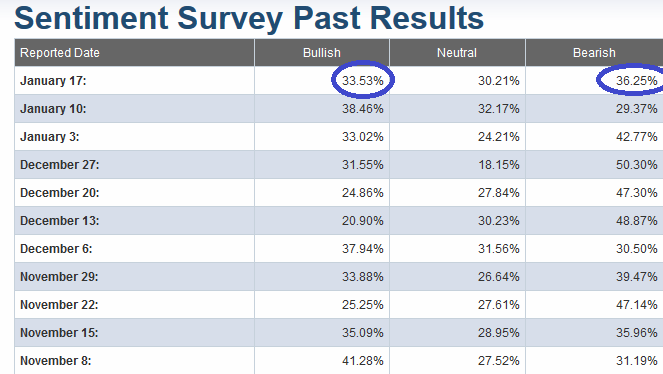

Last week we said that bullish sentiment was getting too high and we would need a few days/week to chop sideways in order to work it off: https://www.hedgefundtips.com/aaii-sentiment-indicator/

Continue reading “AAII Sentiment Indicator”

Be in the know. 5 key reads for Thursday…

- Costco Stock Might Be a Good Buy After 2018’s Pullback (Barron’s)

- The Hartford’s CEO Is Buying Up Stock for the First Time (Barron’s)

- Junk-Bond Sales Have Been Slow, but Don’t Compare This to 2008 (Barron’s)

- Fed Says Student Debt Has Hurt the U.S. Housing Market (Wall Street Journal)

- Warren Buffett might be looking to buy these 12 stocks, Wells Fargo says (caveat: list is quantitative, not qualitative – Buffett generally doesn’t buy commodity stocks and generally avoids tech – but worth a read for metrics): (Business Insider)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Insider Buying

Unusual Options Activity

Today some institution/fund purchased 8,930 contracts of March 15 strike calls (or the right to purchase 893,000 shares of Qualcomm at $60). This is a decent sized bet for this stock and contract as the open interest was just 2,329 prior to this purchase. Qualcomm QCOM reports earnings January 30.

Be in the know. 5 key reads for Wednesday…

- Cisco Is Heading for Serious Growth (Barron’s)

- The Oil Market Is Beaten Up. It Could Be Merger Time. (Barron’s)

- Goldman Sachs and Bank of America Earnings Are Adding Steam to the Rebound in Bank Stocks (Barron’s)

- U.K. Lawmaker Proposes Bills to Prepare for Second Referendum: Brexit Update (Bloomberg)

- Homebuilder sentiment turns higher in January after mortgage rates drop (CNBC)

Smart Money vs. Dumb Money

I came across two interesting articles yesterday. One stated that SocGen – a French Investment bank – was shuttering its commodities business (Bloomberg). I thought that it was interesting for them to be “selling” at the bottom of the commodities cycle. Continue reading “Smart Money vs. Dumb Money”

Quote of the day…

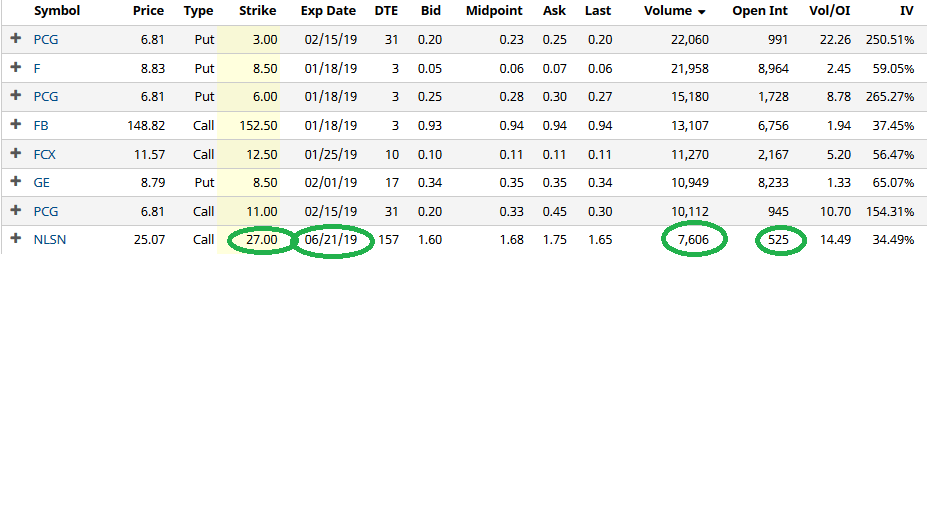

Unusual Options Activity

Today some institution/fund purchased 7,606 contracts of June 27 strike calls (or the right to purchase 760,600 shares of Starbucks at $27). This is a large sized bet for this stock and contract as the open interest was just 525 prior to this purchase. Nielsen NLSN reports in early February.

Be in the know. 7 key reads for Tuesday.

- Netflix (NFLX) is Raising U.S. Prices by 13% to 18% (Street Insider)

- JPMorgan (JPM) Misses Q4 EPS by 23c (Street Insider)

- Wells Fargo (WFC) Tops Q4 EPS by 2c (Street Insider)

- Raymond James Says Top MLPs May Be Poised for a Monster Year (24/7 Wall Street)

- Warning to Investors: Powell Is No Greenspan (Wall Street Journal)

- China to Ramp Up Efforts to Support Economy in 2019 (Barron’s)

- All Eyes on Corporate Guidance (Wall Street Journal)

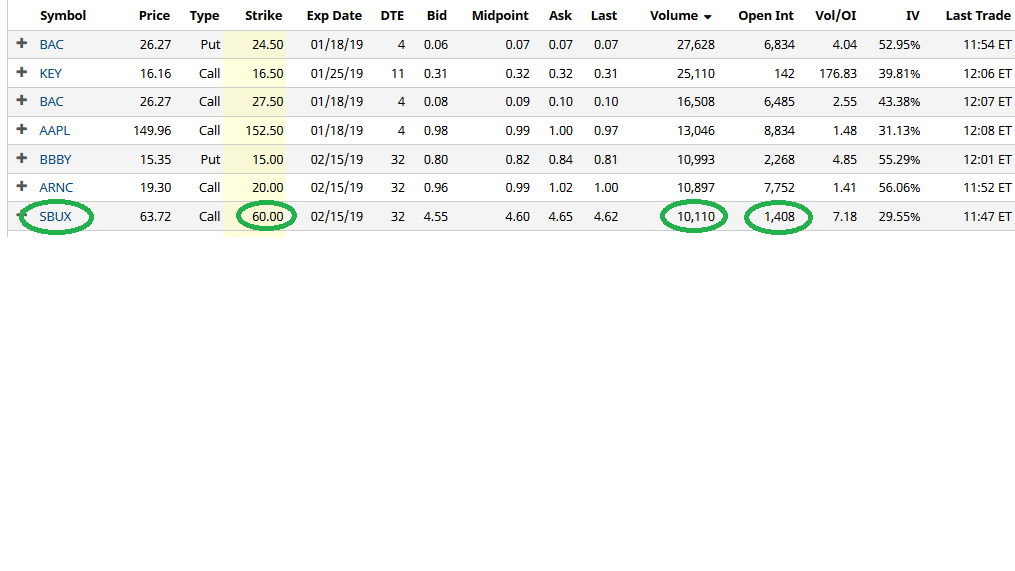

Unusual Options Activity

Today some institution/fund purchased 10,100 contracts of February $60 strike calls (or the right to purchase 1,010,000 shares of Starbucks at $60). This is a large sized bet for this stock and contract as the open interest was just 1,408 prior to this purchase. Starbucks $SBUX reports on 1/24/19.