Key Stock Market Outlooks and Picks

On Monday, I joined Taylor Riggs and Kenny Polcari on Fox Business to discuss sector rotation, style rotation and stock picks. Thanks to Taylor Riggs, Liz Claman, Jake Mack, Kathryn Meyers and Brooke Haliscak for having me on:

Watch in HD Directly on Fox Business

On Tuesday I joined Stuart Varney on Fox Business “Varney & Co” to discuss Nvidia, the story of Icarus, and where to find value in 2025. Thanks to Christian Dagger and Preston Mizell for having me on:

Watch in HD Directly on Fox Business

On Wednesday, I joined Kristen Scholer on NYSE TV to discuss markets, fed, Advanced Auto Parts, Cooper Standard and more. This was a comprehensive outlook on 2025. Thanks to Kristen, Jeff Cohen and Melissa Montanez for having me on:

Watch in HD Directly on NYSE TV

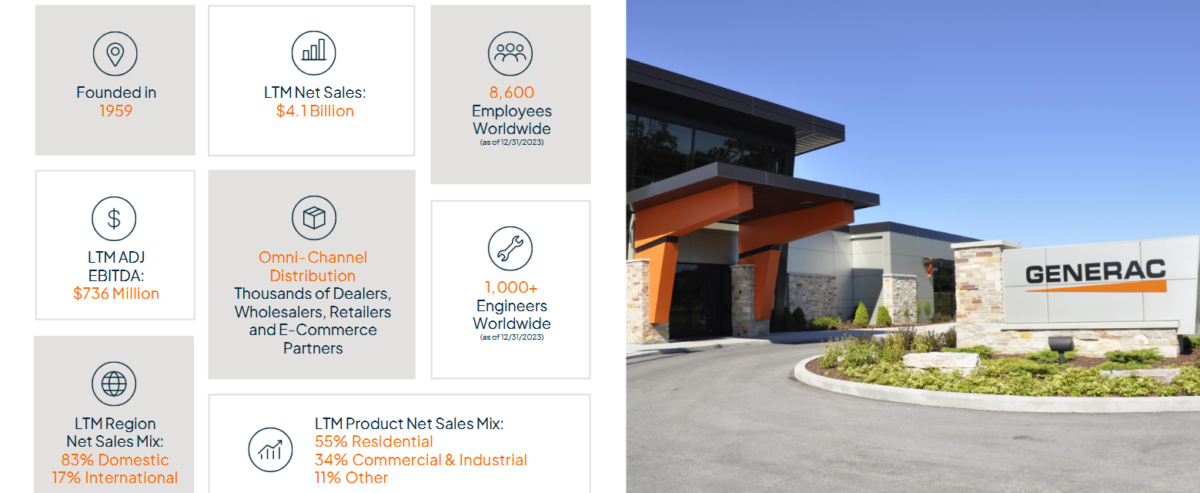

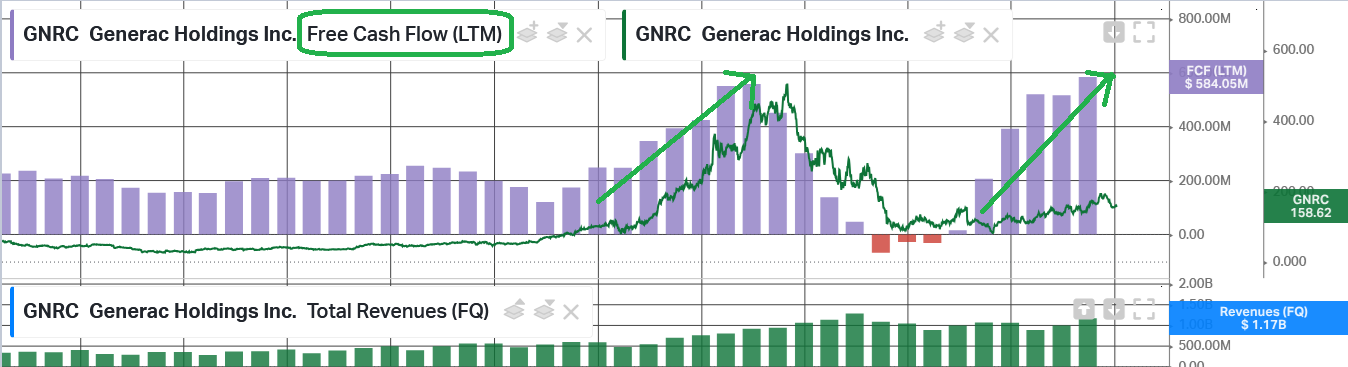

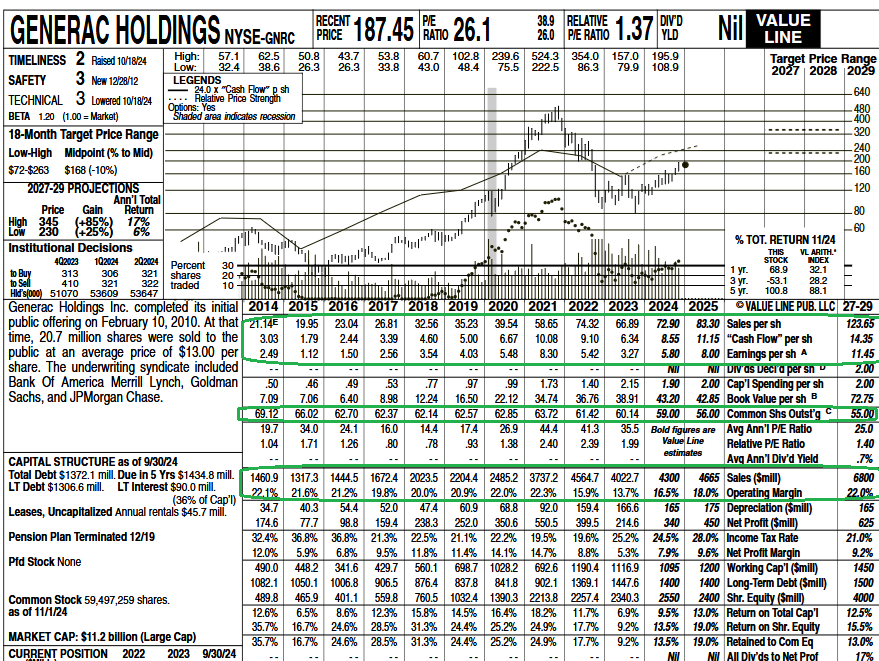

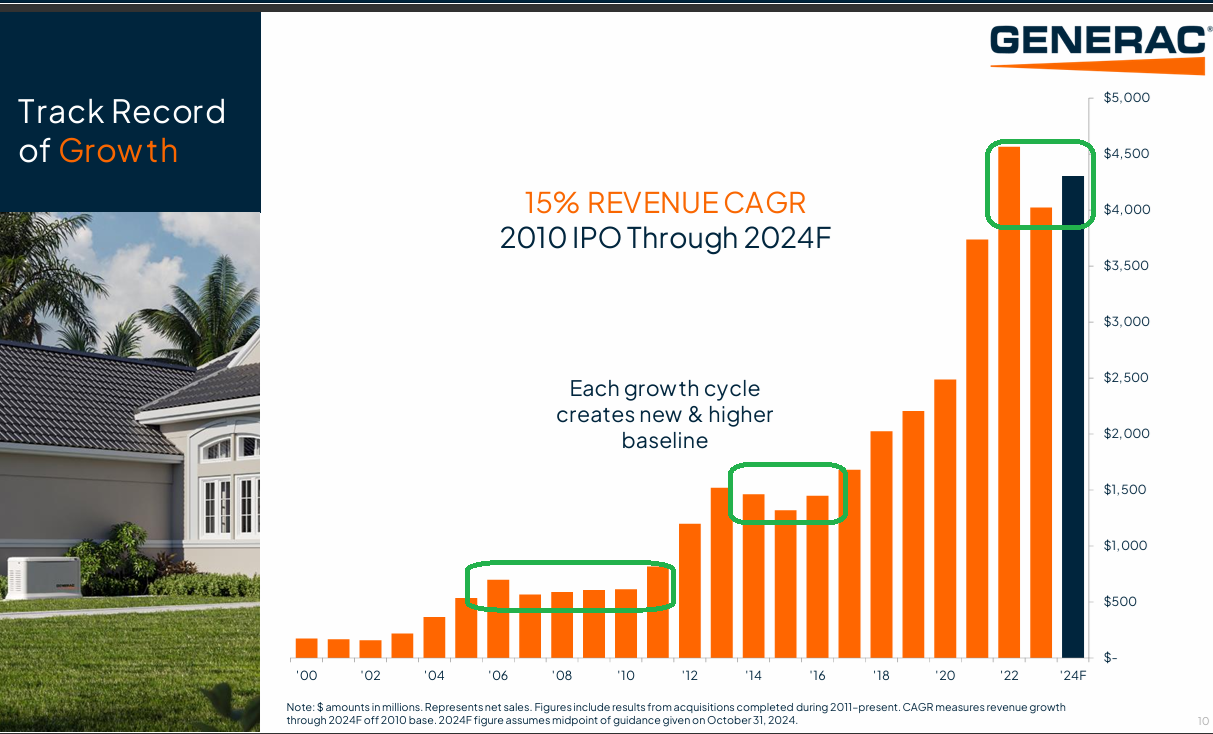

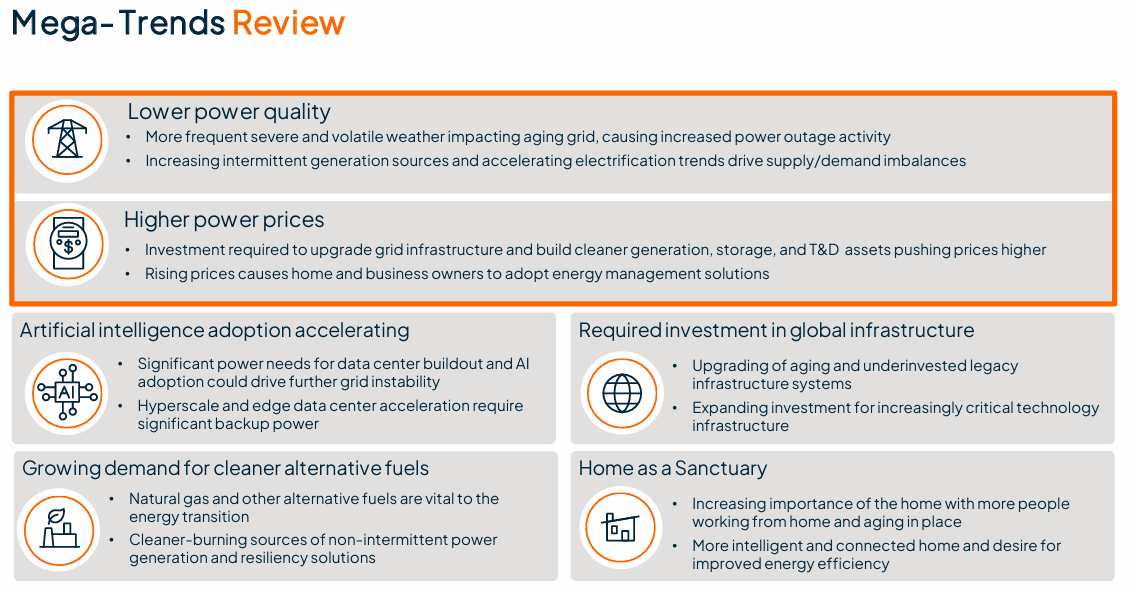

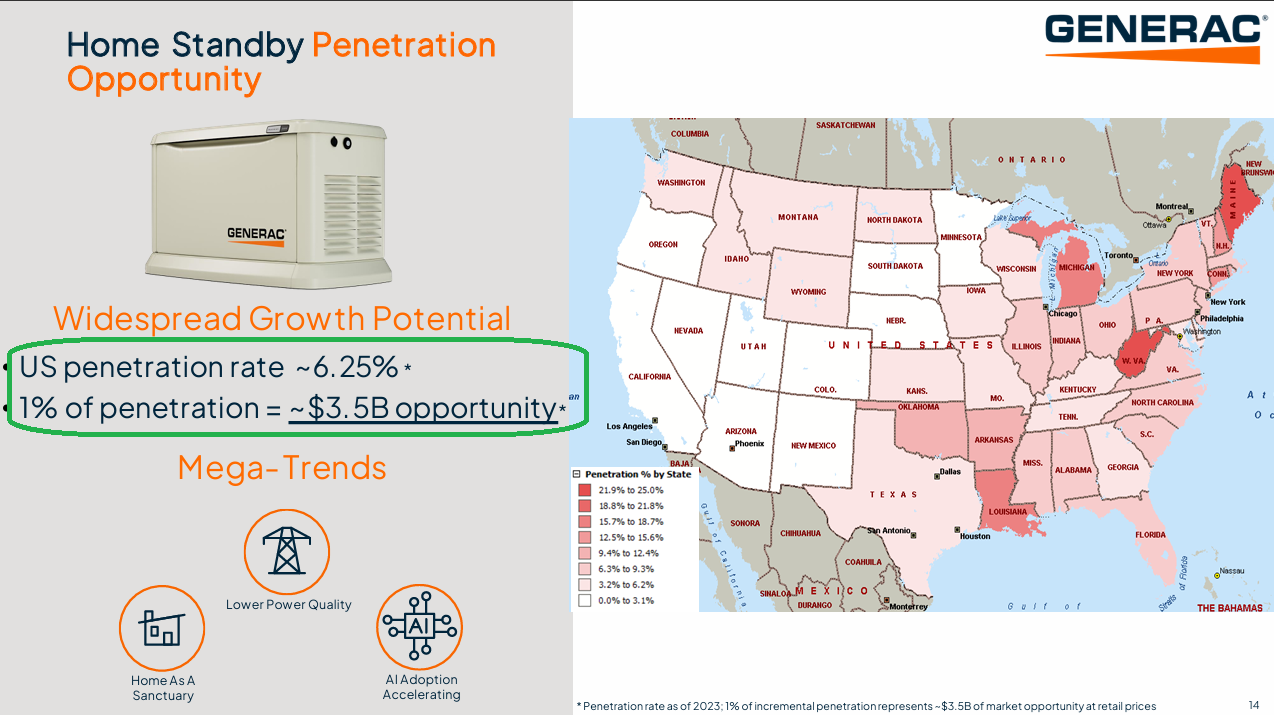

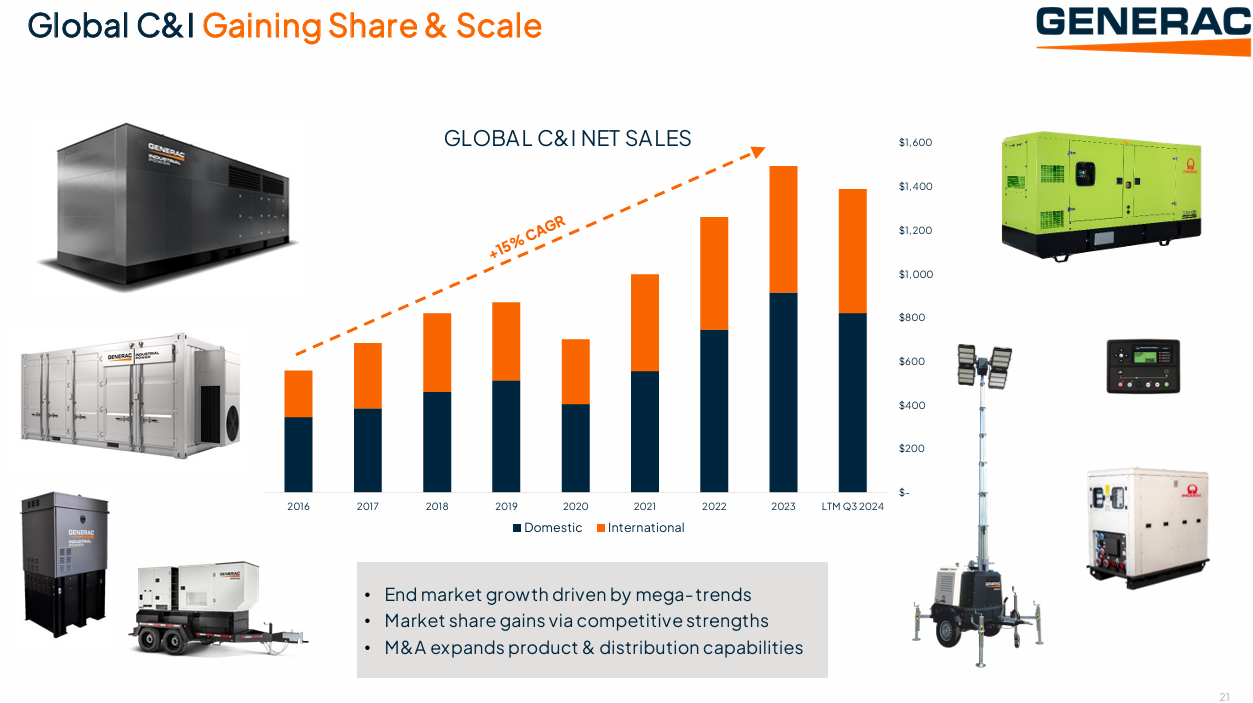

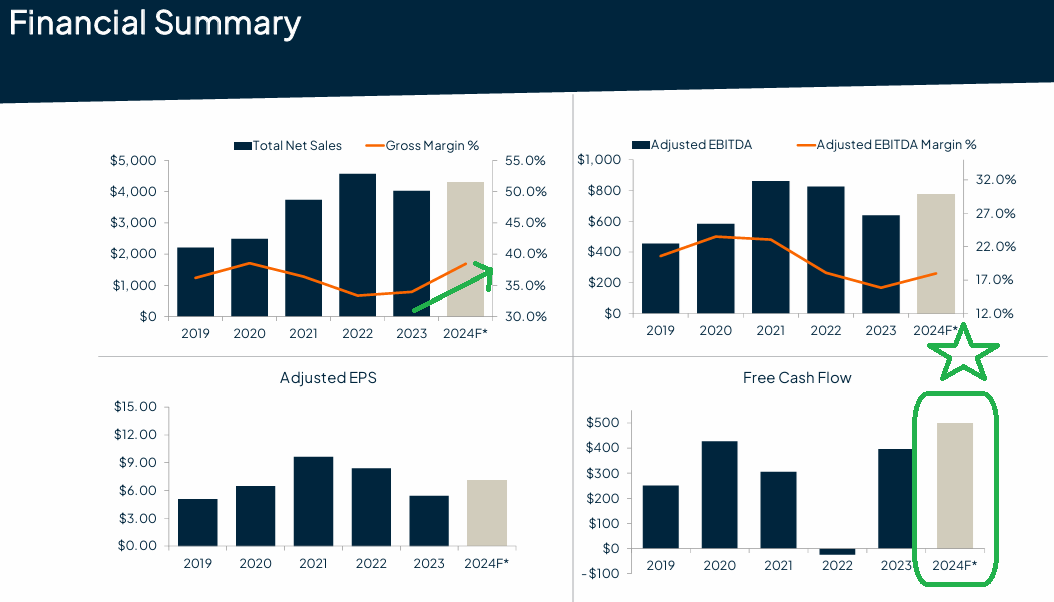

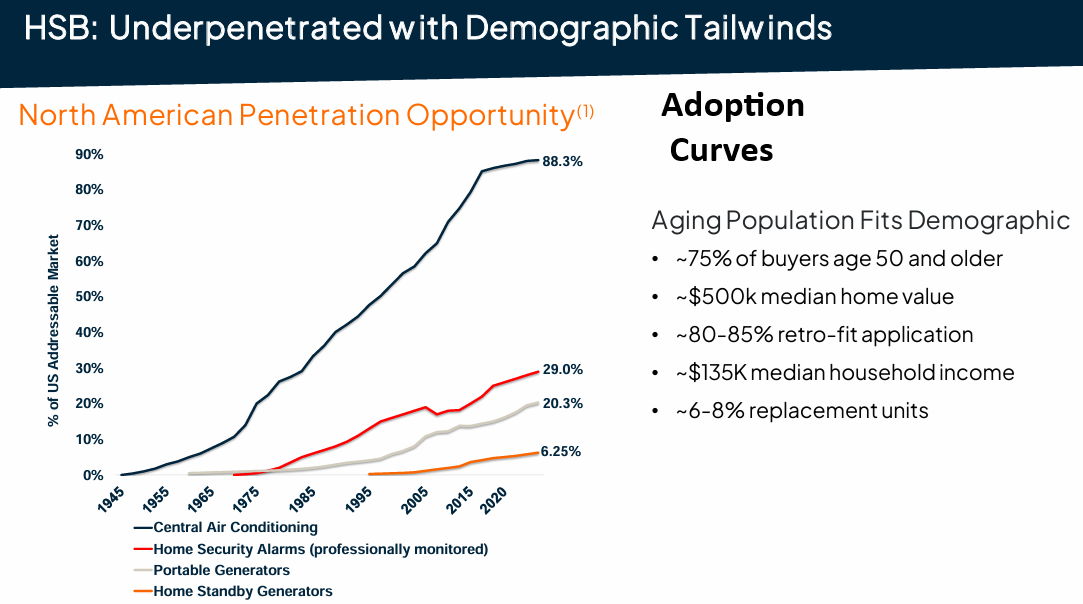

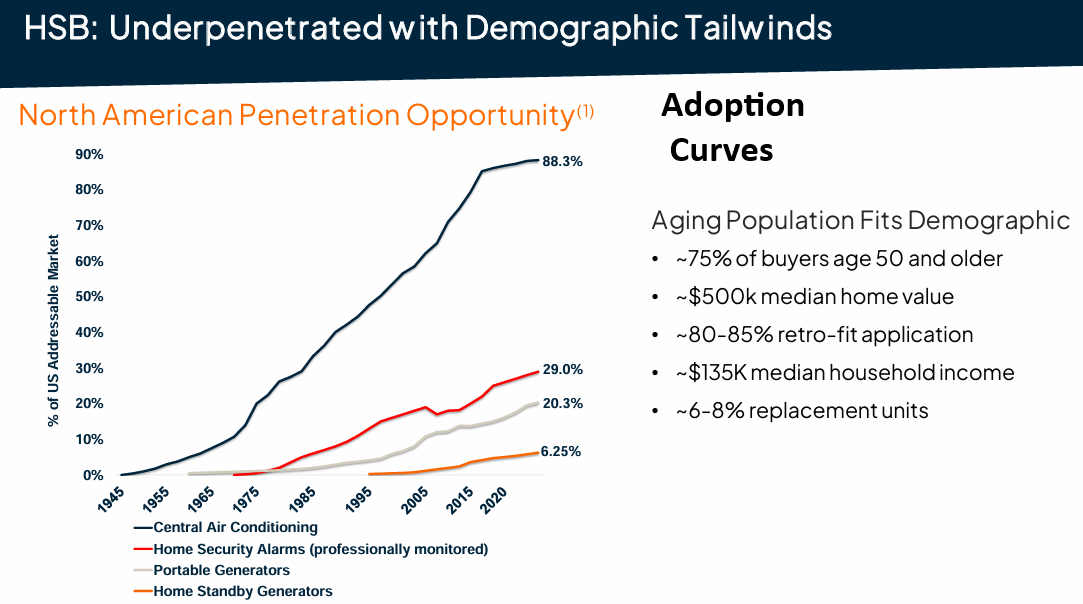

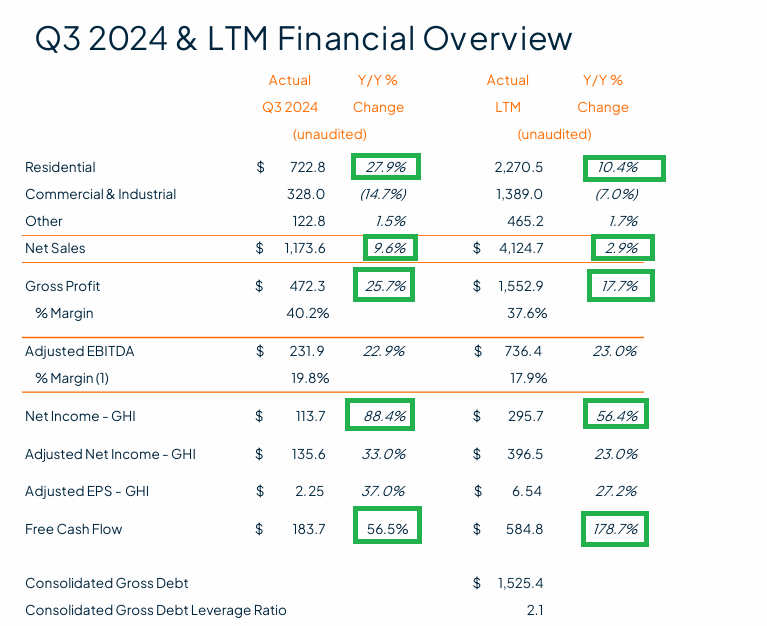

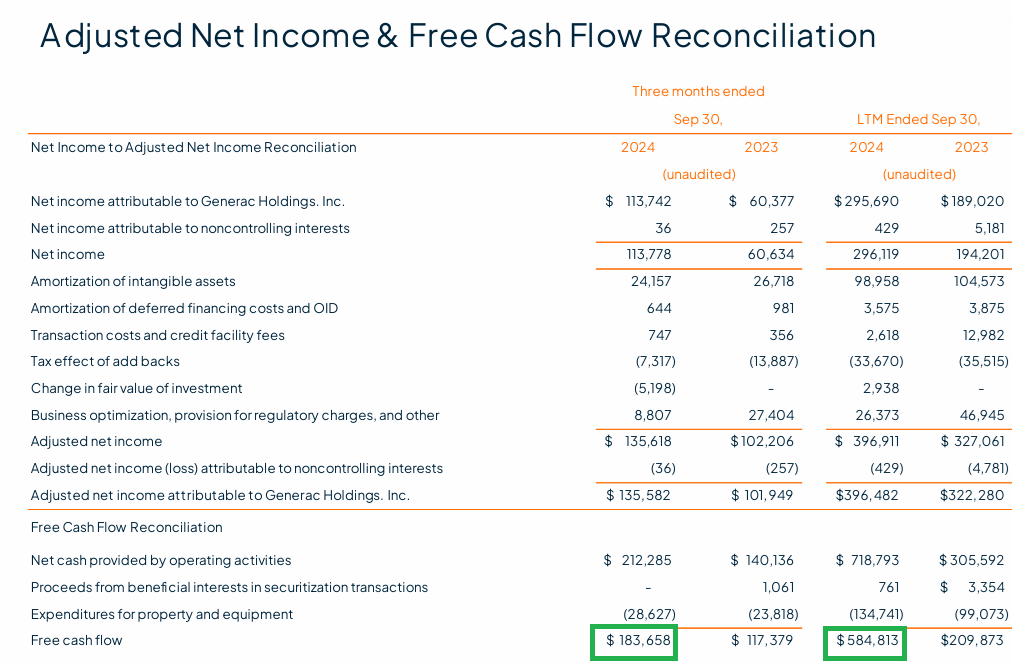

Generac Update

For those who have followed me for a while on our podcast|videocast, you know we don’t spend much time talking about our winners. We’ve been talking about GNRC since well below $100.

General Market

The CNN “Fear and Greed” ticked up from 28 last week to 32 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) declined to 64.10% this week from 80.39% equity exposure last week.

Our podcast|videocast will be out tonight. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our 2024 raises and the first week of our Q1 2025 opening. You could not be better positioned for what we believe will be a highly rewarding year in 2025. This view is based on much of the data we have shared in recent weeks on our podcast|videocast(s), as well as our proprietary methods of expressing and executing upon those views on your behalf.

We re-opened to smaller accounts $1M+ again starting last week (because we want to be fully positioned as soon as possible before the inauguration – based on some of the data we have referenced on recent podcast|videocast episodes) and will remain open for the next couple of weeks (but close no later than the inauguration).

Congratulations to all of you I had the pleasure of speaking with and on-boarding in the last week – after we opened up. We have begun deploying capital on your behalf. If you are still in the process of application approval, it usually take ~24-48 hours.

To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms