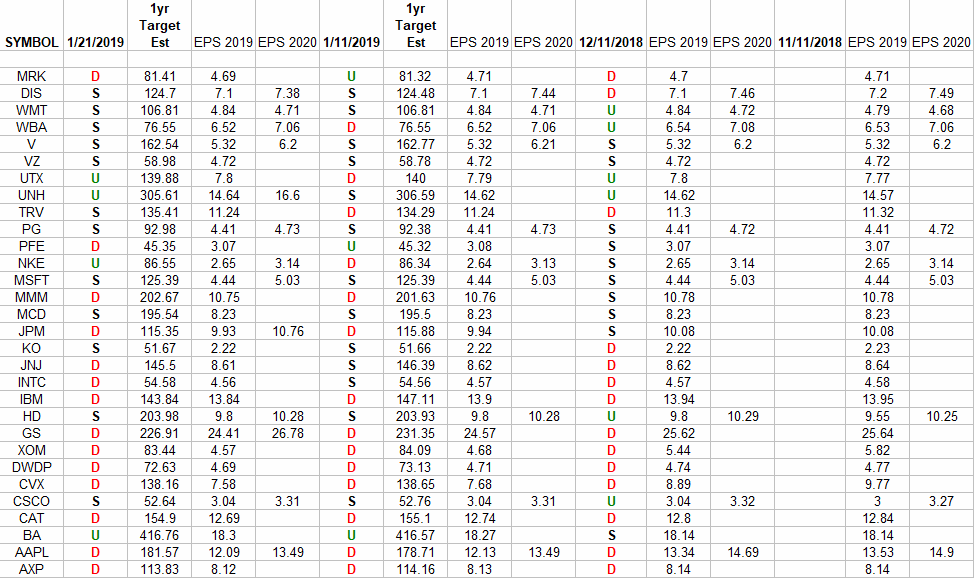

In the spreadsheet above I have tracked the earnings estimates for the DOW 30. I have columns for what the 2019 and 2020 estimates (if available) were: 11/11/18, 12/11/18, 1/11/19, and today 1/21/19. The column under the date Continue reading “Dow 30 Earnings Estimates”

Be in the know. 5 key reads for Monday…

- Abby Joseph Cohen Highlights Global Bargains (Barron’s)

- Why the stock market is headed for a swift recovery (USA Today)

- Amazon Knows What You Buy. And It’s Building a Big Ad Business From It (New York Times)

- Trump, Democrats Inch Closer Amid Personal Shutdown Sniping (Bloomberg)

- Trump and Kim to Hold Second Summit in February (Wall Street Journal)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 5 key reads for Saturday

- Skittish investors made it a painful year-end for hedge funds (New York Post)

- The Fed is Zeus and the algos are the underworld — Greek mythology is a lot like today’s wild markets, Macquarie says (Business Insider)

- Five Ways to Profit from the Boom in Life Science (Barron’s)

- What Keeps Economists Up At Night? And Other Stuff (NPR Planet Money)

- How to Do Great Things (Farnam Street)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

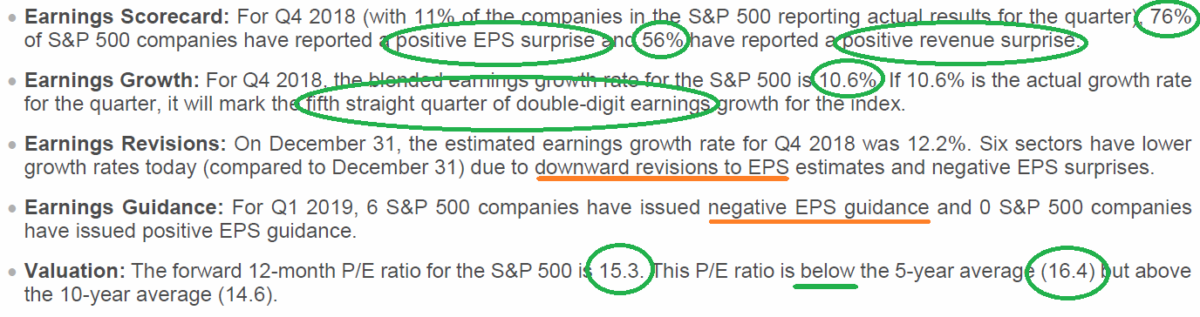

Earnings Update

Per FactSet, eps and revenues continue to beat by 76% and 56% respectively – after 11% of S&P 500 having reported Q4 earnings so far.

Guidance is a bit light but 2019 eps estimates remain ~$171.50 per share. If Continue reading “Earnings Update”

Unusual Options Activity

Today some institution/fund purchased 25,025 contracts of March $29 strike calls (or the right to purchase 2,502,500 shares of JD.com at $29). This is a big bet for this stock and contract as the open interest was just Continue reading “Unusual Options Activity”

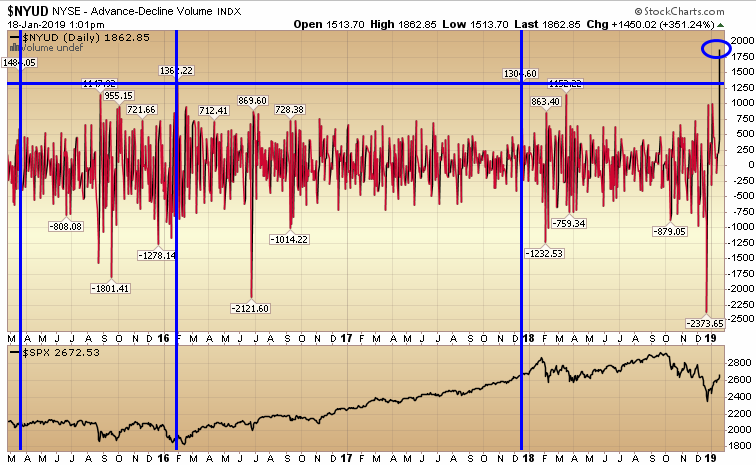

NYSE Advance Decline Volume

I have posted the $NYUD NYSE Advance Decline Volume indicator – which I have used as a barometer for many years. It’s currently at 1862 which is a very extreme reading and consistent with other periods of turnaround after Continue reading “NYSE Advance Decline Volume”

Quote of the day…

Be in the know. 5 key reads for Friday…

- Value Stocks Are So Cheap They Might Be Ready to Run (Barron’s)

- 6 Regional Banks That Pay Big Dividend Yields (Barron’s)

- U.S. Debates Lifting China Tariffs to Hasten Trade Deal, Calm Markets (Wall Street Journal)

- Small caps just did something they haven’t in three decades (CNBC)

- History shows the stock market may be setting up to rip higher once the government shutdown ends (Business Insider)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 6,775 contracts of April $9 strike calls (or the right to purchase 677,500 shares of Callon Petroleum Co. CPE at $9). Continue reading “Unusual Options Activity”

Insider Buying

This week, James DeFranco (Executive VP) at DISH (Dish Network) purchased 25,000 shares in the open market at $28.01 with his own money. It is a $700,350 vote of confidence he is making in the company.

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.