Data Source: FactSet

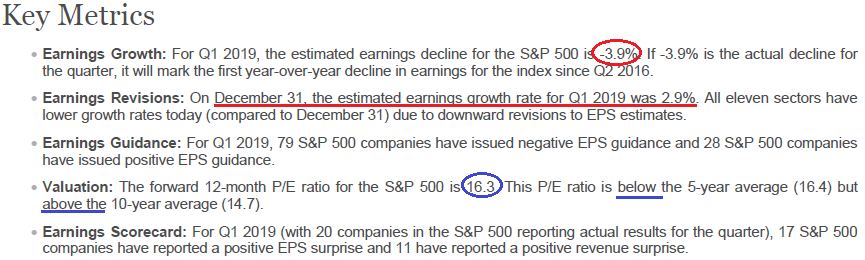

Q1 2019 earnings estimates have come down another 20 bps in the past week and (7.2%) since December 31, 2018. They are now expected to be -3.9% year on year (versus -3.7% last week). With expectations so low it is likely earnings will beat and run ~flat year on year.

So the set up is good for a positive surprise, but we’ll have to see if it is enough. With futures now pricing in a rate cut by end of 2019 that is fuel for multiple expansion PROVIDED earnings are sluggish but NOT poor.

Earnings growth remains fully back end loaded for Q4 with an 8.3% yoy gain expectation yielding an anemic 3.7% gain for full the year. With that said, if you get a turn of multiple expansion (attributable to lower rates) and expectations are met, you could see the S&P 500 at 3100+ at some point in the year.

These are best case assumptions and big IF’s. That scenario does not preclude a short term consolidation of Q1 gains prior to a march higher. A lot has to go right for the bull scenario to play out, but it is not out of the question considering the 2/10 yield curve has not yet inverted.

My eyes will be glued to Q1 “operating earnings” vs. “as reported” to get a better sense of the underlying health of the economy. As outlined in my recent article, operating earnings coming in at < $35 in Q1 is the biggest risk to the bull thesis:

UPDATE (newest data): Bull vs. Bear Death Match: Why Q1 Operating Earnings are “Make or Break”

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.