Today some institution/fund purchased 20,216 contracts of April 35 strike calls (or the right to purchase 2,021,600 shares of EBAY at $35). This is a larger sized bet for this stock and contract as the open interest was 4,604 Continue reading “Unusual Options Activity”

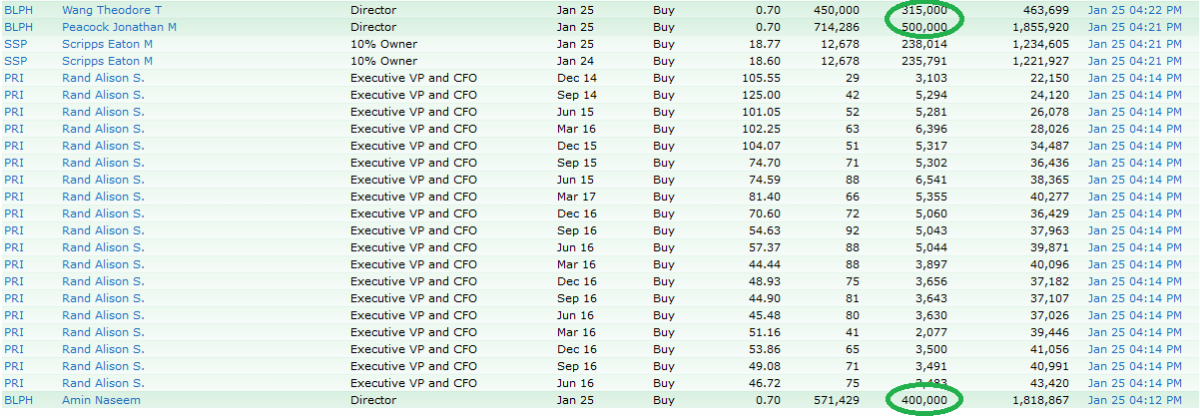

Insider Buying

Last week, 3 Directors of small biotech BLPH – Bellerophon Theraputics, Inc bought a combined $1,215,000 worth of stock with their own money. This is the first such purchase that any of these 3 directors bought stock in the open market.

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 9 key reads for Monday…

- Apple Earnings Are Coming. The Last Round Left a Mark. (Barron’s)

- Inspiring story of a guy who didn’t give up on his dreams: Geoffrey Owens, once shamed for Trader Joe’s job, featured in SAGs opener (New York Post)

- 5 Stocks That Struggled in 2018 Could Be Big 2019 Winners (Jeffries via 24/7 Wall Street)

- NVIDIA (NVDA) Cuts Q4 Guidance (Street Insider)

- Dems Warn Howard Schultz Independent Run Would “Secure Trump’s Reelection” (Zero Hedge)

- The world’s oldest Nobel Prize winner, a 96-year-old physicist, says his new invention will give everyone in the world clean, cheap energy (Business Insider)

- Grubhub rallies after Credit Suisse upgrades, tells clients to expect 60% upside (CNBC)

- Powell on the Spot After Fed’s Monetary Messages Whipsaw Market (Bloomberg)

- Drillers Are Easing Off the Gas (Wall Street Journal)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Bullish Percent – What it says about Consumer Staples right now…

Right now, Consumer Staples as a sector has the lowest percentage of buy ratings of any sector in the S&P 500 – coming in at just 41%. The above chart is the “Bullish Percent Index” for Consumer Staples (red and black Continue reading “Bullish Percent – What it says about Consumer Staples right now…”

Be in the know. 10 key reads for Sunday…

- The ultimate gearhead bucket-list car show and event guide for 2019 (CNET)

- Everything coming to Netflix in February (The Verge)

- How CRISPR lets you edit DNA (TED)

- $5 Billion to Be Wagered on the Super Bowl, Some Legally for the First Time (How Stuff Works)

- 8 Morning Routines of History’s Most Successful People (Mental Floss)

- What one Navy SEAL learned by doing Hell Week 3 times (Big Think)

- The Euro’s First 20 Years (Project Syndicate)

- When Does Your Intelligence Peak? (Scientific American)

- Everything You Need to Host a Winning Super Bowl Party (Consumer Reports)

- Will Tesla change the world or go out of business? Yes. (Recode)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

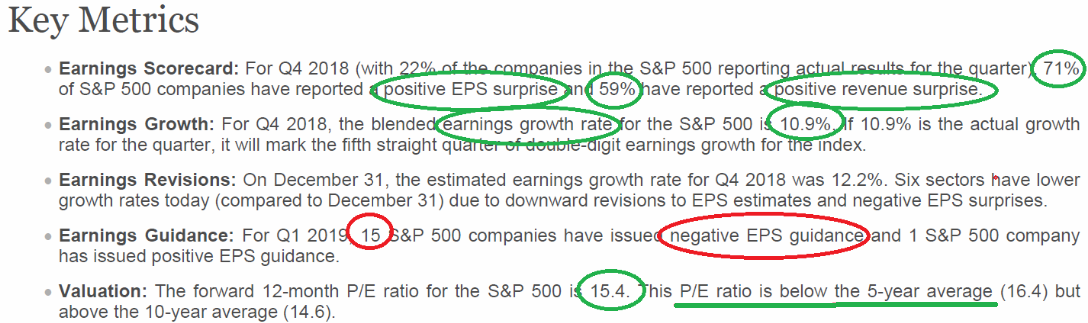

Earnings Update

Per FactSet, eps and revenues continue to beat by 71% and 59% respectively – after 22% of S&P 500 having reported Q4 earnings so far.

Guidance is a bit light but 2019 eps estimates remain ~$170.93 per share. If Continue reading “Earnings Update”

Quote of the day…

Be in the know. 11 key reads for Saturday…

- Bond Traders Face Plenty of Risk as Powell Ushers In a New Era (Bloomberg)

- This Alibaba business could be its next big moneymaker (Market Watch)

- America’s Hidden Workforce Returns (Wall Street Journal)

- Four Low-Debt Stocks to Buy for Uncertain Times (Barron’s)

- Intel Stock Is Selling Off. Here’s Why You Should Buy. (Barron’s)

- Trump To Try Nominating People He Agrees With To Fed Board (Dealbreaker)

- Why Xilinx Is Seeing Strong Growth When Many Chip Peers Aren’t Growing at All (The Street)

- Elizabeth Warren’s New Wealth Tax Could Cost Billionaires $85 Billion A Year (Forbes)

- China confident of keeping 2019 growth within ‘appropriate range’ (Reuters)

- The Marijuana Billionaire Who Doesn’t Smoke Weed (aka Don’t get high on your own supply): (Fortune)

- Robots at a Budapest cafe serve up food and drink, tell jokes, dance with kids (First Post)

If you found this post helpful, consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 10,207 contracts of March $47.50 strike calls (or the right to purchase 1,020,700 shares of General Mills at $47.50). This is a larger sized bet for this stock and contract as the open Continue reading “Unusual Options Activity”