Data Source: Factset

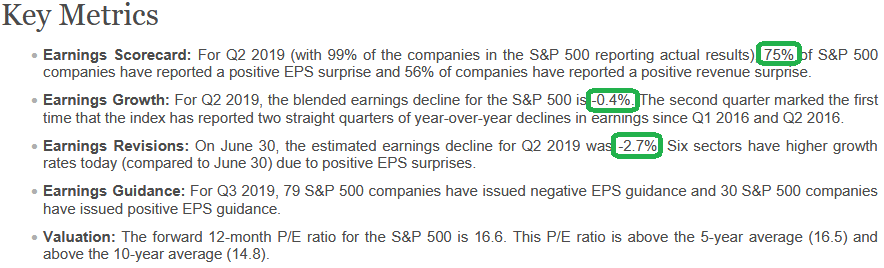

With 99% of the S&P 500 reporting for Q2, earnings beat estimates by 2.3% (expected -2.7%, at -0.4%).The beat rate on EPS was 75% – which is above the five year average of 56%.

Both the forward PE multiple and the percent of companies issuing negative guidance is in-line with the five year average.

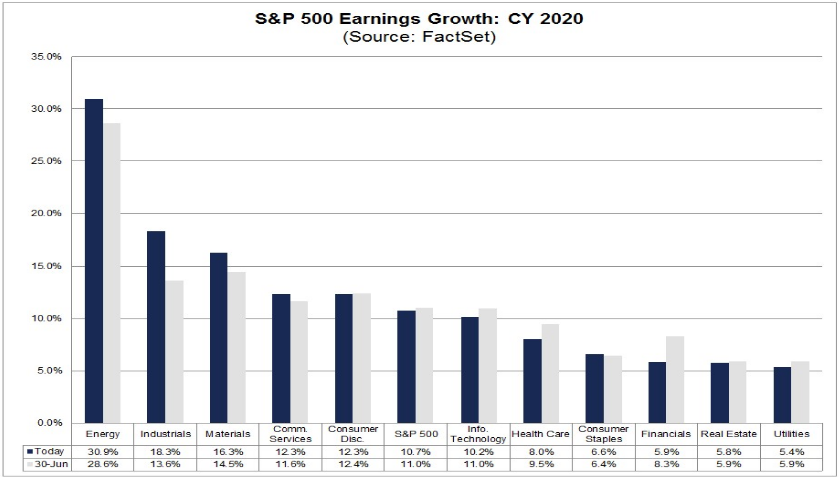

-The bottom-up 2020 target price for the S&P 500 is 3303.71, which is 13.0% above the closing price of 2924.58.

– The Energy (+27.3%) sector is expected to see the largest price increase.

-The Utilities (+1.5%) and Real Estate (+2.0%) sectors are expected to see the smallest price increases.

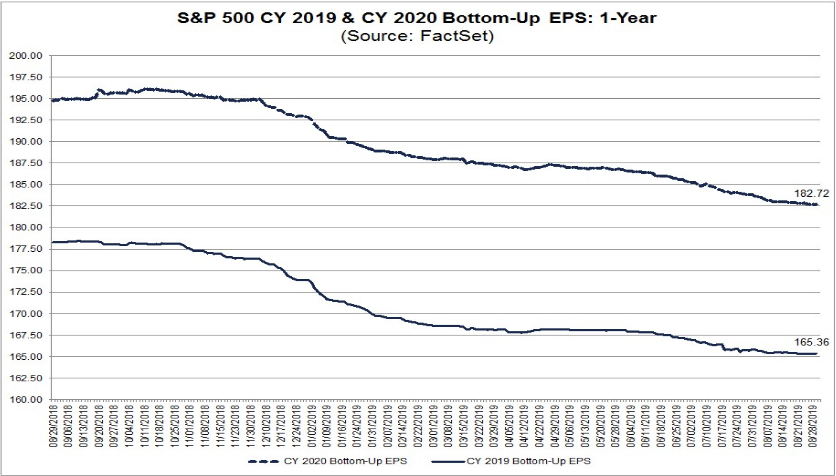

2020 EPS estimates are still above $180 at $182.72. With the discount rate coming down another 50bps over the next couple of Fed meetings, multiple expansion is a realistic expectation (and it would not be uncommon to see 19-21x EPS as a later cycle multiple). This is also in-line with better than average stock market gains that have historically occurred for the 12-18 months after the 2/10 spread has inverted (before a peak).