Data Source: Factset

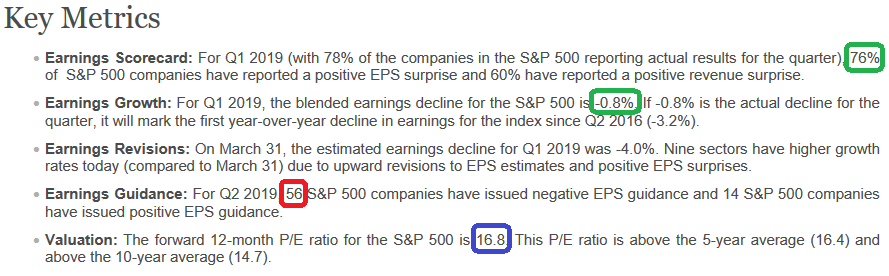

This was a big week for earnings. Q1 earnings estimates bumped up again from -2.3% last week to -0.8% today. This puts a flat to positive year on year result on the table. We’re at a 76% beat rate which is above the long term average.

While the 12mo. forward PE ratio (16.8x) is still above the 5yr avg. of 16.4x and 10yr avg. of 14.7x, the fed has signaled they are doing nothing this year. With a declining yield in the 10yr, 16.8x has some room for further expansion if the news/data flow stays strong.

Guidance still a bit weak: 70 companies in the index have issued EPS guidance for Q2 2019. Of these 70 companies, 56 have issued negative EPS guidance and 14 have issued positive EPS guidance. The percentage of companies issuing negative EPS guidance is 80% (56 out of 70), which is above the 5-year average of 70%.

Right now Factset has 2019 EPS estimates at $168.22 (17.5x p/e) and 2020 at $187.08 (15.75x p/e). Relative to rates, these multiples are not extreme provided the earnings come in near expectations for the back half of 2019.