If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 11 key reads for Saturday…

- Bond Traders Face Plenty of Risk as Powell Ushers In a New Era (Bloomberg)

- This Alibaba business could be its next big moneymaker (Market Watch)

- America’s Hidden Workforce Returns (Wall Street Journal)

- Four Low-Debt Stocks to Buy for Uncertain Times (Barron’s)

- Intel Stock Is Selling Off. Here’s Why You Should Buy. (Barron’s)

- Trump To Try Nominating People He Agrees With To Fed Board (Dealbreaker)

- Why Xilinx Is Seeing Strong Growth When Many Chip Peers Aren’t Growing at All (The Street)

- Elizabeth Warren’s New Wealth Tax Could Cost Billionaires $85 Billion A Year (Forbes)

- China confident of keeping 2019 growth within ‘appropriate range’ (Reuters)

- The Marijuana Billionaire Who Doesn’t Smoke Weed (aka Don’t get high on your own supply): (Fortune)

- Robots at a Budapest cafe serve up food and drink, tell jokes, dance with kids (First Post)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 10,207 contracts of March $47.50 strike calls (or the right to purchase 1,020,700 shares of General Mills at $47.50). This is a larger sized bet for this stock and contract as the open Continue reading “Unusual Options Activity”

Quote of the day…

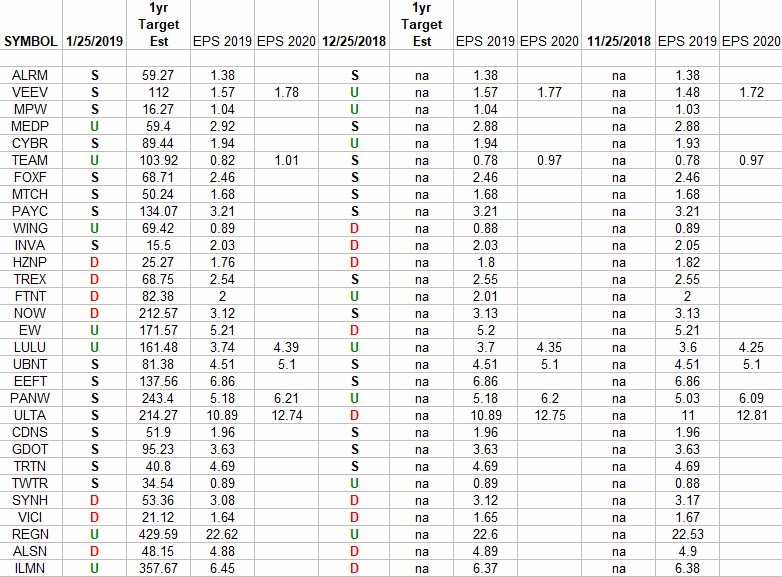

IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) [that are not either included in the top 30 weights of the Russell (posted Jan Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 5 key reads for Friday…

- Futures higher as lawmakers re-engage in bid to end shutdown stalemate (The Fly)

- Elizabeth Warren Proposes 2% ‘Wealth Tax’ On Richest Americans (Zero Hedge)

- The Fed may be moving closer to ending its rally-killing balance sheet reduction (CNBC)

- What DR Horton Earnings Indicate About the Housing Market (24/7 Wall Street)

- Creditors Say Edward Lampert Reaped Billions but Left Sears Insolvent (Wall Street Journal)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 14,969 contracts of April $29 strike calls (or the right to purchase 1,496,900 shares of Bank of America BAC at $29). This is a larger sized bet for this stock and contract as the open Continue reading “Unusual Options Activity”

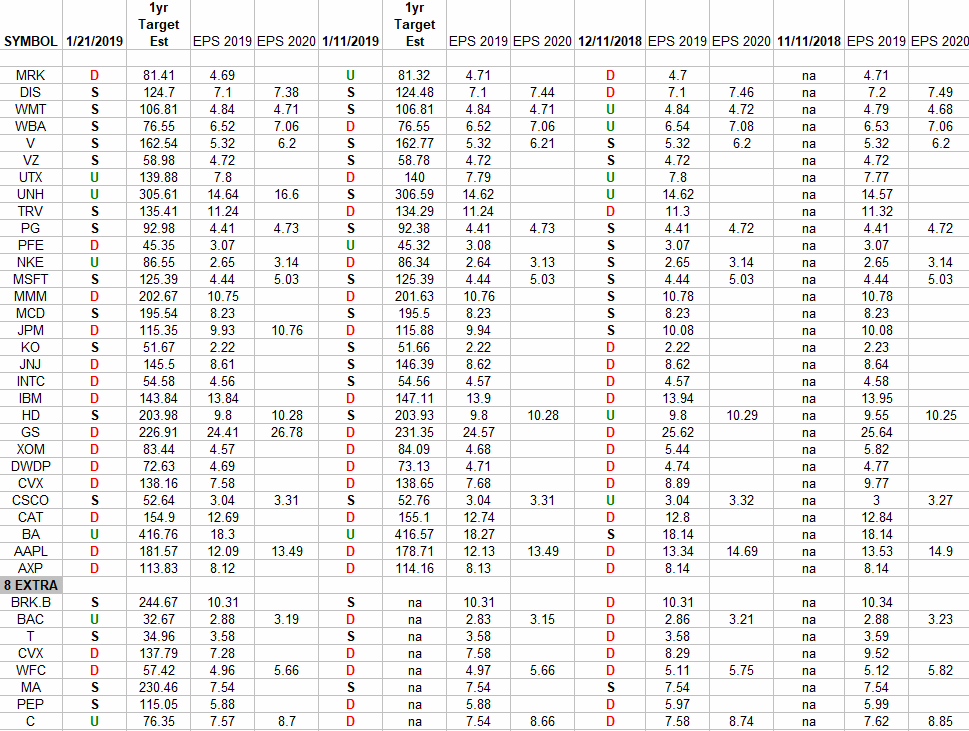

DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS I have just added 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq (which was Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

Be in the know. 7 key reads for Thursday…

- Stocks to Buy in China’s Slowing Economy (Barron’s)

- Initial Jobless Claims Crash To 50 Year Lows (Zero Hedge)

- ECB Keeps Policy Unchanged to Battle Economic Slowdown (Bloomberg)

- United Technologies Offers an All-Clear Signal (Wall Street Journal)

- P&G Raises Outlook After Another Quarter of Strong Sales (Wall Street Journal)

- American Airlines profit and forecast beat on higher fares (Reuters)

- Lam Research (LRCX) Surpasses Q2 Earnings and Revenue Estimates (Nasdaq)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

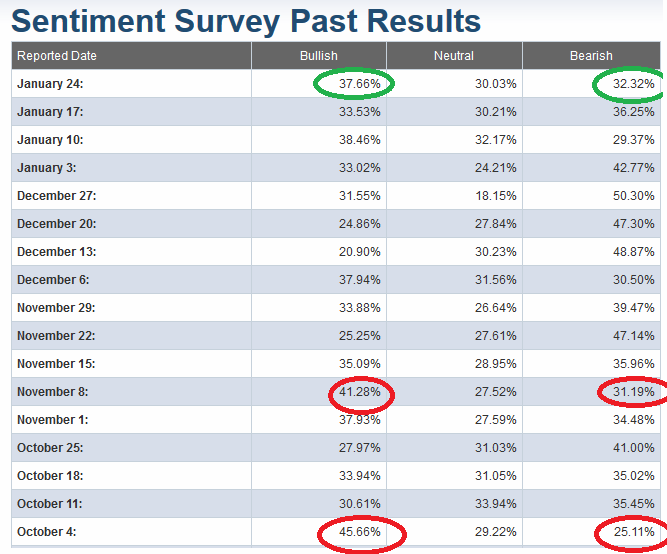

AAII Sentiment indicator

This week’s AAII sentiment indicator is getting close to an extreme, but not there yet. It seems (based on this indicator) that while we are close to euphoria (i.e. everyone back in the boat) we are not quite there yet. I would Continue reading “AAII Sentiment indicator”