry Trend With 3-and-30 Fees (Bloomberg)

- Housing starts fall in March, as new construction running 10% below last year’s pace (MarketWatch)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

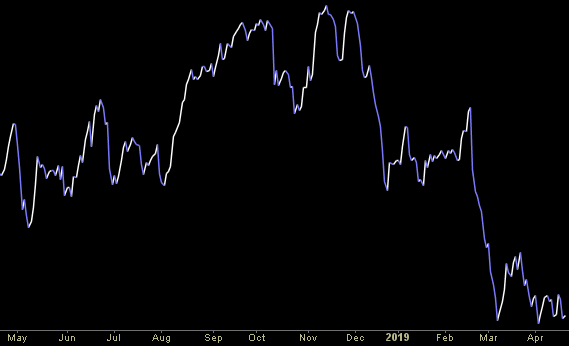

AAII Sentiment Survey results. The pause that refreshes…

Last week we got an extreme read on sentiment which is frequently correlated with market pullbacks:

Warning signs from AAII Sentiment Survey results this morning (out of “No Man’s Land”)

We are now a week later and have gone sideways off the trigger (no pullback yet). The implication is that we either turn soon, or it is going to burn through this extreme in an atypical fashion. Continue reading “AAII Sentiment Survey results. The pause that refreshes…”

Be in the know. 5 key reads for Thursday…

- Germany’s economy is flashing yet another ‘grim’ warning after more weak data and a slump in demand (Business Insider)

- American Express First-Quarter Profit Falls 5 Percent (US News and World Report)

- Honeywell raises FY19 EPS view to $7.90-$8.15 from $7.80-$8.10, consensus $7.98 (TheFly)

- North Korea calls for Pompeo to be dropped from talks; tests tactical weapon (Yahoo)

- Bridgewater warns of lower US stock prices (Economic Times)

Be in the know. 7 key reads for Wednesday…

- Apple and Qualcomm settled their legal battle. Here’s what Wall Street analysts are saying (CNBC)

- Powell Adopts an Inflation Stance Yellen Shunned (Bloomberg)

- Jefferies Analysts Love 5 Stocks That Other Wall Street Firms Hate (24/7 Wall Street)

- China Trade Settlement Could Be Huge for Steel Stocks: 4 to Buy (24/7 Wall Street

- CVS CEO Larry Merlo on the Aetna Deal and the Future of Health Care (Barron’s)

- Activist Investing Is Alive and Well. Here Is a Look at 3 Fresh Ideas. (Barron’s)

- China’s strong data sparks major stock rally with economic stimulus ‘bearing fruit’ (Business Insider)

Unusual Options Activity – Range Resources Corporation (RRC)

Today some institution/fund purchased 6,412 contracts of May $11 strike calls (or the right to buy 641,200 shares of Range Resources Corporation (RRC) at $11). The open interest was just 818 prior to this purchase. Continue reading “Unusual Options Activity – Range Resources Corporation (RRC)”

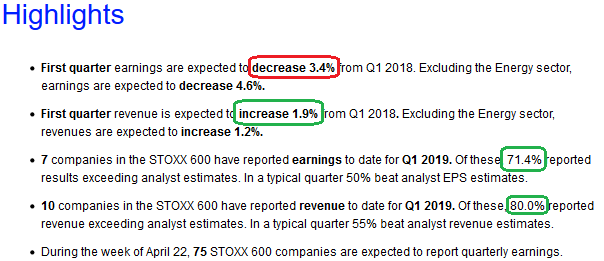

European (Stoxx 600) Q1 Earnings Estimates Drop Again

Estimates for European Q1 earnings have dropped from -1.6% to -3.4% in the past 2 weeks. This puts Europe’s estimates modestly better than the U.S. – which are at -4.3% for Q1 as of Friday.

While this is a big drop, expectations and sentiment remain very low for the region – so with a normal beat rate of ~3% European earnings could come in ~flat year on year. This would exceed the current excessive pessimism in sentiment for the region.

Revenues will come in positive as a function of the weak Euro. The early beat rate is constructive. We’ll know more as the data/forward guidance comes in over the next few weeks.