Data Source: Factset

The good news is that estimates have come down materially for Q2 – just as they did in Q1 and then dramatically beat the lowered expectations.

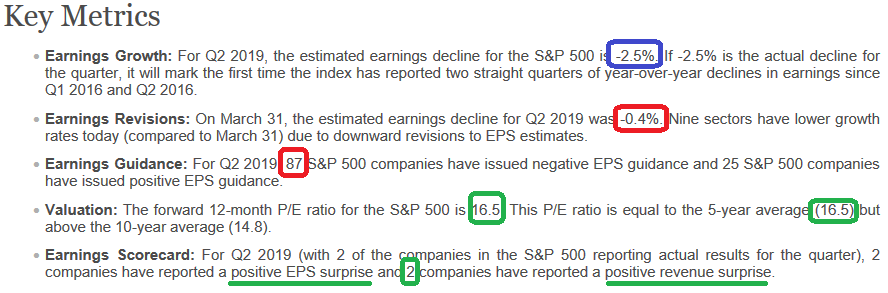

-On a per-share basis, estimated earnings for the second quarter have fallen by 2.3% since March 31. This percentage decline is smaller than the 5-year average (-3.3%), the 10-year average (-3.1%), and the 15-year average (-4.2%) for a quarter.

-The percentage of companies issuing negative EPS guidance is 78% (87 out of 112), which is above the 5-year average of 70%.

With estimates this low – along with multiple other factors/metrics, it may very well give the Fed the cover they need to cut sooner rather than later. One of the things not being discussed is the price of oil, but the Dallas Fed is aware that the breakeven for shale producers is $50 WTI Crude. If pricing drops below that level, credit markets will start to freeze up just as we saw in December 2018 and Early 2016 when the Fed had to intervene in both instances. The knock on effect of Oil breaking below $50 is not only the heavily energy weighted high yield market, but banks themselves. This is not news, but the market is not focused on it at present and this may very well be one of the unspoken (dis-inflationary) factors that causes them to move sooner than later.

(Black line = High Yield Credit Index. Red line = WTI Crude)

There are 10,456 ratings on stocks in the S&P 500. 52.9% are Buy ratings, 41.0% are Hold ratings, and 6.1% are Sell ratings.

-Analysts are most optimistic on the Energy (64%), Health Care (60%), and Communication Services (60%) sectors, as these three sectors have the highest percentages of Buy ratings.

-Analysts are most pessimistic about the Consumer Staples (39%), Utilities (43%), and Real Estate (44%) sectors, as these three sectors have the lowest percentages of Buy ratings.

The estimated (year-over-year) revenue growth rate for Q2 2019 is 3.9%. If 3.9% is the actual growth rate for the quarter, it will mark the lowest revenue growth rate for the index since Q3 2016 (2.7%).

Looking Forward (Source: Factset):

For the second half of 2019, analysts see no growth in earnings in the third quarter and high single-digit growth in earnings in the fourth quarter.

For the first half of 2020, analysts are predicting double-digit earnings growth in both Q1 2020 and Q2 2020 For Q3 2019, analysts are projecting flat earnings (0%) and revenue growth of 4.0%.

For Q4 2019, analysts are projecting earnings growth of 6.8% and revenue growth of 4.5%.

For CY 2019, analysts are projecting earnings growth of 3.0% and revenue growth of 4.5%.

For Q1 2020, analysts are projecting earnings growth of 10.7% and revenue growth of 6.1%.

For Q2 2020, analysts are projecting earnings growth of 13.3% and revenue growth of 6.8%.

With expectations for a trade deal at the G-20 dampened, this gives additional cover for the Fed to move ahead with cuts as the Administration pulls together some type of agreement with China over the months ahead.

If however, the Fed fumbles – as they did in October and December of 2018 -all bets are off. We now get to see if they learned from their mistakes or are destined to repeat them. The market is betting they will do the right thing for the country based on the lack of inflation and slowing data.