Today some institution/fund purchased 6,775 contracts of April $9 strike calls (or the right to purchase 677,500 shares of Callon Petroleum Co. CPE at $9). Continue reading “Unusual Options Activity”

Insider Buying

This week, James DeFranco (Executive VP) at DISH (Dish Network) purchased 25,000 shares in the open market at $28.01 with his own money. It is a $700,350 vote of confidence he is making in the company.

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

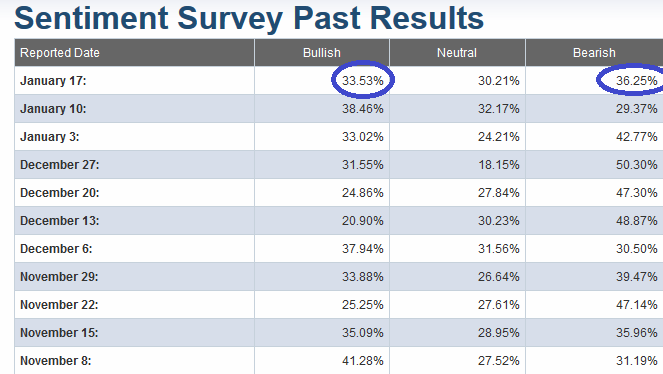

AAII Sentiment Indicator

Last week we said that bullish sentiment was getting too high and we would need a few days/week to chop sideways in order to work it off: https://www.hedgefundtips.com/aaii-sentiment-indicator/

Continue reading “AAII Sentiment Indicator”

Be in the know. 5 key reads for Thursday…

- Costco Stock Might Be a Good Buy After 2018’s Pullback (Barron’s)

- The Hartford’s CEO Is Buying Up Stock for the First Time (Barron’s)

- Junk-Bond Sales Have Been Slow, but Don’t Compare This to 2008 (Barron’s)

- Fed Says Student Debt Has Hurt the U.S. Housing Market (Wall Street Journal)

- Warren Buffett might be looking to buy these 12 stocks, Wells Fargo says (caveat: list is quantitative, not qualitative – Buffett generally doesn’t buy commodity stocks and generally avoids tech – but worth a read for metrics): (Business Insider)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Insider Buying

Unusual Options Activity

Today some institution/fund purchased 8,930 contracts of March 15 strike calls (or the right to purchase 893,000 shares of Qualcomm at $60). This is a decent sized bet for this stock and contract as the open interest was just 2,329 prior to this purchase. Qualcomm QCOM reports earnings January 30.

Be in the know. 5 key reads for Wednesday…

- Cisco Is Heading for Serious Growth (Barron’s)

- The Oil Market Is Beaten Up. It Could Be Merger Time. (Barron’s)

- Goldman Sachs and Bank of America Earnings Are Adding Steam to the Rebound in Bank Stocks (Barron’s)

- U.K. Lawmaker Proposes Bills to Prepare for Second Referendum: Brexit Update (Bloomberg)

- Homebuilder sentiment turns higher in January after mortgage rates drop (CNBC)

Smart Money vs. Dumb Money

I came across two interesting articles yesterday. One stated that SocGen – a French Investment bank – was shuttering its commodities business (Bloomberg). I thought that it was interesting for them to be “selling” at the bottom of the commodities cycle. Continue reading “Smart Money vs. Dumb Money”

Quote of the day…

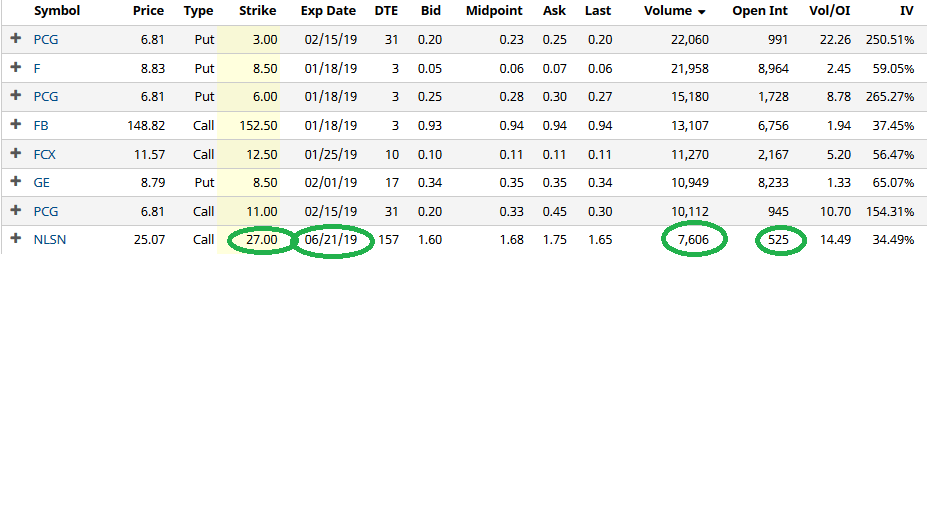

Unusual Options Activity

Today some institution/fund purchased 7,606 contracts of June 27 strike calls (or the right to purchase 760,600 shares of Starbucks at $27). This is a large sized bet for this stock and contract as the open interest was just 525 prior to this purchase. Nielsen NLSN reports in early February.